What is Polkadex (PDEX) | What is Polkadex token | What is PDEX token

Polkadex is a fully decentralized and hybrid peer-to-peer order-book crypto exchange, backed by Web3 Foundation. The trading platform runs on the Substrate framework and merges the Automated Market Maker (AMM) model – common in most DEXs, with the Order Book model used by centralized exchanges.

The DEX is on a mission to combine the user experience and features of centralized cryptocurrency exchanges with the added benefits of decentralized security. On this note, the Polkadex solution is innovating in four core areas – customer experience, liquidity, custody of assets, and execution speed of trades.

It is a no-brainer that without an easy-to-use front end, beginners and even experienced traders will prefer to use centralized solutions. As earlier stated Polkadex is building a decentralized network using the Substrate Blockchain Framework. They are keen on addressing the interface problem by launching a trading experience that has a “centralized feel.”

The Substrate framework enables the creation of application-specific, composable, and interoperable blockchains without having to deal with the complexity of block production and consensus. It also allows a modular structure for building decentralized applications.

To improve customer experience and increase throughput, Polkadex focuses on a rather slim design that reduces the complexity of the chain. Only features that need public verifiability go on-chain. While features like Order-book, On-chain market making tools, Bridge mechanism, and Trader Assets Management go on-chain, other features like market data aggregation, storage and retrieval of trade history, and technical analysis indicators stay off-chain.

This slim design allows the network to increase the throughput of trades. As a matter of fact, the Polkadex platform has been able to achieve a speed of 173 transactions per second, as opposed to Binance’s average of 153 trades per second. In order words, Polkadex has a shot at going head-to-head against some of the top centralized exchanges.

To solve the problem of low liquidity, Polkadex connects AMMs directly to its trading engine. The auto market markers function as on-chain market-making bots. If a trade is not matched against the Polkadex order book, the engine will call on the on-chain trading bots to try to match the order. Trades will be executed only if a better price is provided by the on-chain bots. This ensures that there are no price slippage problems for traders.

In its first iteration, Polkadex will support two types of trades – Limit and Market Orders. While market takers attract a trading fee of 0.2 percent, market-making orders have zero trading fees. Meanwhile, half of the collected fees are assigned to marker makers while the remaining 50 percent is set aside for growing the Polkadex network.

Polkadex: The trading engine for web3 and Defi

A fully decentralized, peer-peer, orderbook based cryptocurrency exchange for the Defi ecosystem in Substrate.

The beginning of the end for AMM DEXes

DeFi rave has triggered the 2020 bull run for Crypto industry. Wherever you look, you see people trying to make AMM based DEXes. The success of Uniswap has probably made investors queuing up to invest in projects focused on liquidity mining and swap protocols. However, may we ask this question? Is this the final shape and form of Decentralized exchanges of the future?

To answer these questions, we need to go back two years into the crypto sphere — a world chocked by scalability issues with Ethereum. Smart contracts couldn’t scale to the level demanded by killer apps waiting to see the daylight to this very day. Blockchain evangelists and smart contract gurus foresaw a world run on intelligent contracts on the blockchain, but simply the “real estate” didn’t have the power to support their vision. People began writing off decentralized exchanges as merely a fad attempt to achieve something that didn’t catch popular imagination.

The answer was in plain sight. Rising gas fees and slow transactions curtailed the growth of an exciting vision. Network fees were prohibitive enough to have so many nodes competing for network space to uniquely verify transactions on the blockchain. Traders got fed up and left the scene, and with them disappeared the lifeline of any exchange — Liquidity. Pundits raved about how decentralized exchanges couldn’t scale with an on-chain orderbook.

The writing was on the wall. People started experimenting with off-chain order books to achieve speed. What is the point of decentralization if there were no transparency in order execution? The final nail in the coffin was the possibility of front running transactions that put retail traders at risk, at the mercy of investors with better computing power and larger stakes in PoS driven networks.

All of this resulted in Bonding Curves based and AMM pools or Constant Function Market Makers (CFMM) ruling the roost with Uniswap leading the industry trend. However, one can clearly see; the attempt to use AMM pool was a desperate attempt to save liquidity in DEX space. It wasn’t the popular demand; people thronged despite the deficiencies like price slippage and impermanent losses. It was something which everybody decided to settle for because Decentralized Exchanges didn’t have the technology to scale transactions to support a traditional orderbook.

We introduce Polkadex’s FSP (Fluid Switch Protocol). Polkadex is a hybrid DEX with an orderbook supported by an AMM pool. The first of its kind in the industry. Someone had to innovate. We are happy to do the dirty work. It may not be perfect, but we are sure that once implemented, it can solve the problem faced by DEXs paving the way for near-boundless liquidity and high guarantee of trades if supported by an efficient trading engine. The trading engine itself needs a separate look and it is a whole dedicated project in itself; hence it is covered in another medium article. Let’s stick to the core protocol here.

In FSP, incoming orders are matched against the orderbook first. Suppose the engine couldn’t match any order, instead of market-making against the orderbook; in that case, it is matched against the AMM pool, thereby giving additional liquidity for the orderbook and a possible arbitrage option created by the activity in the orderbook. Quickly said than done, but it is a complex protocol that switches between the orderbook and the liquidity pool based on the settings enabled by the trader. If he doesn’t want his orders matched against the AMM Pool, the same trade enters the orderbook as a market-making trade without affecting the user in any way.

In our opinion, this protocol will dramatically change the trading experience in a decentralized exchange. AMM Pools not only solve the liquidity problem, the pairing up with an orderbook creates frequent price swings in the liquidity pool, making arbitrage opportunity for an opportunistic trader, looking to earn from the swap pool. We intend to implement this switching seamlessly so that the focus will be on a fluid experience for the trader, when the trade happens in the background, fetching him the price he wanted without compromising experience.

To conclude, AMM DEXes needs to evolve and experimenting with innovations such as FSP will go a long way in achieving this goal. When you create equal opportunity for both market makers and traders, we could finally solve one of the longstanding problems faced by DEXes in the past — a DEX with fast orderbook and near-boundless liquidity to support it.

On-Chain Trading Bots

Polkadex enables HFT through trading bots for both retail and institutional investors. Zero cancellation fees optimized through unique architecture allow dynamic entry and exit based on the market situation, incentivized API endpoints for both trading bot companies and liquidity providers and eliminate front-running of orders by paying high gas fees, a problem that plagues traditional decentralized exchanges.

Polkadex hopes to solve the problem by introducing feeless transactions. This innovation not only takes away the power to control the order of execution; it also eliminates economic incentive to do so. It allows faster trade execution times and also gives equal opportunity for anyone placing a transaction on the orderbook.

While this is economically impossible to apply on general-purpose public blockchains that run on an incentivized model for network participation, it is certainly possible on an application-specific blockchain network. Polkadex, being an application-specific blockchain, has the flexibility to get creative with network incentive model. We have done it and beautifully so!

As far as Polkadex is concerned, any transaction that is inserted into its network is connected with an exchange activity. It could be to place an order or to delete an order. This predictability gives a tremendous advantage to ascertain if the transaction is genuine or not. With an intelligent application of basic AI and machine learning algorithm, we can quickly identify someone who is trying to abuse the network. This innovation makes it possible to allow genuine transactions and penalize the bad ones. If someone tries to abuse the network by incorrect information or denial of service, the network imposes a fee which on a large scale becomes economically impractical to the attacker. In turn, this makes it possible for Polkadex to allow feeless transactions for all genuine activities on its blockchain.

High Frequency Trading bot

Another application of feeless transactions is high-frequency trading(HFT). Usually, the cancellation of trades in HFT is widespread when you engage trading bots to enter positions. In normal circumstances, the network has to impose a fee. This cost leads to expensive cancellations, and hence, trading becomes prohibitive for HFT bots while operating on a DEX. Feeless transactions eliminate this problem and allow for faster trades and settlements. Polkadex uses this to enable endpoints for third-party market makers and trading bot communities to connect to the orderbook and engage seamlessly. By using our cloud architecture, the experience is even better and gives the feeling that they are trading on a traditional centralized exchange.

Hence, feeless transactions in Polkadex play a vital role in eliminating two major issues that are widely seen in other Decentralized exchanges.

Performance

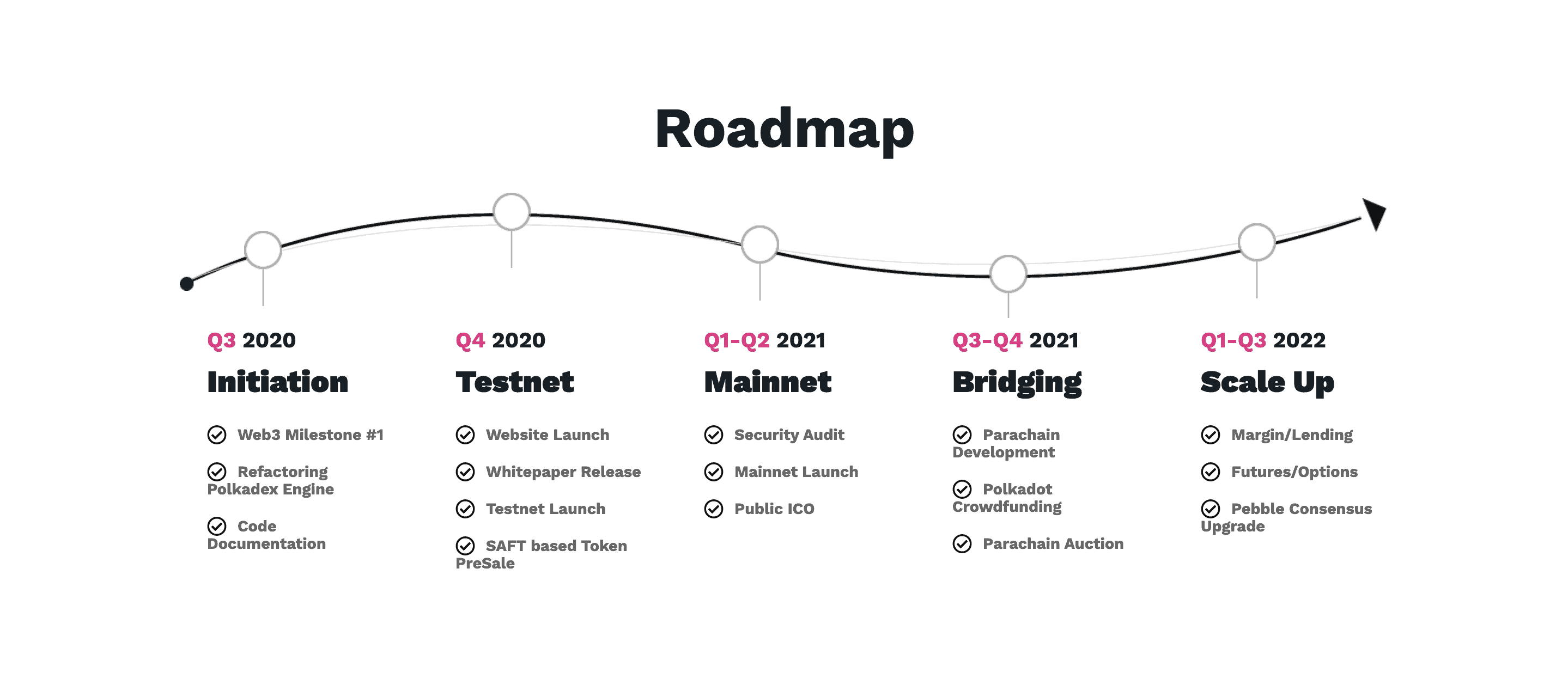

The current testnet transaction throughput of 300 TPS, more than enough to support the current crypto exchange landscape and will continue to improve this speed to 20,000 TPS using our R&D on inhouse consensus algorithm code named Pebble. This upgrade will be part of the Roadmap planned in 2021-22.

How and Where to Buy PDEX ?

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

After the deposit is confirmed you may then purchase PDEX from the exchange: Polkastarter

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once PDEX gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

Find more information PDEX

☞ Website ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Testnet

🔺DISCLAIMER: The Information in the post is my OPINION and not financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you

⭐ ⭐ ⭐ What You Should Know Before Investing in Cryptocurrency - For Beginner ⭐ ⭐ ⭐

Thank for visiting and reading this article! Please don’t forget to leave a like, comment and share!

#blockchain #bitcoin #crypto #polkadex