What is Siren Markets (SI) | What is Siren Markets token | What is SI token

About SIREN

Options are a financial primitive from which one can build many different more complex financial instruments. At their core, options give a trader the choice to buy or sell an asset at a predetermined price at a known time in the future. This is useful for protecting one’s self (also known as hedging) against possible price changes in the asset, as well as speculating on these price changes.

SIREN Markets

No oracle. No settlement. No kidding.

FOR TRADERS

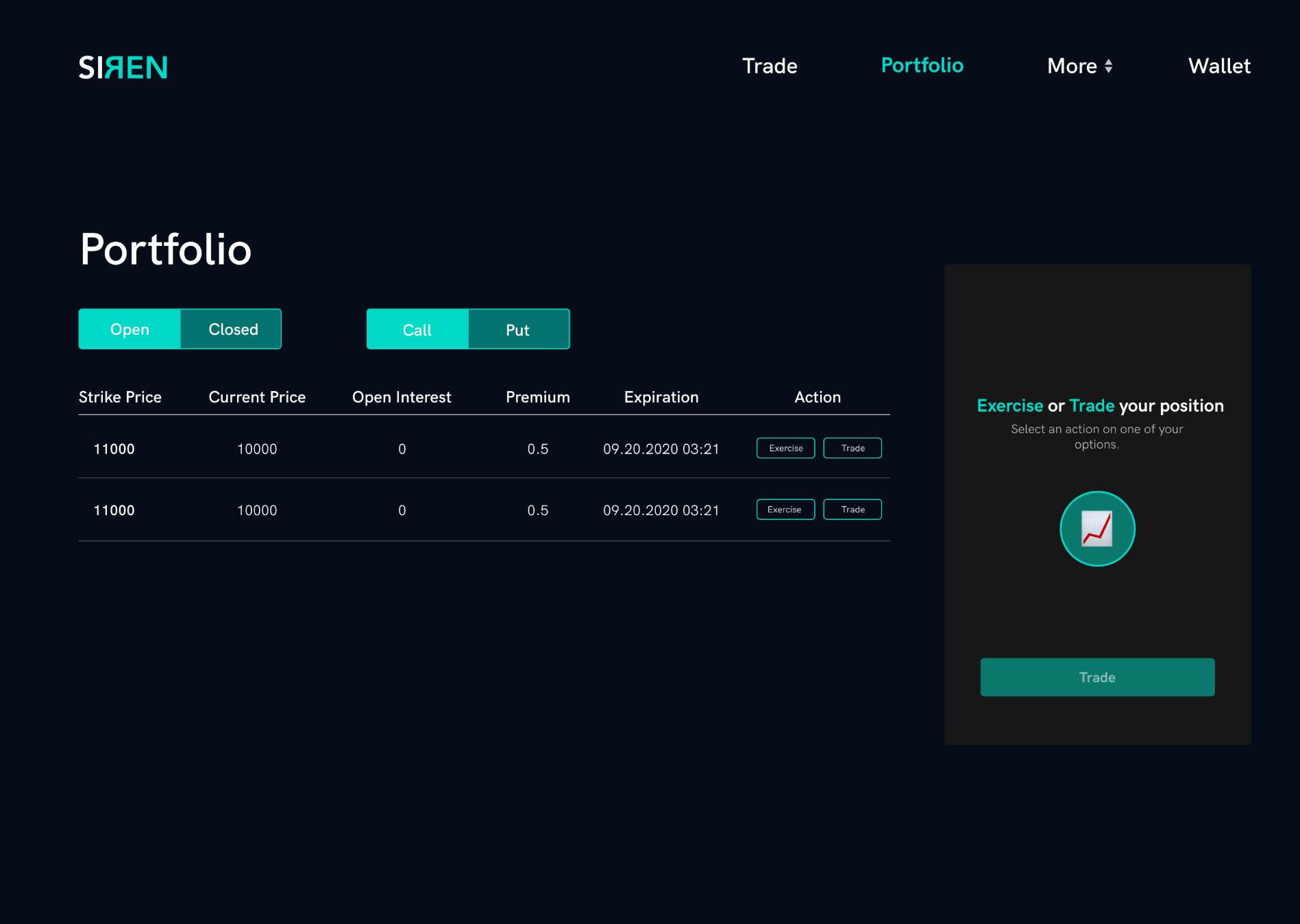

- Hedge, apply strategies to potentially limit downside risk, and utilize other complex techniques or combinations to actively trade regardless of market directions.

FOR LIQUIDITY PROVIDERS

-

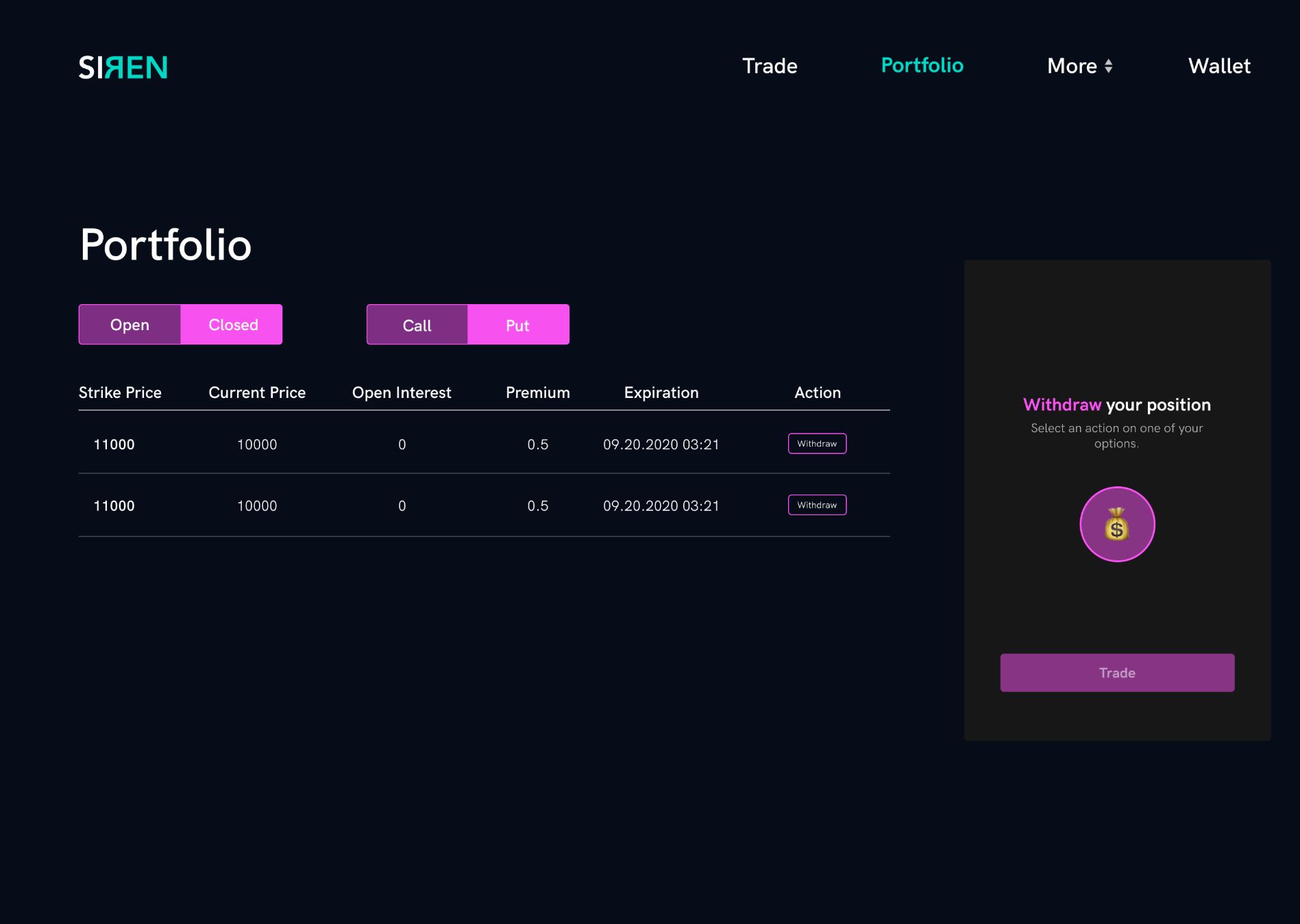

Be market neutral, collect fees for providing liquidity, and seek opportunities to arbitrage with both American as well as European style options.

-

Participate in liquidity mining events as new option markets are created.

-

-

-

-

Core Protocol Mechanics

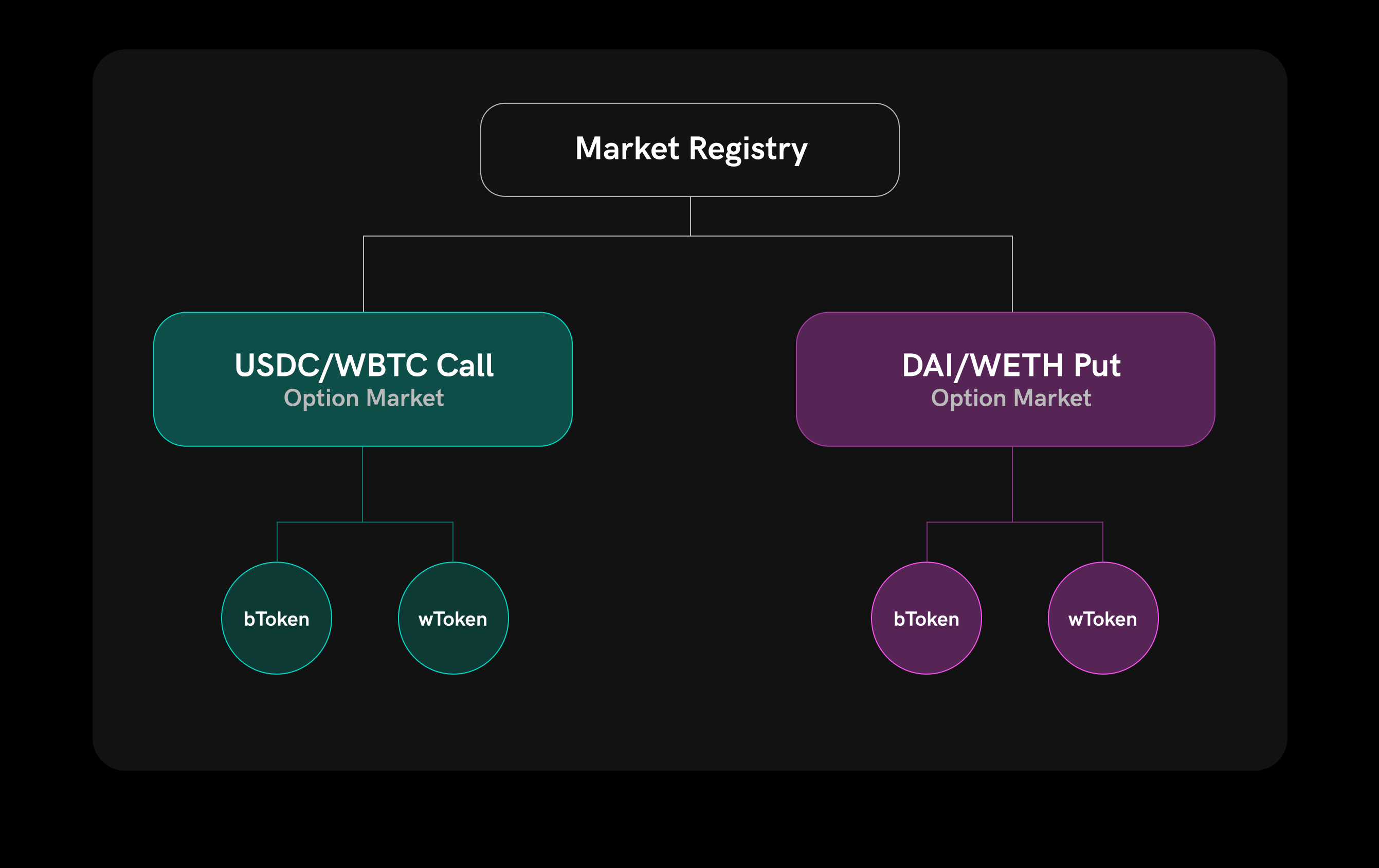

SIREN uses a fully-collateralized approach to writing options that doesn’t require any oracles to function. A single MarketsRegistry contract creates and coordinates individual markets. Once a Market contract is created anyone can interact with it in a permissionless manner. The solvency of a position is ensured at all times by the collateral locked in the smart contract.

With SIREN, both the long and short side of the contract are tokenized. The buyer’s side (bToken) gives the holder the right to purchase or sell the underlying asset at a predetermined strike priceThe seller’s/writer’s side (wToken) allows the holder to withdraw the collateral (if the option was not exercised) or withdraw the exercise payment (if the option was exercised) from the contract after expiration.

When a trader buys a put the on-chain token amount is multiplied by the strike. For example, a 1 WBTC $20K PUT will result in 20,000 bTokens. For the same reason, a put is just a reversed-assets call (e.g. a WBTC/USDC put is actually a USDC/WBTC call).

Tokenizing both sides of the contract allows SIREN to create secondary markets for both the long and short exposure. Under such a design in order to become a writer one purchases a wToken from the SirenSwap AMM (see below). A writer can also unwind their short exposure by selling the wToken back to the AMM. This streamlines the write-side mechanics by reducing it to essentially purchasing the underlying collateral at discount — as opposed to a typical design where the writer mints long tokens and has to then sell them in order to realize the premium.

SirenSwap AMM

Bootstrapping liquidity is core to creating a thriving market. Options are notoriously difficult when it comes to that. Not only does liquidity get fractured by combination of strike prices and expirations, it also requires sophistication on the part of liquidity providers in order to ensure fair and sustainable pricing.

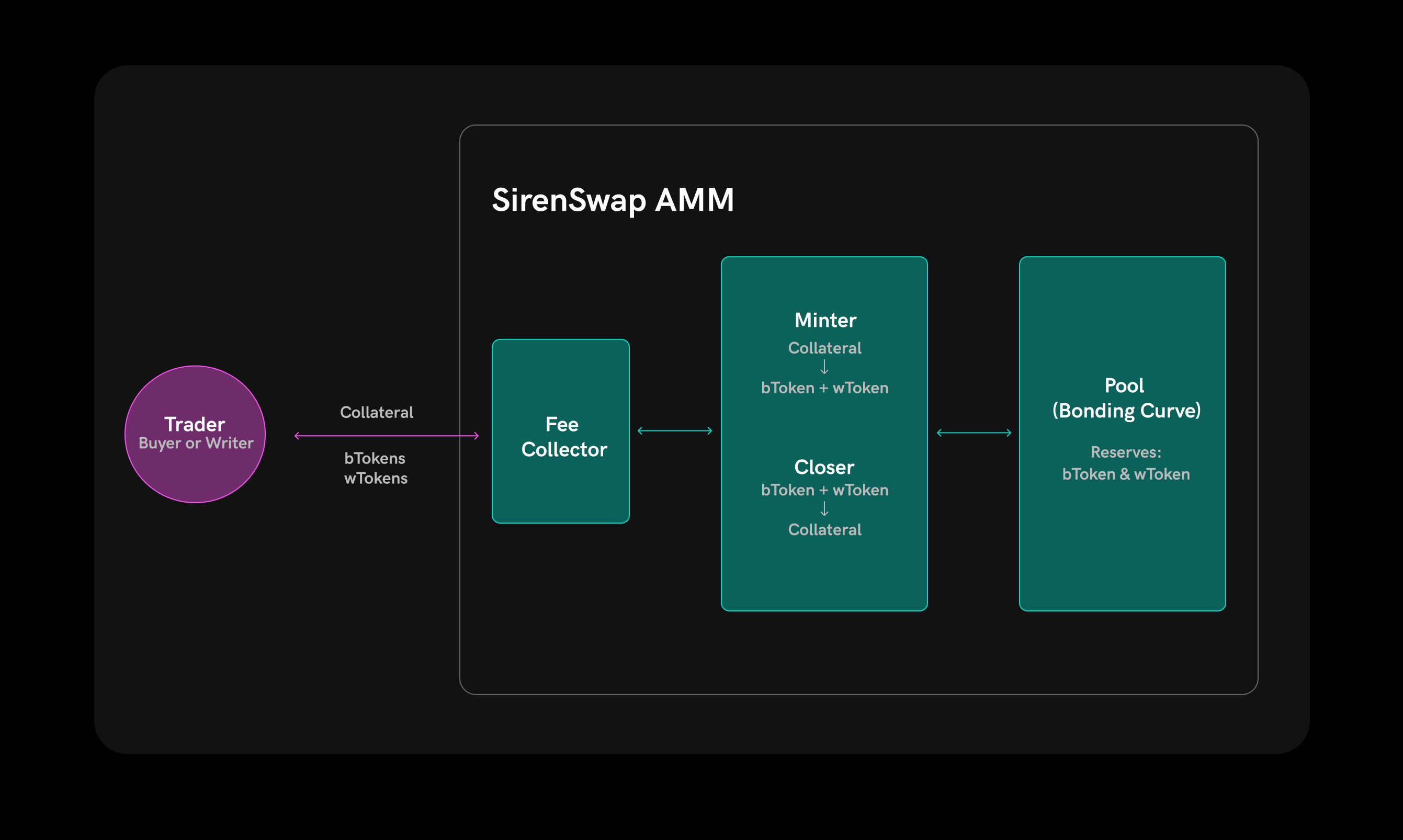

To ensure liquidity on day 1 the SIREN protocol utilizes a custom SirenSwap AMM that uses a novel combination of a constant-product bonding curve and options minting to trade both bTokens and wTokens. Notably, the AMM doesn’t require any asset in the pool other than bTokens/wTokens in order to trade them against the collateral asset (e.g. WBTC). This increases LP capital efficiency and provides other benefits that we’ll expand on in further posts.

The SIREN core team believes that in these early days of Ethereum and DeFi less is more, so they designed SirenSwap to be a model-less market maker. This means there is no complex on-chain pricing formula nor oracle feed required in order for it to function. This makes it easy for anyone to become an LP to potentially earn trading fees."

Building a Protocol for Decentralized Option Markets

The developers and designers at Siren Markets have been working on a protocol for decentralized options trading, and we’d like to share our thoughts on it with you here. Options are a financial primitive from which one can build many different more complex financial instruments. At their core, options give a trader the choice to buy or sell an asset at a predetermined price at a known time in the future. This is useful for protecting yourself (a.k.a hedging) against possible price changes in the asset, as well as speculating on these price changes.

Please continue reading for a high-level description of the unique components we’re working on to allow you to create and trade options for any ERC20 asset. We describe the core mechanics of how Siren Options are written and traded using an Automated Market Maker specifically designed for options, and the role the SIREN governance token plays in coordinating the options markets.

Core Protocol Mechanics

Siren’s Core Protocol Mechanics

Siren uses a fully-collateralized approach to writing options that doesn’t require any oracles to function. A single MarketsRegistry contract creates and coordinates individual markets. Once a Market contract is created anyone can interact with it in a permissionless manner. The solvency of a position is ensured at all times by the collateral locked in the smart contract.

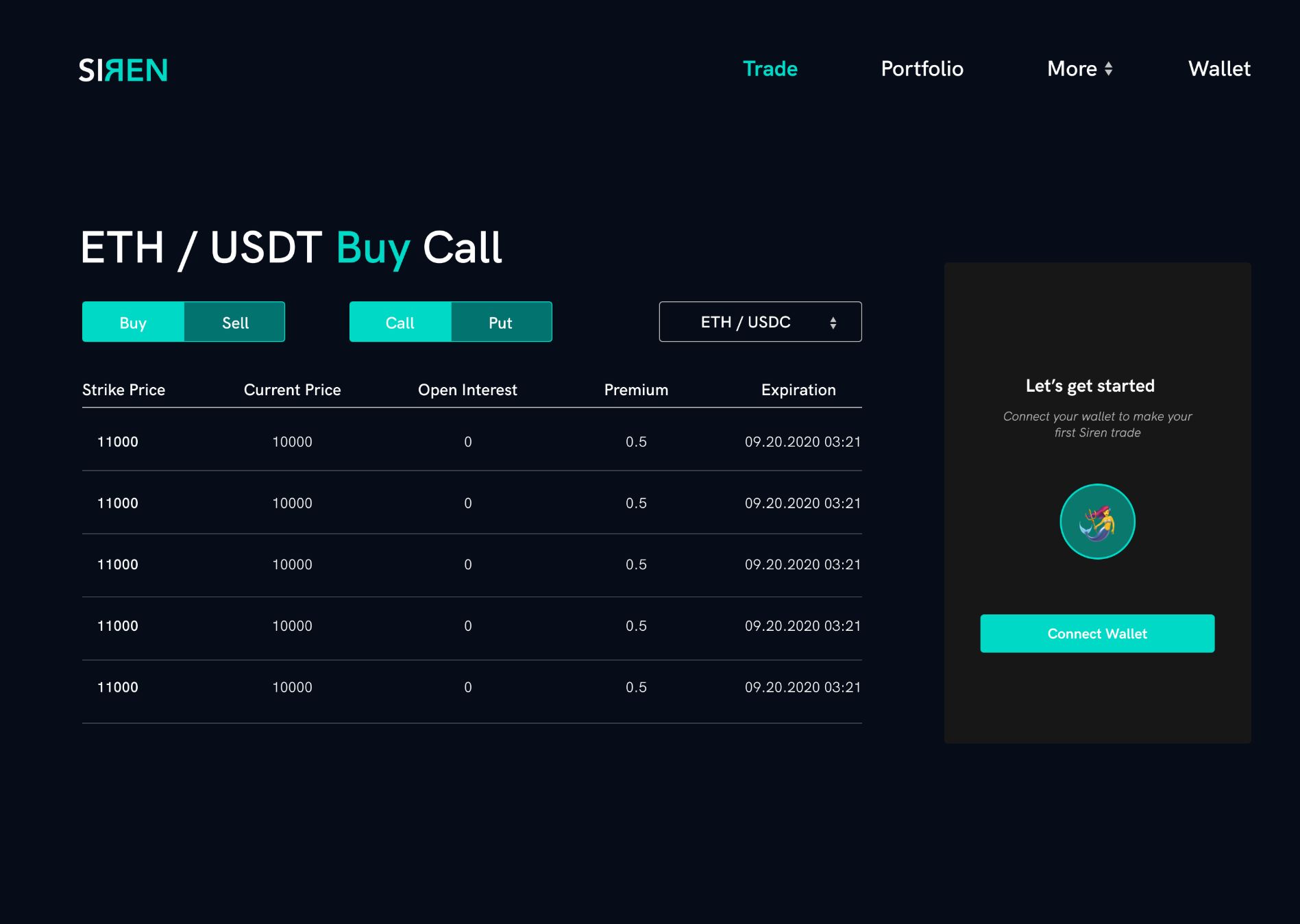

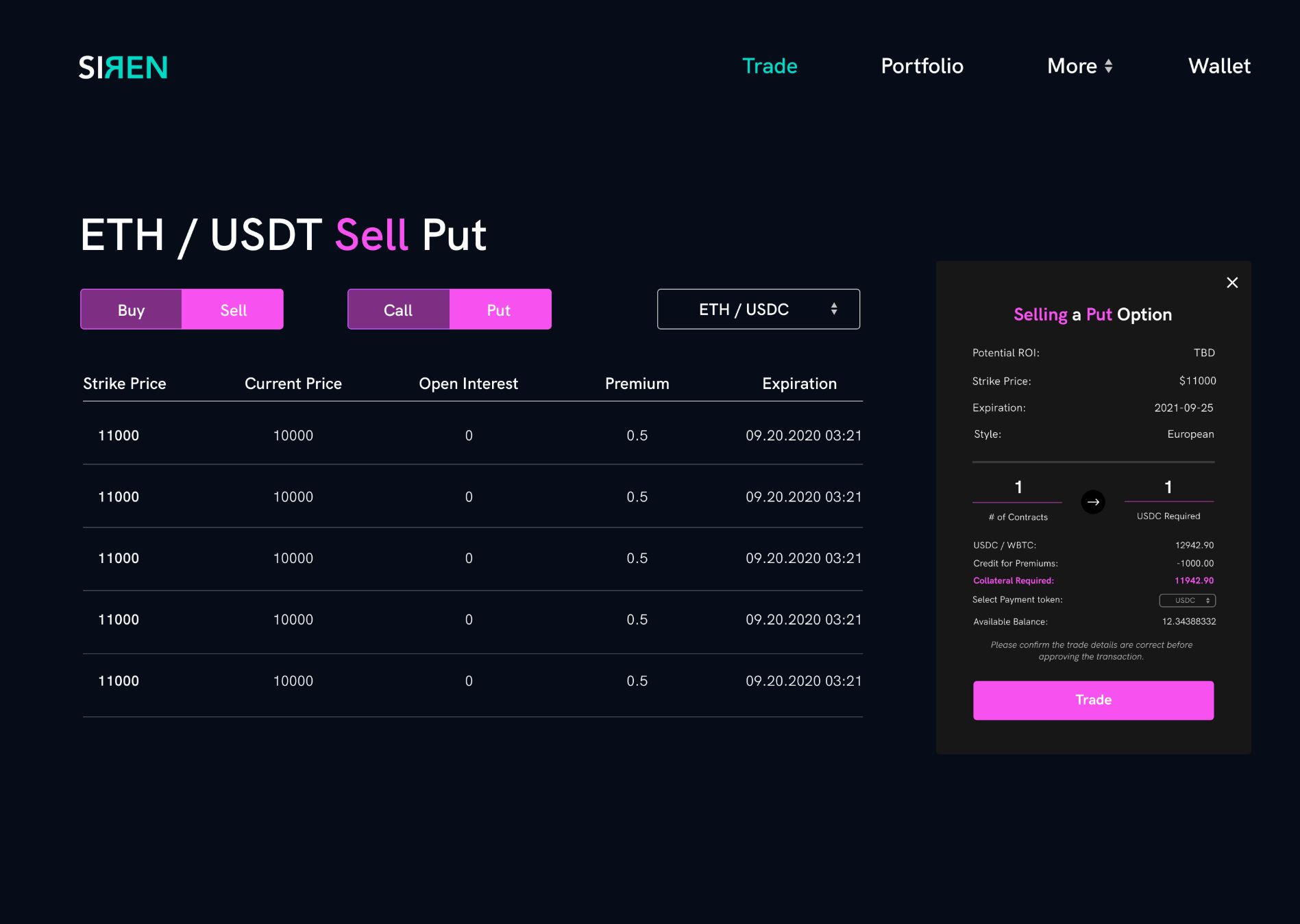

In Siren both the long and short side of the contract are tokenized. The buyer’s side (bToken) gives the holder the right to purchase the underlying asset at a predetermined strike price. The seller’s/writer’s side (wToken) allows the holder to withdraw the collateral (if the option was not exercised) or withdraw the exercise payment (if the option was exercised) from the contract after expiration.

Tokenizing both sides of the contract allows Siren to create secondary markets for both the long and short exposure. Under such a design in order to become a writer one purchases a wToken from the SirenSwap AMM (see below). A writer can also unwind their short exposure by selling the wToken back to the AMM. This streamlines the write-side mechanics by reducing it to essentially purchasing the underlying collateral at discount — as opposed to a typical design where the writer mints long tokens and has to then sell them in order to realize the premium.

SirenSwap Automated Market Maker

The SirenSwap Automated Market Maker (AMM)

Bootstrapping liquidity is core to creating a thriving market. Options are notoriously difficult when it comes to that. Not only does liquidity get fractured by combination of strike prices and expirations, it also requires sophistication on the part of liquidity providers in order to ensure fair and sustainable pricing.

To ensure liquidity on day 1 we designed a custom SirenSwap AMM that uses a novel combination of a constant-product bonding curve and options minting to trade both bTokens and wTokens. Notably, the AMM doesn’t require any asset in the pool other than bTokens/wTokens in order to trade them against the collateral asset (e.g. WBTC). This increases LP capital efficiency and provides other benefits that we’ll expand on in further posts.

We believe that in these early days of Ethereum and DeFi less is more, so we designed SirenSwap to be a model-less market maker. This means there is no complex on-chain pricing formula nor oracle feed required in order for it to function. This makes it easy for anyone to become an LP and earn trading fees.

Governance

There will be a governance token for Siren Markets, called SIREN. This token allows holders to create new option markets, and determine the fee rate for writing, closing, and redeeming an option. These fees accrue to SIREN token holders. Upon launch these fees will be set to 0 to reduce the friction in using Siren options, but will likely increase if the DeFi community adopts Siren options.

SI Token Distribution Event

EDIT: The SIREN Balancer LBP portal is now live

- SIREN Markets is launching the full version of our decentralized protocol for trading cryptocurrency options.

- SI tokens allow community members to engage in governance for SIREN Markets.

- Liquidity mining and Balancer LBP are the recommended ways to get SI tokens in order to participate in governance.

- 5MM SI tokens will be available on Balancer LBP on Tuesday, March 2nd at 16:00 UTC.

- PLEASE NOTE that Balancer LBP is not a regular Balancer Pool. The starting price will be very high to disincentivize front running and price speculation. Moving too early into the pool will not benefit users. If you’re interested in getting SI tokens from Balancer, we suggest fully understanding the Balancer LBP first and acquiring them after a few hours.

- Share questions or concerns in our Telegram community and we’ll do our best to address them quickly.

- SIREN team members will never message you first for any reason.

🧜♀️

Our team is very excited to announce the launch of SIREN Markets, a flexible, decentralized protocol for trading cryptocurrency options designed for sophisticated traders. The goal of SIREN is to provide the high-touch, well-crafted features of a TradFi platform without sacrificing the autonomy, self-custody, and composability of DeFi.

Since the alpha release of SIREN Markets in December 2020, our team has been working furiously to streamline the cryptocurrency options experience for our users. A huge thank you is in order to our early market participants who have made the storm-tossed journey with us so far, submitting bug reports, feature requests, governance proposals, and memes. Together we have brought SIREN to this launch, including over $14MM USD in Total Value Locked in our WBTC and USDC pools.

As part of this launch, we are distributing SI tokens, which the SIREN community can use to participate in protocol governance. This post explains the purpose of SI tokens, how they will be available to the public, the SI token economy, and how to obtain SI tokens if you’re interested in participating in governance.

SI Tokens

The SI token is the SIREN Market project ERC-20 native token. The function of the token is governance. SI token holders will be able to use their SI to vote on or propose new ideas that can be used to improve SIREN Markets. Before the on-chain governance voting platform is ready for SI token holders, core protocol contributors will guide critical decisions with input from the community. We think it’s important to keep governance nimble in the early days of SIREN.

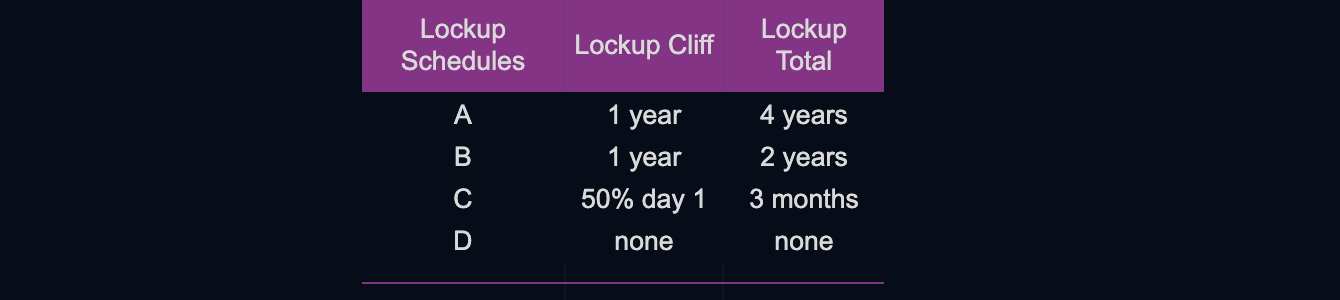

- 34,000,000 SI: Current team, future team, and advisors.

- 10,000,000 SI: Early incubator that invested in the development of SIREN.

- 26,000,000 SI: Previously sold and future unsold positions of investor tokens, to the extent they fully exercise their rights to purchase SI.

- 30,000,000 SI: Ecosystem and rewards, which will benefit traders, LPs, and developers who participate in the SIREN ecosystem.

The total SI token supply will be 100,000,000. All team tokens have a minimum one year full lockup and total four year unlock schedule. All private investors have a minimum one year lockup schedule and a total two year unlock schedule. Details on the SIREN private investment round to be released shortly.

Liquidity Mining

The best way to get SI tokens is through liquidity mining. The first SIREN Liquidity Provider Program (LPP) began in December 2020. The extension of this LPP will continue through May 2021 and rewards will be distributed evenly among our new asset pools. For more information, please see SIP-8, the latest proposal for liquidity mining at the SIREN Governance Discourse.

Balancer Liquidity Bootstrapping Pool

IMPORTANT! PLEASE READ BELOW. DO NOT PURCHASE SI TOKENS TOO EARLY OR FOR ANY REASON OTHER THAN GOVERNANCE OR STAKING.

Another way to acquire SI tokens is through the Balancer Pools. 5MM SI Tokens will be distributed through a Balancer Liquidity Bootstrapping Pool (LBP). Here is a post detailing how Balancer LBP works and the github.

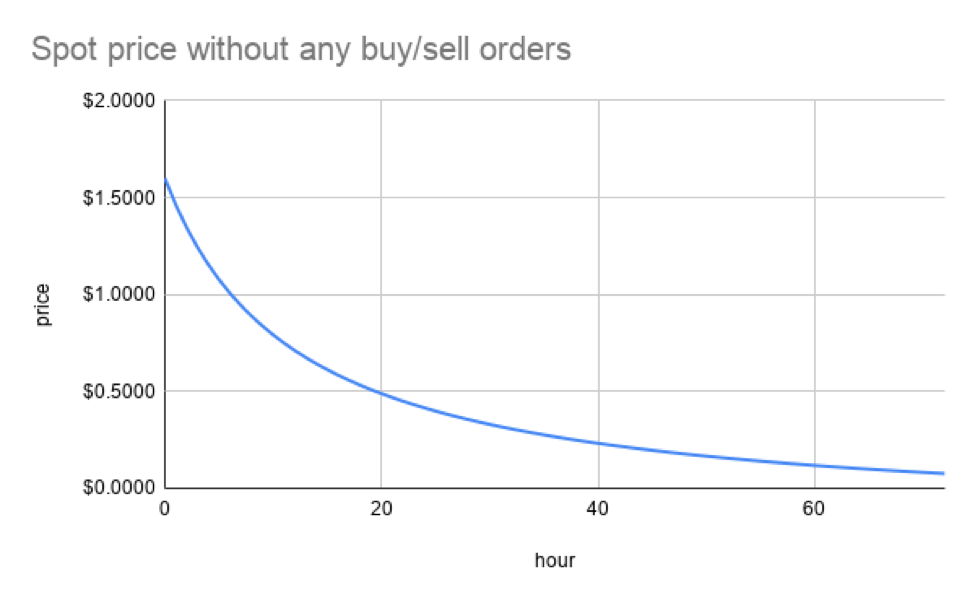

The Balancer LBP will be live for 3 days only and is designed to prevent front-running and speculation. It will start at a high price then go down quickly as the weights of the pool change. This mechanism prevents people from front-running other participants and speculating on SI tokens rather than using them for governance. After the 3-day period, the Balancer LBP will be stopped and part of the proceeds will be used to seed a secondary pool open to everyone. A Pool 2 system on a secondary market (e.g. Uniswap, Sushiswap, 1inch) for providing SI rewards in exchange for providing liquidity to the pool will occur after the LBP.

Below is a chart showing the spot price movement when there are no buy/sell orders on the Balancer LBP. As the chart illustrates, the Balancer LBP has a constant selling pressure to prevent front-running and price speculation.

Balancer Liquidity Bootstrapping Pool Execution

Phase 1:

- Create a SI/USDC Balancer LBP with 5MM SI tokens and 1.5MM USDC.

- The Balancer LBP starts from block: 11,960,039 and ends at block: 11,979,690 (approximately 3 days). The start time is around March 2, 2021, at 16:00 UTC.

- The weights will change gradually from the start (SI:USDC = 90:10) to the end (SI:USDC = 30:70) during that period.

- At the end of the Balancer LBP, the Balancer LBP will cease and Phase 2 will begin.

Phase 2:

- Using the last price and part of the proceeds from LBP, a new pool will be seeded.

- A Pool 2 incentivizes program will begin to encourage LPs to provide liquidity for SI

How and Where to Buy Siren Markets (SI)?

SI has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy SI

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since SI is an altcoin we need to transfer our coins to an exchange that SI can be traded. Below is a list of exchanges that offers to trade SI in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase SI from the exchange.

Exchange: 1inch Exchange, and Balancer

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once SI gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information SI

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Social Channel ☞ Coinmarketcap

Would you like to earn many tokens and cryptocurrencies right now! ☞ CLICK HERE

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #siren markets #si