What is Algorand (ALGO) | What is Algorand coin | What is ALGO coin

What is Algorand?

What the hell is Algorand? They are a scalable, secure, and decentralized cryptocurrency and smart contract platform. They’ve developed their own consensus mechanism that is a variant of proof of stake called pure proof of stake™. The main benefit of this is that Algorand technology finalizes blocks in seconds and provides immediate transaction finality. While preventing forks. Furthermore, Algorand offers highly customizable smart contracts as asset tokenization and atomic transfers built directly in layer 1. I’ll come back to all of this tech in a bit.

The company is based in Boston and was founded by a turning award-winning MIT Professor called Silvio Micali. He has also assembled a pretty strong team from MIT and other academic institutions, given the star power behind this project.

Silvio Mikali, founder of Algorand.

They were able to raise a pretty large amount of money through 2 private sales and one public sale over 120 million dollars. Those backing them in the private sale included the likes of Union Square Ventures** and Brainchild **among many others.

So that’s the quick overview of the project. However, in order to best understand what they’re trying to build, you have to know what problem they are trying to solve. This is essentially the Blockchain Trilemma.

Blockchain Trilemma: Scalability, Decentralization, Security

So, what the hell is that? Well, when it comes to blockchain technology, there are three ideal qualities that we’re all in search of, these are;

1- Decentralized control of the network should be appropriately distributed so that there are no points of centralized control.

2- Secure, blockchains have to be resistant to attacks and must be censorship-resistant too.

3- Scalable, They should be able to grow in size and capacity without impacting the underlying efficiency.

Now, these are all great targets in themselves, but the only problem is they’re highly related and intertwined. You cannot easily scale while at the same time increasing decentralization. You cannot scale in a decentralized way without impacting on the broader security of the network in some way or another. So, you’re left with this problem where you cannot scale in a decentralized and secure manner the blockchain trilemma. This is something that’s so many other projects have encountered not least of which the most popular smart contract blockchain of all ETH. So, why do we have this trilemma? Well, it comes down to the nature of current consensus mechanisms.

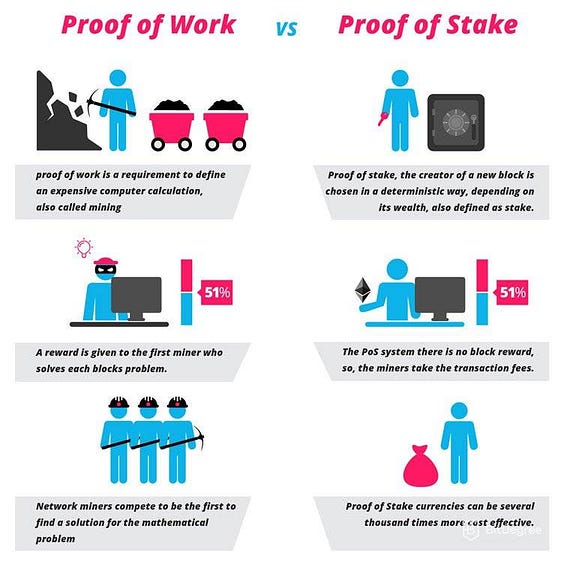

When it comes to blockchain consensus, there are a number of different options. However, two of the primary ones are proof of stake (POS) and proof of work (POW).

Now most of you are no doubt familiar with good old proof-of-work. It’s the consensus mechanism that’s used by the likes of Bitcoin, Etherium, and a number of other protocols. However, as we’ve come to realize, the trilemma is quite acute when it comes to proof-of-work systems. There is a lot of centralization where most of the hashing power is controlled by large mining farms. They’re also not the most secure as there are a number of blockchains that have been attacked through Double Spending Attacks.

The most recent of these is an ETH Classic for example. They’re also not very scalable. Of course, you need to look no further than ETH here. Transaction times are slow as hell and those gas fees sometimes have us screaming at the sky. This is perhaps one of the primary reasons why everyone is so excited about ETH 2.0 and the transition towards proof of stake. However, despite being more favorable than a proof of work, there are challenges with proof of stake as well. So, let’s take a look at the delegated proof of stake (DPOS). For example or DPOS under this mechanism, the community will empower a number of users the delegates to choose the next block. This is a mechanism that is used by blockchains such as EOS etc. Now, the only problem is that this does create concerns around centralization. There is a fixed number of delegates and these delegates can be viewed as having centralized control. In the adipose blockchain, the delegates may own a tiny fraction of the total money in the system. Yet, the whole blockchain is secure, If and only if the majority of delegates are honest. Now, even if we were to assume that all of these nodes were honest, these nodes can easily be identified and attacked. They can run denial-of-service attacks that stop consensus and hence bring down the blockchain itself.

Another variant of the proof of stake system is of course Bonded Proof of Stake. This is your more typical model where the users were bond tokens at state in order to vote on blocks. The thinking goes that they will never vote against their own interests as they could lose that stake. The only problem with this is that it allows a well-heeled adversary to overtake the network. There are many occasions where an attacker could get more value from bringing down a network then they could lose with money bonded in stake. So, quite clearly the current message of consensus means that it’s hard to scale a blockchain insecure and decentralized way, and that is exactly why Algorand has developed its secure proof of stake mechanism. So let’s slide into that now.

The Algorand consensus mechanism is called pure proof of stake. And it operates on this simple principle. It makes cheating by a minority of the money impossible and cheating by the majority stupid. So what do I mean by that? Well unlike with other bonded proof of state mechanisms that rely on punishing bad actors, but the fun staked. They developed a mechanism so that those with small stakes cannot cheat, moreover those that have a large stake in the network won’t cheat. It will completely devalue their holdings and make no economic sense. So, basically as long as 2/3 of the majority are honest, the protocol will work just fine. It also differs from other mechanisms in that the money does not have to be bonded for a particular period of time. Money is always in users’ wallets ready to be spent and used in other ways on the network. On the other hand, blocks are constructed into two phases through lotteries known as cryptographic sortition. And if that sounds like mumbo-jumbo to you, don’t worry, it’s basically just a mechanism where consensus on blocks is established through two stages a proposal stage and a voting round.

Who does what in the is completely random and hence impossible to manipulate. By the way, I have linked to the docks below if you want to do a bit more reading but what this basically means for the ecosystem is that you have fast finality. For example, Algorand smart contracts operate at over 1,000 transactions per second, which is considerably higher than the number of other smart contract blockchains. Moreover, the random nature of the sortition that I mentioned above means that It is immediately decentralized, and given that there’s no way for adversaries to know who is voting on the next blog. It’s also secure.

Okay, so the underlying blockchain layer of Algorand is able to attack that scalability problem. I know I want to move on to the next most important component of the tech stack and that is their smart contract functionality. This is particularly relevant given their recent DeFi pivot.

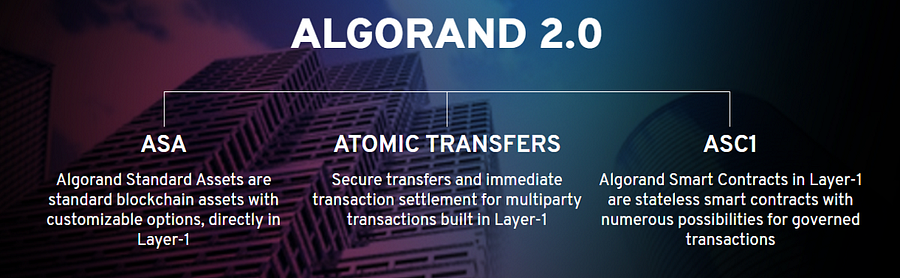

Algorand 2.0

Last year Algorand released Algorand 2.0 which was a much-needed update to its protocol. This would see the introduction of three key features these include the following the Algorand Standard Assets, the Algorand Atomic Transfer, and The Smart Contracts. If you want to read about those first two, then I encourage you to look at the docs. The one that I’m most interested in covering now, is that concerning those stateful smart contracts. Algorand’s smart contracts are integrated into Algorand Layer 1, which means that they inherit the same speed, scale, finality, and security as the Algorand platform itself. Moreover, they are cost-effective and error-free in order to get a sense of just how compelling they’re smart contracts are.

I’d like to direct you to this handy guide over here. As you can see there are a number of benefits that come with the Algorand smart contracts. They’re energy-efficient, fast, have immediate transaction finality, easy to develop on they support Java, JavaScript Python Go, and of course, they’re cheap to send on. The applications for smart contracts like this in the DeFi space are immense. I want to direct your attention to their post on smart contracts in DeFi. It takes you through all these use cases including Escrow, Synthetics, stable coins, credit, exchanges, margin trading, etc. the list goes on. So there are clearly a lot of use cases for these smart contracts in DeFi and it’s also not completely theoretical there have been a number of projects that have started developing on Algorand. I also mentioned stable coin applications there. Well, it was recently announced that Coinbase’s USDC would be migrating over to Algorand The main reason for this was of course the high fees and transaction blown on the ETH network. In fact, even back in June of this year, the center consortium announced its intention of diversifying away from the ETH blockchain. It’s pretty telling that Algorand was one of the first blockchains that they decided to move on to. So, all-round, it seems that our grant has the cutting-edge tech most investors and developers consider when scouting for opportunities, and this does not even factor in the star power behind the project.

Team

As mentioned the founder of Algorand is an MIT cryptography Professor called Silvio Micali to say that he’s accomplished in the field of cryptography is an understatement. He’s won three different international academic awards for his work. He’s one hell of a bring a chap. Oh and here’s a fun fact those **Zero-Knowledge Proof **that you often hear about those were first conceived back in the day by Silvio and two other professors.

Silvio Micali_ is the founder of Algorand. He is an expert in cryptography, secure protocols, and pseudo-random generation and he oversees all of the research and security involved with Algorand. He is the co-inventor of a large number of protocols, including Verifiable Random Functions, Zero-Knowledge Proofs, and Probabilistic Encryption._

Steve Kokinos_ serves as the CEO at Algorand. He was previously the CEO at the global enterprise communication platform Fuze, and he brings a wealth of business and entrepreneurial experience to Algorand._

W. Sean Ford_ is the COO at Algorand, and he also brings a wealth of business experience, having previously been the CMO at LogMeIn._

Silvio is only one component of the team. I encourage you to take a look at their team page and see some of the other names and credentials that are behind this project. And this is just their human capital. They have a lot of financial capital behind them as well. As mentioned they managed to raise over 120 million dollars in a number of token sales and heck they even completed a separate fundraise for their own Venture Capital Arm. This was originally called Algo Capital and was recently renamed to Borderless Capital. They raised over 200 million dollars in order to invest in those projects that are building on the Algorand blockchain. If that does not spur development activity. I don’t know what will. So, I’ve been writing a lot about the benefits of Algorand and how great the tech team and use cases all are. However, this all brings us to a very important question. Why is the token still underperforming?

Tokenomics

I think this has to come down to its tokenomics. So let’s take a look at those now shall we as mentioned the native token on the algorithm blockchain is there an ALGO token? This is a utility token and there are two main functions that I can see. Firstly, it can be used in order to **steak and earn **those ecosystem rewards, and secondly, it can be used in order to **pay for transaction fees **and dap computations.

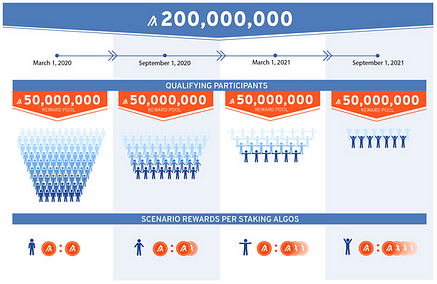

There were a total of 10 billion tokens that were minted in the Genesis block. Now while that may seem like a lot the circulating supply is only about 1 billion and right here, you can see the token release schedule now something that you should note about. This is the fact that there are still token sales ongoing. As they state they set a sales target of 150 million ALGOs for this year. However, with a 1 billion circulating supply that implies protocol inflation of close to %15 which is pretty damn high and these are just the token cell components. There are additional ALGO hitting the market as a combination of not only participation rewards but also a staking rewards component. Here you can see the total ALGO that’s being dispersed through the standard rewards, and here you can see the ALGO just coming onto the market as a result of the staking participation program by my calculations. That’s an additional 165 million ALGO there would be hitting the market in 2020.

If we add that to the proposed token cells that’s quite a hell of a lot of inflation. Now, I should also point out that 5 million ALGO were burned in an auction by a back this year more on that in a bit. However, this is just not enough to counteract the millions of the coming on to the market, as we know increased supply without a counteracting increase in demand results in a price fall.

Resource: https://coinmarketcap.com/currencies/algorand/

Let’s pull up that price chart of ALGO. Shall we as you can see? They hit the market at over 3,20 and fell immediately. In fact, they were one of the worst-performing new listings on Binance as the tokens felt almost 50 cents within a month of hitting the market.

1 month later, after listed on Binance, worth was almost 50 cent.

Now, there are a number of other factors that were external to Algorand that led to this fall. Of course, they launched in the soft market last year as there was little appetite for all coins. It could also have been down to the lack of any sort of excitement prior to the listing. Given that Algorand raised most of their funds through a private sale. Not many people knew about it. However, I think a great deal of that was just a flood of tokens hitting the market the moment trading went live. For example, just prior to the listings ALGO sold tokens to the public through a Dutch Auction process. This saw them issue 25 million tokens at a price of 2.40 USD per ALGO. So the moment The training went live a flood of ALGO hit the market and subsequently tanked the price. So bad was the fall the Algorand Foundation actually implemented a token by back for some of those Auction buyers that would see them receive 90% of the original purchase price in return. In fact, I have to say that is pretty commendable. I mean how many other projects have you heard of that offered to buy back tokens that have created after listing. Either way, some people took advantage of it and some didn’t. If they did then the tokens that they sent over would be burned which would, of course, reduce the supply. However, that was not enough to slow the rate of inflation that I mentioned above. The trading history since the buyback was really quite lackluster. It culminated with ALGO dropping to an all-time low of just above 10 cents in March of this year (2020).

In March 2020. ALGO felt down to almost 10 cents

This no doubt spurred those Algorand chaps to conduct their second by back in July. However, July did renew some hope in the price of our go. After it was listed on Coinbase. Now, we all know the impact that the coin based system had not only on the price of an asset but also on the broader liquidity this did spur a much-needed rally in August that saw ALGO reach its highest level since listing and over 60 cents. This was unfortunately short-lived as the price has subsequently retraced. So this of course brings us on to the most important question of all, where does the price go from here?

Token Economy

The Algorand Foundation, the non-profit organization overseeing and funding development of the protocol, says that only 10 billion units of its ALGO cryptocurrency will ever be created.

Algorand maintains a block explorer, which keeps an official count of its circulating supply.

A schedule of distributions, which the foundation expects to be completed within five years of the protocol’s launch, can be found below:

Overall Token Distribution:

3.0 billion

Estimated algos to be injected into circulation (initially via auction) over the first 5 years

1.75 billion

Estimated participation rewards (distributed over time)

2.5 billion

Relay node runners (distributed over time)

2.5 billion

Algorand Foundation & Algorand, Inc.

0.25 billion

End user grants (distributed over time)

Price Potential

It’s a tricky question despite how impressive Algorand is from a tech and team perspective. The current economics are still quite challenging. Yes, there is a max supply that cannot be increased. However, this is quite high and inflation is currently only impacted by what is coming on to the circulating supply. The ALGO hitting the market through the combination of those two reward programs is likely to still be a bit of a drag. The something else that you have to factor in here, too.

Because there is no bond as it is required to be put up for a period in order to stake. There are no counteracting supply-side mechanisms restricting circulating supply. This is something that bonded proof of stake mechanisms require, which does bring down those supply numbers.

The final question then has to come down to that utility demand. Is there likely to be a lot of demand from the protocol to use ALGO for Dapps or transactions? Well, given the benefits of the tech that I’ve taken you through I do happen to think so. Algorand is trying to expand the use case of its blockchain to the burgeoning DeFİ space. Prices with fast finality and low transaction fees. Indeed the move by coin basis with their USDC stable coin is Testament to that.

Did you know that a country is actually building its own digital currency on the Algorand blockchain? Yes, The Marchall Islands are issuing their own sovereign SOV that will be built on Algorand so that could be another strong utility demand-side factor right there.

Moreover, it’s pretty clear that Algorand is focused on growing its ecosystem. Let’s not forget about those 200 million dollars in funds that they have to invest in projects that are built on Algorand. However, the real question is whether the eventual demand that’s created can outstrip all that supply that’s currently hitting the market. At current levels. It doesn’t seem so but if demand does drastically pickup and more defy projects build on or migrate to ALGO then it could be a different story.

Conclusion

It’s time to start wrapping things up. What do I really think of Algorand? One can’t deny that their tech stack is impressive true. They’re unique and ingenious pure proof of state consensus mechanism. They are much closer than other projects to attacking that blockchain trilemma. We all know that scaling is one of the most important things in everyone’s mind. It’s also one of the reasons why I cannot wait for the launch of ETH 2.0. Perhaps this really could be that scaling Holy Grail that everyone is talking about.

However, delays to the launch of the beacon chain mean that people are in search of the best alternatives given the recent launch of a ground state for smart contracts the applications that can be built on the network are immense as we’ve seen there is potential for defy projects that are looking for a more scalable alternative to build on. Moreover, I have to go out on a limb here and say that the team behind the Algorand project are some of the most accomplished that I have seen, not only do they have the academic star power, they also have hundreds of millions of dollars of capital backing the project. Despite all this so things have not fared so well for the ALGO tokens. As I’ve pointed out, there are a number of supply-side pressures that are keeping the price down. As we approach that supply cap, these emissions are likely to continue. The only thing that can counter these supply-side pressures is an equal or greater demand from users building and transacting on the Algorand Network. At current levels of network use, it does not appear, as if this demand-side driver is strong enough. However, that may be about to change with their recent expansion into the field of DeFi. Theirs also dedicated to support projects building on Algorand and have a lot of coin in the kitty to do that. So, it will be interesting to see how things play out in the next couple of months. It’s no doubt a project that I will be keeping a very close eye on.

Would you like to earn many tokens and cryptocurrencies right now! ☞ CLICK HERE

How and Where to Buy Algorand (ALGO)?

ALGO has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy ALGO

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

After the deposit is confirmed you may then purchase ALGO from the Binance exchange.

Exchange: Binance, Huobi Global, OKEx, HBTC, Coinbase and BiKi

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once ALGO gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi ☞ MXC ☞ ProBIT ☞ Gate.io ☞ Coinbase

Find more information ALGO

☞ Website ☞ Website 2 ☞ Explorer ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Social Channel 4 ☞ Social Channel 5 ☞ Coinmarketcap

Would you like to earn ALGO right now! ☞ CLICK HERE

I hope this post will help you. If you liked this, please sharing it with others. Thank you!

#blockchain #bitcoin #algorand #algo