What is ChainX (PCX) | What is ChainX coin | What is PCX coin | Substrate on Polkadot

ChainX Background

The ChainX project has roots stretching back to 2016, when the founders came across the work of the Parity team and began to look into the Polkadot whitepaper. Work on substrate began in 2018, and by May 25, 2019 the first ChainX mainnet version was launched.

The project itself is addressing the need to make native blockchain assets interoperable with other blockchains. As a distributed system the ChainX network has made it possible to exchange assets cross-chain in a peer-to-peer manner. This eliminates most human error and the opportunity for fraud.

While ChainX did follow Bitcoin in many respects, the team noticed early on that the Proof-of-Work consensus mechanism decentralization suffers from the centralization of miners. Currently the large mining operations get to sit at the top of the pyramid and the only way for new entrants to access block rewards is through large investments in powerful mining rigs.

Unfortunately Proof-of-Stake can be little better at times when a large chunk of tokens are held by the early investors, or by the development team. This leaves just crumbs for the newcomers, who are left at the mercy of the open market, and have no real power in the governance of the network. In essence it makes these networks subject to centralization due to the large coin holdings of the early investors in the network.

ChainX has gone with a Proof-of-Stake consensus, however it has been implemented in a different manner that makes it fair for all the network users. Throughout this review you will get to see how this differentiates ChainX from other projects, and how it improves the governance of the network.

What is ChainX

Most simply, ChainX is a blockchain system that allows for the sharing of native assets from other blockchain systems. It does this through the use of parachains, and uses a Proof-of-Stake consensus mechanism to reach consensus.

This also allows for the staking of coins that typically don’t support native staking, such as Bitcoin. ChainX initially launched as a single-system chain, was later upgraded to a dual-chain network, and as of 2021 is operating as a multi-chain system supporting a number of other blockchains.

The complex structure of ChainX – built on Substrate 2.0. Image via ChainX whitepaper.

In the current multi-chain version of ChainX it is running as a layer 2 relay network on the Polkadot blockchain. It currently operates with four major modules:

- PCX Module – The module is based on the native token PCX. For the most part, it includes functions performed by PCX such as staking, paying fees, on-chain governance, distributing inter-chain mining rewards, and backing Bitcoin financial derivatives. PCX is related to most programs running on ChainX.

- DEX Module – A cross-asset transaction module, it promotes circulation of assets on different chains while minimizing transaction costs.

- Inter-chain Module – This is an ‘entering or exiting’ module for different chain assets and the X-Tokens. It includes an inter-chain transaction verification system, on-chain mintage program, trusteeship program, and a deposit and withdrawal program for the X-Tokens.

- Relay Module – A window for information exchange and verification between ChainX and outside chains, it is primarily comprised of a chain information update program, a chain monitor program, and an inter-chain information collection and transmission program.

The platform uses a form of staking it refers to as asset mining. While ChainX can accept assets from a variety of different decentralized blockchains using any number of consensus algorithms, which introduces a good deal of complexity in the background, at its heart the concept of asset mining remains quite simple.

It begins with the notion that each asset deposited to the platform will carry just one vote. This allows for staking any asset supported by the ChainX platform. Users can deposit BTC or ETH, and many other cryptocurrencies as well, receiving PCX in return. Because there was no pre-mine or ICO distributing large amounts of PCX to early investors this system keeps staking and governance fair, even and balanced.

In the ChainX protocol, computing power is created through votes. This means users are rewarded based on the number of votes they have in the system. A greater number of votes means greater computing power, and that leads to greater staking rewards.

ChainX Mining

As alluded to above ChainX uses a “One Asset One Vote” model for mining. It splits that into two different forms as well: Voting mining and interchain asset mining. PCX is used as the computing power unit in the system.

Voting mining is quite simply the actual staking of real PCX to participate in mining. Interchain asset mining is quite different however as it involves depositing or mapping various other assets such as BTC or ETH to participate in mining. These assets have a virtual computing power calculated based on a number of factors such as fixed computing power calculation, market price discount calculation and others which are described in more detail in the ChainX whitepaper.

Mining power in ChainX illustrated. Image via ChainX whitepaper.

The ChainX platform uses Proof-of-Stake consensus that combines the computing power of PCX voting/mining power, and the added voting/mining power of interchain assets. The security of the network is guaranteed by PCX, with more staked PCX increasing the overall security of the network.

Since ChainX also acts as a gateway for inter-chain assets it connects assets from other blockchains, and increases in value as more assets are connected. Both the PCX and inter-chain assets participate in the mining process.

To avoid a massive surge in inter-chain assets overwhelming the system in the early days a dynamic mining model has been adopted to offset any sudden influx of inter-chain assets. This also comes with a fixed computing power ratio between the two that can be adjusted through a chain governance referendum.

Computing Power

Inter-chain assets are discounted when participating in mining. The current ratio of interchain assets to PCX in terms of mining power is set at 1:9 which can be adjusted through community voting, which means the maximum mining power of all interchain assets is set to 10% to ensure PCX voting mining power greater than or equal to 90%.

ChainX Consensus

ChainX uses a hybrid Proof-of-Stake consensus mechanism known as “Babe + Grandpa”, whose most notable feature is the block generation and confirmation are now separate. The Babe module handles block generation, with new blocks being created every 6 seconds, while the Grandpa module handles block confirmations.

The ChainX team has determined that the traditional Proof-of-Work consensus model features weak individual nodes that are unable to forge blocks on their own. This necessitates creating or joining mining pools, with the result being a small number of mining pool nodes on each chain.

In PoS the initial chain might have roughly 7 nodes, and later follow-up chains might grow to dozens of nodes. All this does is block the decentralized nature of the blockchain by keeping ordinary users from becoming nodes and assuring that large organizations can take control of the blockchain.

_Grandpa block confirmation. Image via _Polkadot Wiki

With the Babe + Grandpa consensus mechanism there are already several dozen consensus nodes when the blockchain was launched. That number is gradually growing as the ChainX community grows and evolves. While it’s true the cloud servers were required to build the initial nodes, later nodes can be created through the desktop wallet.

However these nodes do still need a persistent internet connection and sufficient computing power, otherwise blocks could be delayed, resulting in punishment for the node. If a punishment is incurred the funds are delivered to the Treasury where later referendums can decide how those funds should be used.

There is an incentive for running a node as the node has a profit model that includes obtaining 10% mining income from users, although that proportion can be modified at any time by a referendum. Any dropping nodes or malicious behaviors will be punished through the reduction of rewards. Verification nodes follow an election cycle that is just 1 hour long, with nodes being ranked by the number of votes they receive.

Any node that fails to receive enough votes to become a verification node will become a synchronizing node instead. Votes of both consensus nodes and synchronizing nodes participate in the mining reward distribution with the same benefit rate so that the advancement of synchronizing nodes will not be compromised.

ChainX and Polkadot

If an interconnection between blockchain projects is to be achieved it is critical to have interaction between ChainX and Polkadot and this occurs in a number of ways. Primarily however we see that ChainX handles the interaction of blockchain assets, while Polkadot handles the exchange of data between the various blockchains.

ChainX and Polkadot are a powerful combination. Image via ChainX blog.

In bringing these two systems together ChainX works as a secondary layer relay on Polkadot. The two are brought together via a parachain system that includes the following modules:

- ChainX Relay Chain – Responsible for securing the entire second layer network

- **Bridge Para-chains **– Splits the responsibilities of various transfer bridges to different parachains to improve on throughput and enhance scalability.

- Trade Para-chain (DEX Module) – Provides a matching service for assets on the platform, increasing throughput along the way.

- **Dapp Para-chains **– This handles decentralized applications (Dapps) developed by the ChainX community.

ChainX Bridge vs. Polkadot Bridge

The ChainX Bitcoin transfer bridge provides transparent operations via a one-way light node relay mode. This is possible by hosting user funds on multiple trust nodes. Additionally there are two hot and cold public multi-sig addresses.

The main differences between the ChainX and Polkadot bridges. Image via ChainX blog.

Polkadot is used for communication of data between parachains, however at any time a chain under it needs to communicate outside the ecosystem the transfer bridge must be used. With the parallel chain bridge is is possible to realize one or more transfers in this way. It’s important to note that because Polkadot allows communication between parachains any bridge implementation serves all other parachains and creates a network effect.

Besides being a parachain the Polkadot chain is also a complete main chain. That allows for secondary slots and because slots on the main chain are limited and parallel chains can be expensive the secondary Polkadot chains provide an affordable solution.

It has already been foreseen by the ChainX team that as the number of bridges connected to the Polkadot ecosystem increases there will come a time when the first layer of parachains is insufficient to handle the needs, and at that time the secondary relay chain will provide a way to develop additional bridges.

With the addition of the ChainX transfer bridge to Polkadot that provides trading services for all the assets on the relay chain ChainX has the advantage of access to all the assets connected to the network.

This will allow ChainX to provide for any financial services desired by the network, including stablecoins, private trading based on ZEC, betting with BTC, and anti-risk tools such as insurance, loans, indices, options, futures, and other DeFi tools. ChainX is also divided into multi-chain frameworks to improve throughput, and as a whole Polkadot’s second-level relay network.

The ChainX token (PCX)

ChainX was created with a total of 21 million PCX tokens and an initial emission of 50 PCX per block. Halving is done every 2 years and the founding team will hold 20% of the total coins after the initial two years of operation.

PCX emission slows by half every two years. Image via ChainX whitepaper.

Uses of the PCX token

- To pay miner fees

- Acts as the market capitalization unit

- As collateral for both consensus and trustee nodes

- As a standard during PoS consensus election

- Forms the base currency and exchange medium

ChainX was created with a transaction fee of 0.0001 PCX, but as the throughput and performance of the network improves the fees are designed to decrease to the point they will become irrelevant. As the network evolves into its later stages the issuance of new parachains will slow, and the mining income will primarily come from these small transaction fees and from network punishment fees.

There is a gas fee associated with PCX as well, which is necessary in order to avoid DDOS attacks. The gas fees are based on the complexity of the operations being performed. Users also have the option to accelerate transactions based on network congestion.

While this may make it appear that users are paying fees to use the network, this can be offset by the mining income generated by holding and staking PCX. So, most users will still be able to use the network at no net cost, although heavy users of the network will likely end up paying net fees due to the number of transactions.

ChainX Price Performance

In the roughly 18 months since the PCX token has been publicly trading it has seen quite a bit of volatility, with an all-time high of $19.73 notched on August 27, 2020 and an all-time low of $0.5446 hit on March 13,2020. There have been a number of other spikes higher for the token as can be seen from the chart below.

_ChainX has seen some volatile behavior. Image via _Coinmarketcap.com

In terms of market capitalization ChainX is hovering around #300 in terms of market cap, at roughly $120 million. With the relatively large emission of PCX tokens occurring at the start of the network it is expected that PCX will quickly climb in terms of market capitalization, presuming the price does not crash back towards its all-time low.

How to stake

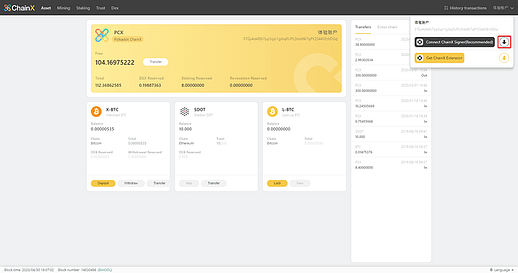

Staking PCX is done through a signer + DApp combo, which can be found here: https://dapps.chainx.org/

You can change the language in the bottom right.

1. Download the Signer

In the top right, download the signer and install it on your desktop.

Where to download the Signer

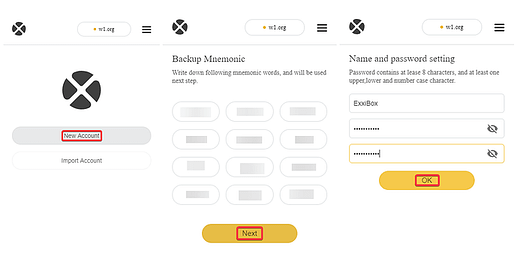

2. Make a Wallet

Open and click on New Account. Save your Mnemonic and choose a name and password.

Creating a wallet

3. Sync the signer with the Dapps

Go back to https://dapps.chainx.org/ and sync your signer as show in the picture below.

Syncing the signer to the wallet

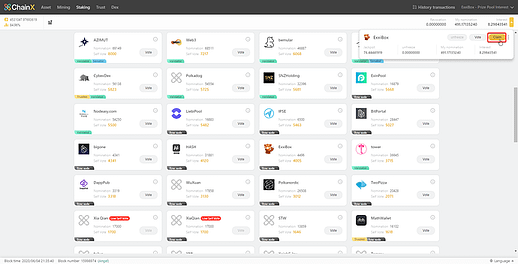

4. Vote on a Node

After depositing PCX from your exchange of choice navigate to “Staking” and find the node with the red panda called ExxiBox. Click on Vote and delegate your PCX (Leave about 0.01 PCX for transaction fees).

Use your signer to ‘sign’ the transaction with your password. There’s no difference in rewards between nodes and the PCX remains in your possession, but it does give me a little kickback if you decide to delegate your PCX to me.

Voting on a node

Note: Memo is a message you can add to the transaction, feel free to add anything or leave it blank.

5. Claim your interest

Your interest can be collected in the top right, using the ‘claim’ button. I suggest you claim and re-stake this daily for compound interest, but that’s completely up to you.

Claiming Interest from your stake

Would you like to earn PCX right now! ☞ CLICK HERE

How and Where to Buy ChainX (PCX)?

PCX has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy PCX

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since PCX is an altcoin we need to transfer our coins to an exchange that PCX can be traded. Below is a list of exchanges that offers to trade PCX in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase PCX from the exchange.

Exchange: Gate.io, MXC.COM, BigONE, Hoo and Hotbit

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once PCX gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information PCX

☞ Website ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Message Board ☞ Coinmarketcap

I hope this post will help you. If you liked this, please sharing it with others. Thank you!

#blockchain #bitcoin #chainx #pcx