What is Nftfy (NFTFY) | What is NFTFY token

In this article, we’ll discuss information about the NFTFY project and NFTFY token

What is Nftfy

Nftfy is a robust decentralized open marketplace that enables anyone to effortlessly monetize digital assets with no coding skills required.

The Nftfy ecosystem as well as its native $NFTFY Token have been created in order to solve these issues by enabling anyone to easily fractionalize and create a market for all forms of NFTs. This will be a game-changer as much-needed liquidity will be injected into this nascent space and NFTs on the higher end of the price spectrum will become available to smaller investors via fractionalized ownership components.

The protocol allows for all of the most powerful DeFi services in the industry:

- AMM

- Liquidity Mining

- Yield Farming

- Airdrops

- DAO Treasury

First-Mover

A pioneer in the cryptographic space, Nftfy will revolutionize the industry by becoming the first decentralized protocol that enables NFT holders to fractionalize their Non-Fungible Tokens (NFTs) in a trustless and permissionless manner. The highly sophisticated — yet user-friendly — Nftfy platform utilizes smart contracts to fractionalize digital assets into several ERC-20 compliant components while ensuring that each component is backed by the NFT itself.

NFT Mania

The unprecedented explosion in the popularity of NFTs in 2021 and the rapid pace of mainstream adoption have been nothing short of remarkable; even the savviest investors and enthusiasts in the space were unable to predict this phenomenon. While the current excitement surrounding NFTs is great for the industry and cryptocurrency in general, there are certain elements to the market which remain problematic for both NFT creators and investors.

Low Liquidity

A lack of liquidity puts a cap on the number of new investors in the NFT ecosystem.

Investment Risk

Given the highly speculative nature of the current NFT marketplace, current investors take on significant risk as the “value” of any given NFT today can fluctuate significantly within a short timeframe.

Monetization of Assets:

Extremely high-priced NFTs may not be sold for their true “value” within a reasonable timeframe. There is currently no method to fractionalize these assets into smaller ownership components.

Value Proposition

The fractionalization of NFTs as well as the shared ownership mechanisms provided by Nftfy solve these major pain points, thereby paving the way for even more mainstream adoption as well as real-world utility for NFTs.

Fractionalization and issuance of fractions

The primary purpose of Nftfy is to fractionalize NFTs into ERC-20 components. In traditional finance, this process is highly centralized and requires regulatory oversight to guarantee the backing of value for all market participants. The product of multiple intermediaries combined with strict regulation is a lengthy, inefficient process that comes with a high price tag.

Nftfy has solved this problem via an entirely decentralized and software-guaranteed backing mechanism, thereby eliminating the need for all intermediaries. Furthermore, Nftfy allows for legal contractual agreements via the Lex Cryptographia methodology and employs legal contractual concepts via Smart Contracts. The net effect is twofold; a smooth, streamlined process and guaranteed user rights.

Nftfy Use-Cases

NFT Valuation Transparency

At present, the leading NFT markets — Opensea and Rarible — are peer-to-peer marketplaces that lack the level of liquidity required to determine an appropriate/reliable valuation for a given NFT. Nftfy’s decentralized marketplace will solve this issue as the platform will enable users to trade fractionalized components of NFTs which will add a significant amount of liquidity to the market. The added liquidity will allow for much more accurate NFT valuations in real-time.

How Nftfy works

Step 1 — Stake your NFT

Once your NFT is staked and the fractionalization process is complete, one million fractions of your NFT will be deposited into the wallet of your choice and will be available for immediate access.

Step 2 — IDO

Once an NFT has been fractionalized into its ERC-20 compliant components via the Nftfy protocol, all of the traditional functionalities of the current crypto ecosystem can be explored.

At this stage, you will have the capability to create your own Initial Dex Offering (IDO) via a Liquidity Bootstrapping Pool on the Balancer protocol thereby providing liquidity to your NFT fractions. This revolutionary functionality allows for the creation of an entirely new marketplace enabling anyone to easily buy and sell fractions of your NFT. This innovation represents a simple, instant, and trustless method of sharing ownership of NFTs.

$NFTFY is the token of the protocol. It can be farmed by providing liquidity to various pools containing NFT fractions and $NFTFY.

Private Offerings

Issuers of NFTs will have the capability to raise funds on Nftfy from a private group of individuals by selling only a portion of the asset. This will generate a network effect, as numerous interested parties will increase the valuation of a shared asset. This is particularly true for rare NFTs such as Crypto Punks and Hashmasks which are not accessible to the masses due to their high valuations. The increase in liquidity will lead to increased transactions and will ultimately achieve Nftfy’s primary objective — the democratization of NFT ownership.

$NFTFY Token — Utility in Nftfy Ecosystem

The $NFTFY token will be a fungible ERC-20 token and will be the fuel for the Nftfy ecosystem.

$NFTFY will act as a liquidity base (collateral) for fractionalized contracts. Tokens will also boost the ecosystem of the new ERC-20 contracts via liquidity mining.

Who is the Nftfy token/platform for

Digital artists & NFT Entrepreneurs

Potential to realize the maximum value from the NFTs via instant liquidity, fair market pricing, and an enhanced network effect.

Collectors

Opportunity to buy and sell a wide array of fractionalized NFTs at a fair market price.

Speculators

Fractionalized NFT trading, liquidity providing, yield farming, risk sharing, arbitrage opportunities.

Nftfy User’s Guide

How the Nftfy protocol works and how the legal clauses selected for the Minimum Viable Fractionalization (MVS) apply to the smart contracts.

As discussed in the previous articles, the clauses of the Exit Mechanism are extremely necessary for the perfect operation of a fractionalization process, which runs in an autonomous, fluid and immediate manner, without depending on the intervention of those involved.

The Fractionalization Protocol must guarantee 3 topics.

- The Fractions must be backed by the NFT;

- A simple, fluid and immediate process for redeeming the NFT;

- A process that guarantees the rights of shareholders after the Redeem.

Therefore, during the Fractionalization, the NFT’s owner stakes it in the contract and creates a Shareholders’ Agreement. This is simply the action of defining the Exit Price Fixed, by determining the amount and the cryptocurrency to be used as a token basis. For example: 20 ETH; 300,000 DAI; 10,000,000 MANA.

Any other ERC20 can be used as a token basis. However, in order to simplify the explanation in this article, we are going to consider ETH as the cryptocurrency determined.

According to that rule, any user can redeem the NFT by paying this amount in ETH, or using a combination of Shares and ETH. The part paid in ETH is stored in a vault, where it waits for other users who still have shares to be exchanged, rewarding them with the respective amount of ETH.

It all can be resumed in three processes: Fractionalization, Redeem, and Claim. In this article, we focus on the practical part, that is, on how to use the Nftfy platform. The whole procedure is fully explained in our White Paper.

How to fractionalize NFTs in Nftfy Protocol?

Fractionalization

- Log in via wallet (Metamask and Portis);

- Visualize your NFTs on Nftfy Dapp;

- Select the NFT to be fractionalized;

- View the complete NFT metadata and establish your contract rules: determine the exit price by choosing a cryptocurrency and the respective amount;

- Confirm the blockchain transaction via wallet;

- Fractionalization completed: you receive 100% of Shares (ERC20 tokens) in your wallet.

After this process, the Shares can be distributed in any way the owner wishes, whether by donating or selling them in private or public offerings.

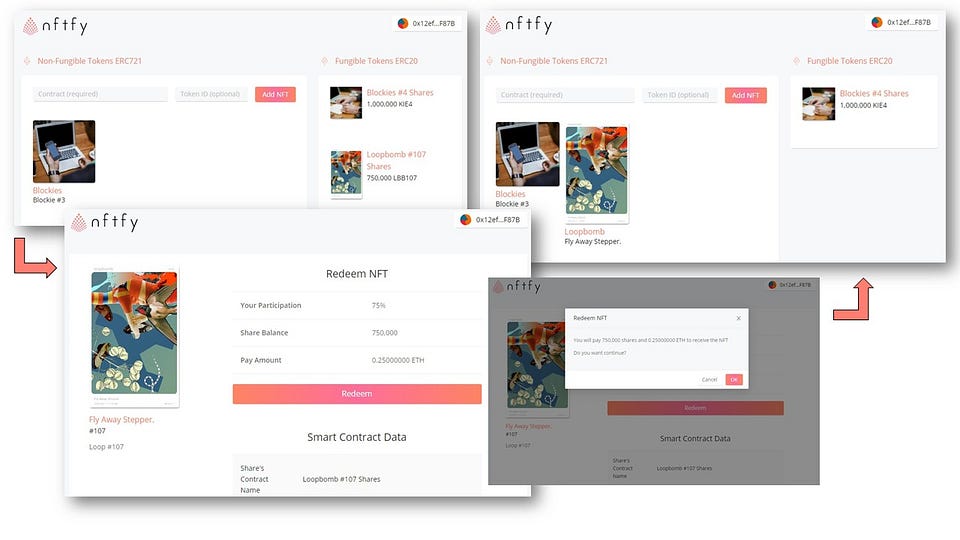

Redeem

The Redeem process establishes that any user can pay to extract the NFT for himself/herself. The only necessary thing is to pay the Exit Price as previously described, no matter the way. However, there is an interesting possibility the user can proceed in order to spend less ETH. This process consists of the following steps:

- In the open market, the user starts to search for and buy as many Shares of the NFT as possible at the lowest prices. This search is not an obligation; it is simply a possibility that might be useful.

- After accumulating a significant amount of Shares, the next step is to access the Nftfy protocol to do the Redeem.

- The Shares are presented and the remaining quantity is paid in ETH.

- Once the process is confirmed, the user receives the NFT.

Two other events take place internally within the contract:

- The contract burns the Shares that were sent;

- The amount of ETH paid is stored in the Vault.

Claim

The process called Claim is important to guarantee the right of the shareholders who own Shares of the NFT, which, at this moment, is no longer at stake. In this case, after the Redeem, the amount of ETH paid is stored in the contract Vault awaiting the shareholders to present their Shares that were previously backed by the subjective value of the NFT and are now backed directly by an amount of ETH.

The Claim process can be understood as follows:

- The Claimer access the contract of the Shares;

- The Claim is requested to exchange the Shares for the ETH;

- Once the transaction is confirmed, the respective amount of ETH is sent to the Claimer’s address.

Internally to the contract, after each Claim operation, the Shares received are burned and the quantity of ETH is sent to the Claimers’ addresses. After the total burning of Shares, the contract is finalized on the Ethereum blockchain.

How and Where to Buy NFTFY ?

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Once finished you will then need to make a BTC/ETH/USDT/BNB deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase NFTFY from the exchange IDO: Poolz IDO

Overview for Fast Readers

The changes will not impact the IDOs that we have already announced through 31-March-2021. These changes will affect all IDOs after the Rage Fan IDO that takes place on 31-March-2021.

- There are two tiers: Top 100 (Guaranteed Tier) and a Poolz Community Tier.

- There will be a specified IDO base allocation set for the Top 100 Tier and the lottery winners of the Poolz Community Tier.

- The base allocation for each tier will be split evenly amongst the IDO whitelisted winners.

- There will be a specified IDO bonus allocation set for the Top 100 Tier and the Poolz Community Tier.

- Every POOLZ token held in the Poolz Community Tier increases the likelihood of winning a base allocation in this tier.

- The bonus allocation will be awarded to IDO whitelisted winners in each tier, proportional to the number of POOLZ tokens they hold. Every additional POOLZ token owned will increase the bonus allocation awarded.

- Phase 1 will involve staking as a requirement to participate in the IDOs. Phase 2 will remove the staking as a requirement to participate in IDOs and require only the whitelist mechanism to participate in IDOs.

The top exchange for trading in v token is currently …

There are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once NFTFY gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

Find more information NFTFY

☞ Website ☞ Source Code ☞ Social Channel ☞ Social Channel 2

🔺DISCLAIMER: The Information in the post isn’t financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you

⭐ ⭐ ⭐ What You Should Know Before Investing in Cryptocurrency - For Beginner ⭐ ⭐ ⭐

Thank for visiting and reading this article! Please don’t forget to leave a like, comment and share!

#blockchain #bitcoin #nftfy