What is Pendle Finance (PENDLE) | What is Pendle Finance token | What is PENDLE token

In this article, we’ll discuss information about the Pendle Finance project and PENDLE token

We are seeing finance being rebuilt on open rails, with DeFi having the potential to become an independent financial system. In a healthy and mature capital market, yields can be traded, be it in bond coupons, interest rate swaps or other financial instruments. Pendle aims to assist in achieving this next milestone in DeFi.

What is Pendle?

Pendle is the first protocol that enables the trading of tokenized future yield on an AMM system. We aim to give holders of yield-generating assets the opportunity to generate additional yield and to lock in future yield upfront, while offering traders direct exposure to future yield streams, without the need for an underlying collateral.

Pendle exists on top of first-degree protocols. We currently support Aave and Compound, with more platforms to be integrated in future.

There are three components that make up Pendle’s system:

- Yield tokenization

- Pendle’s Automated Market Maker (AMM)

- Governance

Why Pendle?

Accessibility

Pendle aims to support numerous protocols and assets, allowing you holistic and effortless management of yield on a single platform.

Flexibility

You own your capital. On Pendle, you can deposit or withdraw as you please, without having to wait for contract maturation.

Fully On-Chain

All transactions are handled by smart contracts and are verifiable. This means transparency and honesty between Pendle and you.

System Overview

How Pendle Works

Minting and Trading

- User mints XYT and OT through Pendle by depositing aToken; OT (ownership token) and XYT (future yield token) are minted. OT represents ownership of the underlying aToken, and XYT represents the future yield of the underlying aToken.

- XYT Minter can sell the XYT or add to the XYT liquidity pool in exchange for LP tokens to earn liquidity incentives.

- XYT tokens can be purchased or sold, and after the change of ownership has occurred, the entitlement of subsequent interest revenue tied to the underlying aToken will be changed to the new XYT owner.

- XYT token can be traded until its expiry. XYT has no value upon expiry. The OT holder can choose to roll forward to a new expiry and repeat the process, or redeem the underlying

Redeeming the Underlying Asset

- Redeeming aToken before contract expiry requires the possession of both OT and XYT. The OT holder can obtain XYT by either purchasing XYT from the market or withdrawing XYT from the liquidity pool./

- With both OT and its corresponding XYT in the wallet, the minter can execute redemption of the underlying aToken from Pendle.

$PENDLE TOKEN

The page describes the $PENDLE tokenomics

$PENDLE will be a pure utility token at launch, with governance functions to come after the protocol has matured sufficiently. It will eventually be key to the value accrual mechanics and management of the protocol.

Token Ticker: PENDLE

Token Type: ERC-20

Token contract address: TBA

Token emission schedule and allocation

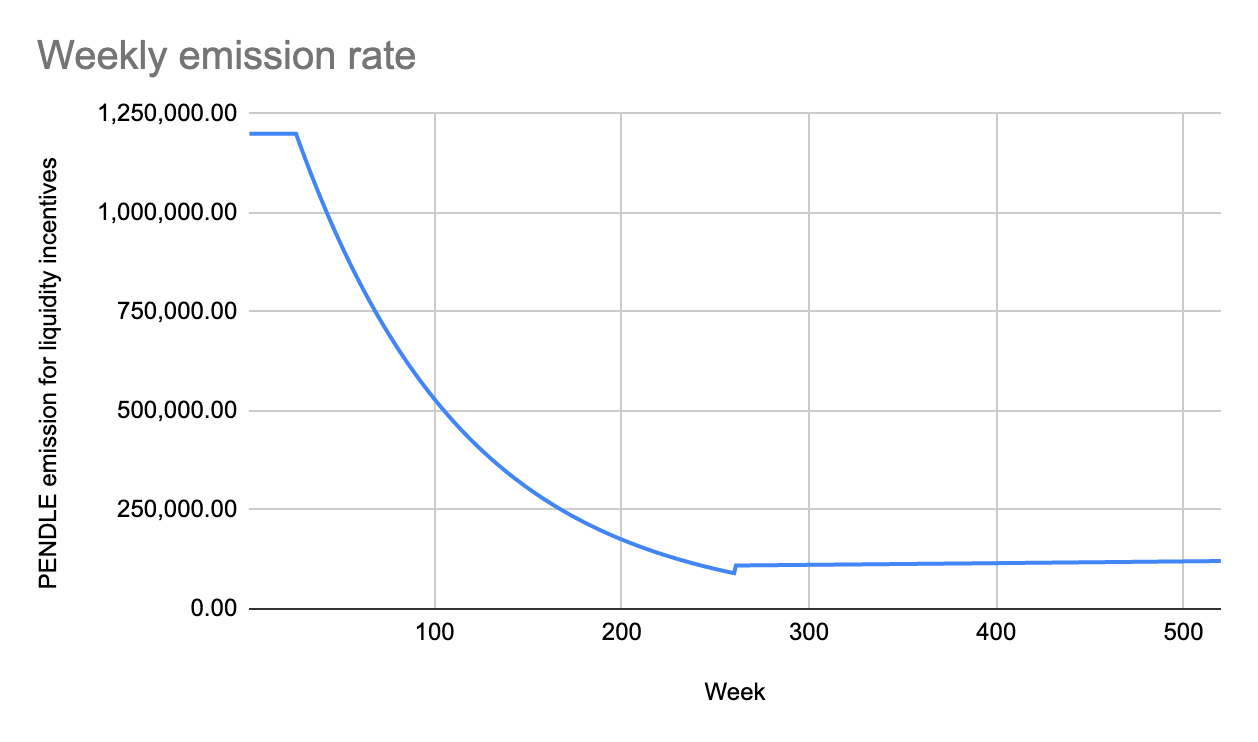

Pendle adopts a hybrid inflation model.

The emission will begin with stable incentives of 1.2M PENDLE per week for the first 26 weeks, following which, liquidity incentives will decay by 1% a week until week 260. At this point, there will be a terminal inflation rate of 2% per annum based on the circulating token supply.

The maximum number of tokens in circulation by the end of year 2 is 251,061,124. Any subsequent increments will come from liquidity incentives. The following chart shows the breakdown of our token allocation at the end of year 2:

We have allocated the highest percentage to liquidity incentives as the team places a high priority on creating deep and liquid yield markets. The Pendle team will decide on the incentive distribution at the beginning and this will evolve into community governance as the protocol matures.

The token distribution was also planned such that everyone can have a reasonable chance of participating and owning a percentage of the $PENDLE ecosystem.

Perpetual inflation will also help ensure that constant contribution to the protocol is required to maintain an ownership position.

Vesting Schedule

All investors and team members are under a vesting schedule to align incentives. The table below shows the schedule for the various components:

How and Where to Buy Pendle Finance (PENDLE) ?

PENDLE has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT, BNB from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy PENDLE token.

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since PENDLE is an altcoin we need to transfer our coins to an exchange that PENDLE can be traded. Below is a list of exchanges that offers to trade PENDLE in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT/BNB deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase PENDLE from the exchange.

The top exchange for trading in PENDLE token is currently Balancer, 1inch Exchange, and DODO

Contract ETH: 0x808507121b80c02388fad14726482e061b8da827

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once PENDLE gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

Find more information PENDLE

☞ Website ☞ Explorer ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Documentation ☞ Coinmarketcap

🔺DISCLAIMER: The Information in the post isn’t financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you

⭐ ⭐ ⭐ What You Should Know Before Investing in Cryptocurrency - For Beginner ⭐ ⭐ ⭐

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#blockchain #bitcoin #pendle #pendle finance