What is YOLOrekt (YOLO) | What is YOLOrekt token | What is YOLO token

In this article, we’ll discuss information about the YOLOrekt project and YOLO token

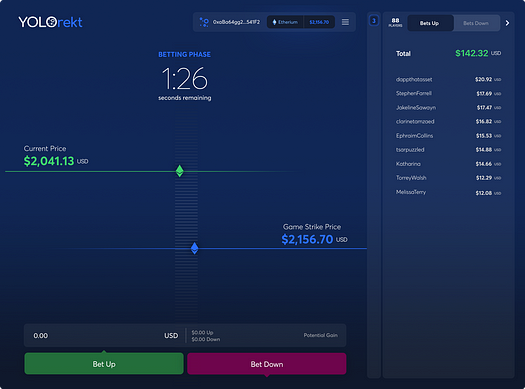

A social, hyper-gamified approach to short-term prediction markets. Provide in-game liquidity or predict the future price of ETH and other crypto assets. YOLOrekt is building a comprehensive short-term prediction platform for crypto, stocks, and more. YOLO is a social and fun way to bid on the future price of an asset. Provide in-game liquidity to earn game fees and YOLO rewards.

“YOLOrekt was designed to cater to a short attention span and for options traders who don’t have to own the asset or buy an option to predict where the price is heading within the next few minutes,” says YOLOrekt Founder Yogesh Srihari.

For those who don’t remember or are new to the game: YOLOrekt’s players bid on the price of a specific asset such as Ethereum, predicting whether the price will be above or below a specific strike price in the next 3 minutes. As part of the upcoming re-launch of the platform, YOLOrekt plans to issue a YOLO token that enables decentralized liquidity, thereby incentivizing liquidity providers to turn a profit (via a fee) on each game while contributing to the global liquidity pool.

New ‘in-game liquidity,’ reimagined.

In each game, a portion of the liquidity from YOLOrekt’s liquidity pool will be drawn and placed as bids to balance bid amounts on each side against the incoming users’ bids. The size of the LP pool grows or shrinks based on a few factors:

- Liquidity mining on YOLOrekt is unique because the pool plays with or against the players, depending on odds. Asymmetric Impermanent Loss in the pool reduces losses to one side. Liquidity providers can further take their YOLO LP tokens to receive additional rewards in YOLO.

- Liquidity providers on YOLOrekt earn 3% of each game’s fee in ETH and YOLO. You can also stake your LP to earn additional YOLO rewards.

- Profits earned through in-game liquidity can increase the size of the pool after each game.

- Conversely, losses suffered through in-game liquidity can decrease the size of the pool.

Token Issuance Overview

For the first time in crypto history, YOLOrekt is doing a synced dual-token issuance simultaneously on Ethereum and Polygon. The YOLO token issuance aims to raise capital for bootstrapping liquidity by issuing 5% of the YOLO tokens. The majority of the remaining YOLO tokens will be issued as rewards over three years to incentivize in-game liquidity.

A multi-issuance token employs a relatively novel approach of running token issuance on multiple blockchain platforms concurrently, allowing users to buy tokens on either platform. At the end of the token issuance, coordination logic will be invoked to calculate the actual price per token based on the contributions across both blockchain platforms.

YOLO Token Issuance App

Introduction to Dual Token Issuance

Dual issuance comprises of smart contracts running on both blockchain platforms simultaneously, i.e., Ethereum and Polygon.

The issuance contracts, simply stated, accept contributions until the end of the token issuance period and then proportionally distribute the combined 5% issuance amount between all the contributors on both chains.

- 1 billion minted (Ethereum-Mainnet)

- 5% will be available through the public issuance

- Issuance is managed by the YOLO-ETH issuance contract (Ethereum Mainnet) | YOLO-Matic issuance contract (Matic Mainnet)

- Contributions are made with ETH and mETH, respectively

Issuance leverages Polygon’s FX-portal state sync mechanism for passing total contribution sum from child to root (cross-chain Polygon to Ethereum) via proof validation of checkpointed message data stored on Ethereum by Polygon validators. Once the Ethereum contract is aware of the mETH sum, it can divide up the token to migrate the necessary portion of 5% YOLO issuance to the Polygon (Matic) network. Subsequently, the Polygon proof of stake (POS) token bridge is used for locking tokens on the Ethereum chain for one-to-one transfer onto the Polygon chain.

Once the platform is ready to go live, or following 60 days after issuance close-whichever comes first-the redemption regime can be initiated. All contributors can withdraw their portion of the YOLO tokens from the issuance contract.

Post-Token Issuance

Up to 15% of contributed funds will be encumbered for the project budget. The remainder of contributed funds will be deposited along with the YOLO token into decentralized AMMs (likely SushiSwap) to bootstrap liquidity. The pair deposit ratio is based on the total contribution ratio of ETH and mETH on both Ethereum and Polygon to total tokens issued during the issuance campaign (5% of total or 50 million YOLO). As such, no less than 4.25% of the fresh tokens will be deposited along with contributed funds into AMMs to provide liquidity on the open market. The aforementioned occurs immediately before opening up the redemption window when contributors can redeem their token share.

Liquidity Pools

Liquidity on YOLOrekt is provided by decentralized in-game LP pools that liquidity providers back. To enable decentralized liquidity provider (LP) pools, YOLOrekt utilizes a token called YOLO token. The mechanism solves issues revolving around in-game liquidity and incentivizes liquidity providers with fees per game distributed back to the pool. In addition, LPs can stake YOLO tokens directly used in the game liquidity pool.

YOLO Token Holders

Depositing YOLO tokens into the platform provides in-game liquidity through participation in YOLO LP Pool, capturing fees generated from the games. Fees of 3% or more are deducted from the payout of each game. More details on the design and mechanism of YOLO tokens will be disclosed in upcoming articles.

How to Participate

- Users can use YOLOrekt Issuance dApp (shown above) or directly interact with contact.

- Users can claim their tokens upon opening of the redemption window.

- More details regarding the participation in token issuance will be released in the upcoming week.

Audits and issuance contract mechanics

Two independent auditing teams are performing the YOLO issuance contracts security audits:

- Dedaub (https://www.dedaub.com/)

- NonceBlox (https://nonceblox.com/)

Audits will be undertaken on two major contracts and several already well-audited and battle-tested contracts by Polygon and OpenZeppelin. The two major contracts are:

- IssuanceEthereum Contract

- IssuancePolygon Contract

Interaction between IssuanceEthereum and IssuancePolygon happens through the following:

- Use of FxChild Tunnel for sending child (Poygon side) contribution sum to root (Ethereum) Issuance Contract, so that proper YOLO token proportion (of 5%) is sent to Matic Polygon using the following step.

- Admin then calls the depositFor method on the root chain manager contract (Polygon Proof of Stake bridge) to transfer YOLO tokens to Polygon.

Sequence Diagram

The diagram depicts the three significant interactions.

- The YOLOrekt team (as admins) interacting with contracts on Ethereum and Polygon

- Interaction of contributors with contracts on both platforms while contributing and claiming tokens through https://yolorekt.finance

- Cross-chain bidirectional interactions between IssuancePolygon on Matic and IssuanceEthereum on Ethereum mainnet

We hope you enjoyed our rundown of the novel YOLO dual-token issuance. Stay tuned for our upcoming lite paper and further technical releases.

How and Where to Buy YOLO token?

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Once finished you will then need to make a BTC/ETH/USDT/BNB deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase YOLO from the website: https://yolorekt.finance.

The top exchange for trading in YOLO token is currently …

Find more information YOLO

☞ Website ☞ Social Channel ☞ Social Channel 2 ☞ Message Board

🔺DISCLAIMER: The Information in the post isn’t financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

⭐ ⭐ ⭐The project is of interest to the community. Join to Get free ‘GEEK coin’ (GEEKCASH coin)!

☞ **-----https://geekcash.org-----**⭐ ⭐ ⭐

Thank for visiting and reading this article! Please don’t forget to leave a like, comment and share!

#blockchain #bitcoin #yolo #yolorekt