What is HAPI token?

HAPI: Onchain Cybersecurity Protocol for DeFi projects

Teaser

Launching any DeFi product is similar to launching a rocket: after the rocket takes off, you have a minimal toolset to influence its flight. You can send commands or even update the software. However, any unforeseen event could lead to a disaster, and you have no way of influencing it any further. You become a passive observer.

DeFi is similar to this in many ways. You create code, conduct a security audit, launch your smart contract into space (blockchain) and start praying that everything goes according to plan.

How do cybersecurity risks occur at DeFi?

Before we introduce HAPI, let’s have a look on how most DeFi projects work and what kind of security issues might arise.

- Blockchain:

A Blockchain is a database stored on multiple computers at once. And all of these computers are verifying that no one deceives one another and all of the records within this database are correct. A smart contract is a program that can be run within this database.

Example #1: 0x1111 is Alex’s wallet. We can write a smart contract crediting 10 HAI tokens to Alex if he has 10 ETH in his wallet. Every time Alex runs this contract, 10 HAI tokens will be sent to his wallet (as long as there are enough tokens on the smart contract). In this case, the program will verify whether there are 10 ETH on Alex’s wallet every time.

Example #2: 0x1111 is Alex’s wallet. We can write a smart contract crediting 10 HAI tokens to Alex if the price of gold on stock exchange is higher than $2000.

However, where can the smart contract get the price of gold from?

This is one of the big challenges in building smart contracts — we can use only the on-chain data in smart contracts’ implementation (only those that are already in our distributed database).

So, how can we record this data into the blockchain?

2. Oracles:

This is how Oracles have appeared — servers recording our necessary data onto the blockchain. Smart contract defines what kind of data it needs in blockchain. Oracles monitor these requests by taking the information from the outside world (usually via API) and recording it onto the blockchain.

However, this is where security issues might arise. Smart contracts are not aware of where the information is coming from and how reliable it is.

3. API or Application Programming Interface:

An API is an interface we can use to interact with programs, apps or devices. You can login into the bank’s client app and it will show you your balance by connecting to the Bank’s server via an API. You can also launch Coingecko’s mobile app and use the API to show you cryptocurrencies. In this case, the request is sent in a very precise form (if you want to receive the required information — learn to ask the right questions).

This is what we get — the user launches a smart contract, it contacts the Oracle’s smart contract and requests data. Oracles (servers) contact the required place (bank, exchange) via API, receive the necessary information and record it into the blockchain.

An onchain cybersecurity protocol to create trustless Oracles

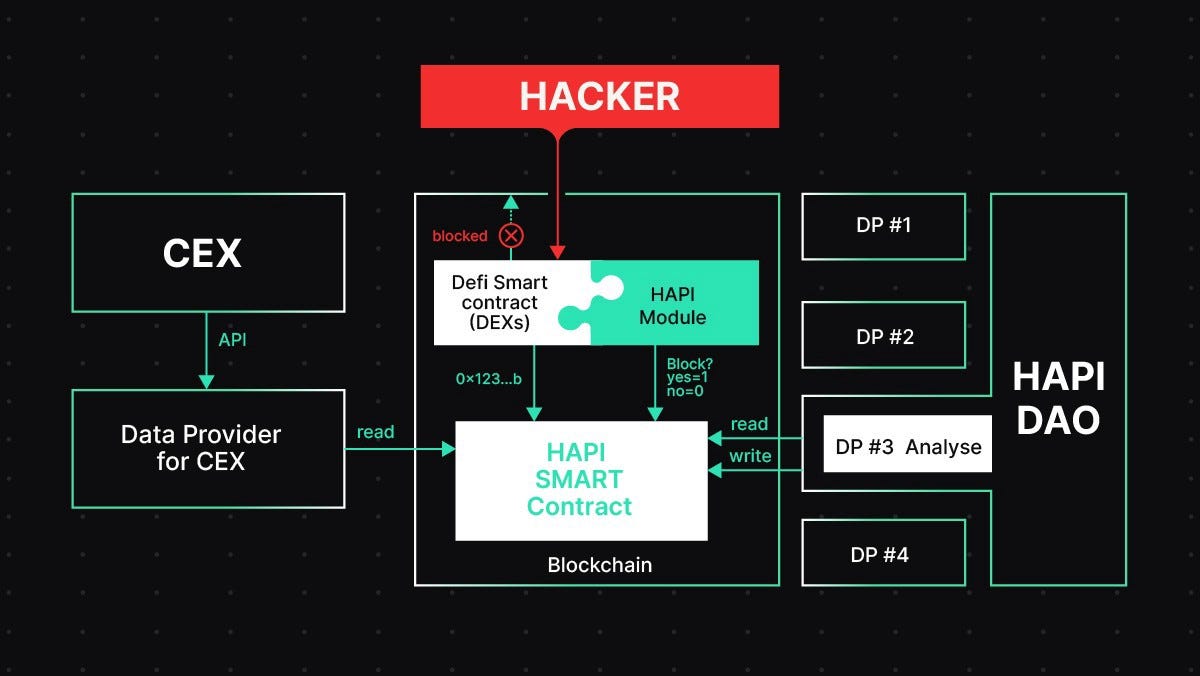

HAPI is a set of cross chain smart contracts that are embedded into DeFI products that allow them to reach a new security level. Also, HAPI’s Oraclizing and DAO system delivers SaaS in the DeFi environment that prevents hack attempts.

How does HAPI work?

Who is a Data Provider?

The main Data Provider is selected by the voting process in HAPI. It analyzes and marks all of the suspicious addresses. This data provider becomes the main provider of information to the blockchain. Upon request from exchanges (via API), service records all of the suspicious addresses into the blockchain and their ban period varies from 12 hours to a permanent ban.

HAPI example usecase: blocking the movement of stolen coins between DeFi and exchanges

Let’s say a hacker breaks into an exchange’s hot wallet and begins to transfer funds out of the exchange.

The exchange sends the address and coin details immediately to HAPI.

Every exchange connected to HAPI receives this information almost instantly and can block these transactions and funds until the situation is resolved. DEXs use smart contracts, allowing them to reject requests from suspicious addresses using HAPI. The momentum of the attack is slowed, and a portion of the funds is blocked.

Key points

- Will be built for most popular blockchains (Ethereum, Vechain, Polkadot etc.)

- All DeFi projects will substantially increase their security, if add HAPI module

- HAPI is to become a security standard for DEXs, lending protocols, derivatives protocols and other DeFi classes

- The data provider is voted via a DAO

- The cost of reputational loss to a Data Provider is significantly higher than the potential damage caused by false data

- The data would be onchain. Publically available

- Request to change or add additional data will have a fee

HAPI token

The HAPI token is an ERC20 token minted on the Ethereum blockchain.

Key utility of HAPI is to circulize between data submitors and security oracles.

Utility

Users stake HAPI tokens to be able to participate in the projects governance. The governance is conducted by a voting procedure. The voting involves staking HAPI tokens to support or reject voting proposals.

HAPI holders in fact act as the whole DeFI industry security arbitres. Selecting the trusted oracles defines the direction and the speed of crypto mass adoption.

HAI token holders are also able to stake their tokens to receive HAPI tokens as a reward. The total supply of HAPI token increases over time following an inflation model (see below). This supply is accumulated and distributed among HAI token holders as long as they have their tokens staked. One can vote by staking with his or her HAPI tokens.

Every transaction to be submitted in the Security oracle database will require HAPI tokens that would be further sent for Oracles review work.

The Data Provider determines the final price according to the demand for the off-chain resource and similar information supply.

Key HAPI utilities

- **Data submission fee. **Provides rights for the customer to submit any information connected with the hack or suspicious wallet.

- **Governance. **Provides governance rights for the Users (DP election by DAO). Each HAPI token stakeholder can participate in governance conducted by a voting procedure. The voting involves staking HAPI tokens to support or reject voting proposals.

- **Oracle rewards. **Serves as a payment method to Oracles for the review and audit work done on the submitted data.

- **DeFi projects audit report submission. **DeFi projects will legitimize their code by submitting it to a unified audit reports data centre.

HAPI token distribution

HAI community members are the main beneficiaries from the HAPI project entering HFoundation.

HAI holders have a unique opportunity to enter the HAPI project at the most beneficial price.

HAPI token will also become exclusively available for farming by staking HAI on the HFoundation cross-blockchain staking platform.

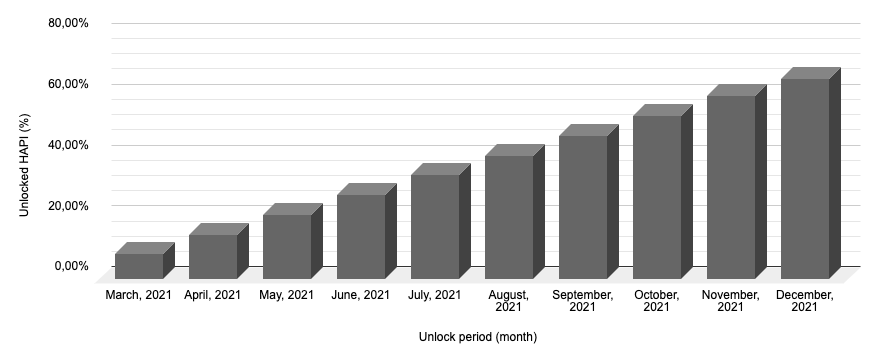

How will the tokens be unlocked?

HAPI Token Sale

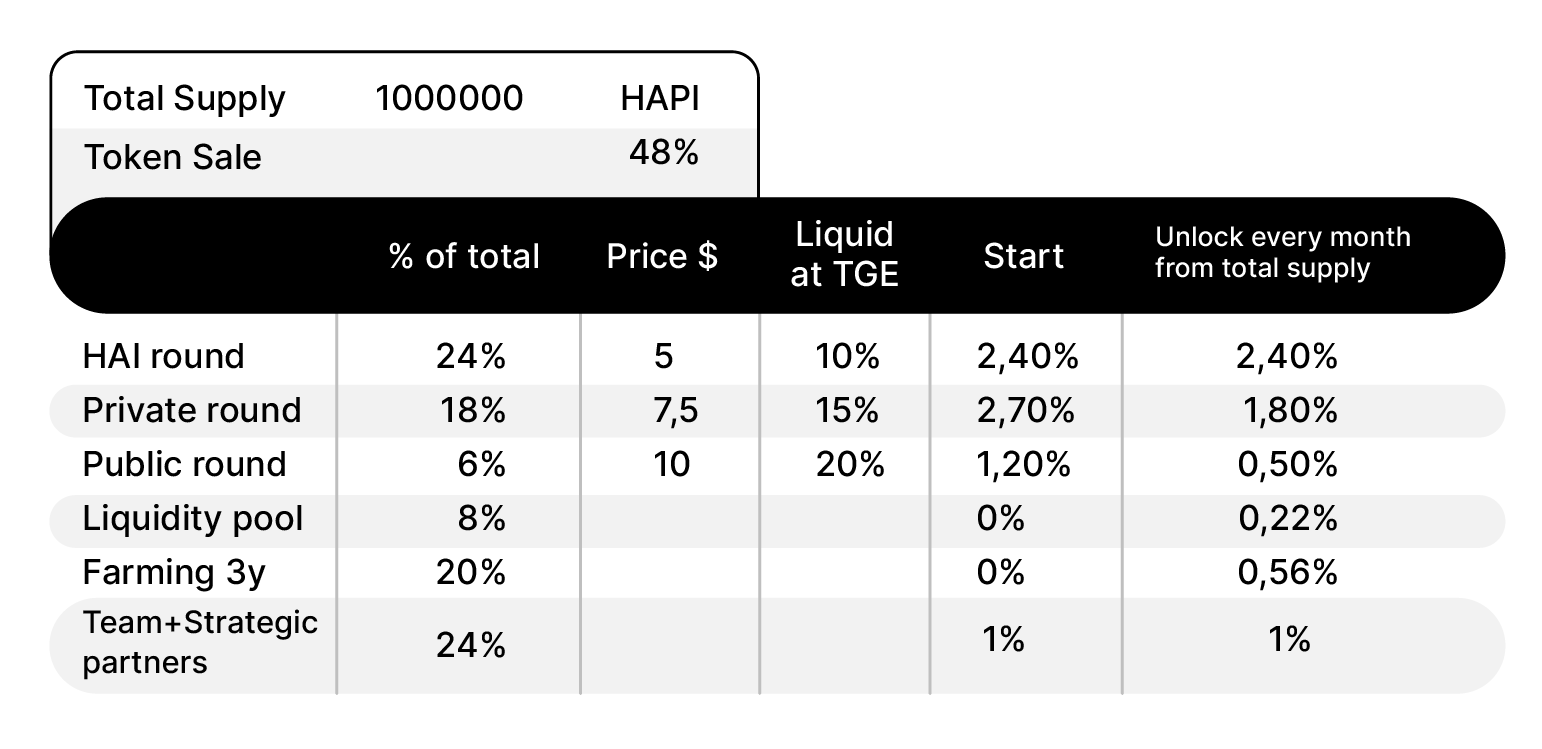

Total Supply: 1,000,000 HAPI.

There will be three rounds of HAPI token sales.

The total number of tokens for sale is 480,000 HAPI.

Round #1 — HAI round

Our most exclusive and valuable round is reserved and held specifically for the Hacken community using HAI tokens. The price for the community is $5 per token. 240,000 HAPI tokens will be sold. The initial unlocking will represent 10% of the purchase amount and 10% monthly.

Joining the HAI round is simple. You send HAI (VIP180 VeChain) tokens from your address to the address that will be specified in the sale details. Tokens will be credited to a similar address on the ETH network. You will receive detailed instructions on how to open a wallet with the same address in the ETH network.

50% of all HAI tokens collected on the sale will be burned immediately. The rest will be locked up for two years.

Max amount per 1 VeChain address is 500,000 HAI.

Oversubscribed HAI would be returned to HAI holders proportionally.

Round #2 — Private round

The private round is held in ETH for strategic partners. The price for this round is $ 7.5 and 180,000 HAPI tokens will be sold. The initial unlocking will be 15% of the purchase amount and then 10% monthly. Minimum lot is 50k usd equivalent. Maximum is 100k USD.

Round #3 — Public round

The public round is held in ETH. The price for this round is $10. 60,000 HAPI tokens will be sold. The initial unlocking will be 20% of the purchase amount and 12% monthly.

Creating a Liquidity Pool

80,000 HAPI tokens and the corresponding amount of ETH at the public round price will be locked in the HAPI/ETH pool on Uniswap. Lock term is one year.

Farming HAPI token

200,000 HAPI tokens will be farmed over three years using HAI token staking. The accrual system is proportional. The farming system is uniform.

HAPI Opens Whitelisting for Poolz IDO Participation

Recently, we announced that the HAPI Initial DEX Offering (IDO) is scheduled for March 10, 2021. As we’re getting closer to our IDO date, we announce that we’re opening whitelisting for Poolz IDO participation.

Poolz relies on a whitelisting process to ensure that all investors get a fair opportunity to invest in the IDOs. We explained the whitelisting process in the previous announcement and below are the** basic requirements for you to be eligible for HAPI IDO whitelisting.**

How the IDO whitelisting works

To participate in whitelisting for the HAPI IDO on Poolz:

1. Follow Poolz on Twitter

2. Follow HAPIon Twitter

3. Retweet the pinned Tweet on the HAPI Twitter account. Make sure you mention the cashtags $POOLZ and $HAPI

4. Join the HAPI Telegram groups

5. Join the Poolz Official Telegram group

6. Fill in the whitelist form

7. Stake your POOLZ tokens in the staking page for 7 days with 12%APY guaranteed

source: EverythingAltcoin

Would you like to earn HAPI right now! ☞ CLICK HERE

How and Where to Buy HAPI token ?

HAPI has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy HAPI

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since HAPI is an altcoin we need to transfer our coins to an exchange that HAPI can be traded. Below is a list of exchanges that offers to trade HAPI in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase HAPI from the exchange.

Exchange: Gate.io

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once HAPI gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information HAPI

☞ Website ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Coinmarketcap

I hope this post will help you. If you liked this, please sharing it with others. Thank you!

#bitcoin #crypto #hapi