What is Conv Finance (CONV) | What is Convergence token | What is CONV token | Conv Finance (CONV) ICO

Convergence — The First Decentralised Interchangeable Asset Protocol

“There’s a way to do it better — find it.” — Thomas Edison

Innovation often comes from the force of transformation and destruction. Without a doubt, the rate of innovation in DeFi is exponential. Layer 2 solutions, AMMs, synthetics, aggregators, flash loans, etc. You name it. But why are real assets not part of this revolutionary paradigm shift?

Two years ago, the buzz surrounding security tokens started. The concept is great — fractionalising real assets democratises access to investment. However, the lack of secondary market liquidity has penalized and stunted its innovation. On the other hand, utility tokens are becoming more and more liquid with the emergence of decentralised AMM infrastructures which are highly composible across the open universe of DeFi legos. Given this, the convergence of both worlds make sense. How can a system / protocol harness the benefits of both security tokens (exposure to real world assets) and AMMs (permissionless access and liquidity provisions)?

Imagine a world where you can swap BNB with Binance’s equity and FLOW with Dapper Lab’s equity. If we extend beyond the crypto ecosystem, what about DOGE with Space X’s shares? Total value locked in DeFi is still a drop in the ocean compared to its ‘real world’ traditional financial counterpart; sooner or later crypto enthusiasts will be longing for real world exposure, from the case of stocks (where our fellow friend FTX is the pioneer), indexes (synthetics) to unicorn companies, or even private equity funds and real estate assets. We are often locked into the mentality that IPOs on NASDAQ / NYSE will unlock liquidity of the rare unicorn companies…but what if a protocol can generate liquidity, create access, enable price discovery prior to traditional listings? As crypto pioneers we have to think steps ahead. Now is the time to lead innovation of the traditional financial market and create the new world of finance, not to be dragged down by legacy and dogma.

The Synthesis: Convergence Protocol

To navigate and traverse this new world we will need gates, boats, roads, railways and bridges. Recognising this, Convergence Protocol is a bridge to converge this new world, allowing institutional and retail investors to travel seamlessly between permissioned real world asset exposures and permissionless crypto and utility token DeFi positions.

We are essentially creating bridges for ANY Utility Tokens (UTs) <> Wrapped Security Tokens (WSTs). The protocol design architecture consists of two components:

- Token Wrapping Module: Think about BTC <> WBTC. This is the token wrapping layer for creating WSTs that will be injected into Convergence AMM

- Convergence AMM: Decentralized liquidity pool for the swapping of UTs and WSTs

Our vision obviously is not just limited to providing organic liquidity to real assets. Alongside our ecosystem partners (more on that soon!) we want to bring real assets into every fold of the DeFi supply / service chain — for example, borrowing and lending protocols (WSTs as collateral for borrowing USDT), and decentralized stablecoins (WSTs as reserve assets), to name a few.

Convergence Token (CONV)

Token Ticker: CONV

Total Supply: 10,000,000,000

Initial Liquid Tokens: 448,000,000

Initial Market Price: 0.005 USD

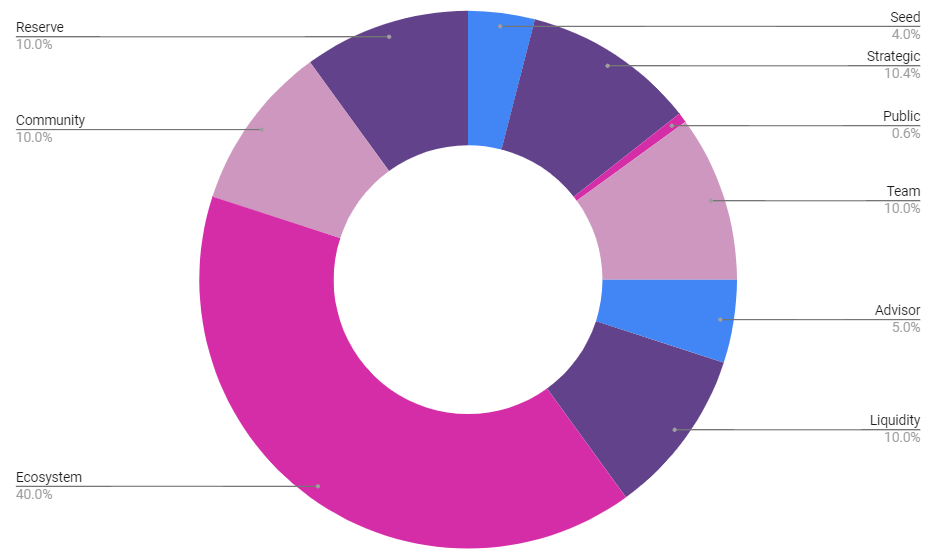

Token Allocation by Percent

Our total strategic sale (consisting of two private sale rounds) is 10.4% of all our tokens. The initial sale will be used for our technology development, community building, partnerships and marketing to build out Convergence Protocol.

3 Year Circulating Supply Release

Token Unlock and Vesting Schedule:

Seed: 0% unlocked at listing. Daily vesting over 12 months.

Strategic: 20% unlocked at listing. Daily vesting over 12 months.

**Public: **100% unlocked at listing.

**Team: **6 months cliff. Quarterly vesting over 24 months.

**Advisor: **6 months cliff. Quarterly vesting over 24 months.

**Liquidity: **5% unlocked at listing. Monthly vesting for 36 months.

**Ecosystem: **2% unlocked at listing. Monthly vesting for 36 months.

Community: 5% unlocked at listing. Monthly vesting for 36 months.

Reserve: Reserve use determined by DAO afterwards.

Convergence Whitelist for Polkastarter IDO is Now Open!

The Convergence Team is extremely grateful for all the support from the community as we continue to build out our platform.

The whitelist for our Polkastarter IDO subscription process is now live — here are the details to subscribe.

Details

- IDO date: Thursday 25th March 2021

- 60 000 000 CONV tokens for sale in total

- Token Price — $0.005 per token

- Total Raise — $300,000

- POLS Pool & General Pool

- Max cap / person: $300

To qualify for the POLS pool, holders will need to hold 3000 POLS or provide POLS liquidity on Uniswap.

https://support.polkastarter.com/article/9-how-to-participate-in-pols-only-pool

There will also be spaces from the public pool for winners of our upcoming community competition (more details to be announced).

Steps

To qualify for the IDO, **all **of the following whitelist tasks must be completed:

- Follow our Twitter

- Follow Polkastarter’s Twitter

- Join our Telegram group

- Fill in the whitelisting form

All entries in the lottery will be checked for valid ERC20 addresses, Telegram handles and Twitter accounts. Bot entries will be removed prior to a randomised draw of qualified users who will then be whitelisted for the IDO. For fair launch, entries that have not completed all of the above steps will not be considered. Entries with duplicate identities will be** disqualified**.

Whitelist lottery winners will be contacted per email from admin@conv.finance email address and all whitelist lottery winners will need to pass the Convergence KYC process within 48h. Beware of scammers: admin@conv.finance will never request funds.

Our subscription form will be open from 15/03/2021 UTC 12:00 and will close at 19/03/2021 UTC 12:00.

_Please note that citizens from the following countries have been excluded from the IDO: _ Botswana, Cambodia, Comoros, Ethiopia, Ghana, Iran, North Korea, Pakistan, Panama, Seychelles, Sri Lanka, Syria, Thailand, Trinidad & Tobago, Tunisia, USA, and Yemen.

How and Where to Buy Conv Finance (CONV)?

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

After the deposit is confirmed you may then purchase CONV from the Website: https://polkastarter.com

There are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once CONV gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information CONV

☞ Website ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Coinmarketcap

🔺DISCLAIMER: Trading Cryptocurrency is VERY risky. Make sure that you understand these risks if you are a beginner. The Information in the post is my OPINION and not financial advice. You are responsible for what you do with your funds

Learn about Cryptocurrency in this article ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

Would you like to earn TOKEN right now! ☞ CLICK HERE

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#bitcoin #crypto #conv finance #conv