What is Smoothy (SMTY) | What is Smoothy Finance token | What is SMTY token | Smoothy (SMTY) IDO

In this article, we’ll discuss information about the Smoothy project and SMTY token

Due to explosive growth of DeFi, multiple assets were introduced into the Ethereum network as anchor coins, such as BTC, USD, and GOLD. At present, there are more than 20 asset-backed tokens in the current market, multiple among which are backed by the same assets. In the future, more tokens backed by the same assets are expected to be introduced into the network. The swap ratio between these tokens should be 1:1, theoretically, due to the backed assets mechanism. However, in the current DEX, the swap requirements were not fully considered when designing, which caused unnecessary high cost for users because of the slippage. Thus, a better designed product specialized in the same backed assets is urgently needed in the market.

Curve.fi and mStable are the two representatives that are dedicated to token backed by the same assets (including stablecoin). However they do not provide a perfect solution for slippage, plus there has to be a trade-off between high gas fee and interest earning in both designs. Our unique design allows the swap ratio of the same backed asset to be fixed at 1:1 for most of the time, makes the gas fee 80% lower than existing projects, and brings maximum interest to the liquidity providers at the same time.

Today, we want to introduce Smoothy, a product built upon SmoothSwap. It is a novel single pool liquidity protocol specialized in same backed assets with low-cost zero-slippage swapping and maximum interest earning.

Our Design

1. Single pool with low-gas-fee swapping and maximum interest earning

The composability of DeFi makes it possible for multi-contract interactive arbitrage. DeFi contracts can achieve operations similar to banks’ getting deposits and issuing loans. Ideally, liquidity providers can earn interest as well as receiving swap fee rewards. But for the same reason, the entire system has a long interaction chain, which reduces the funds trading efficiency, and also increases the gas fee.

For this reason, some projects have to choose one of the two: either give up interest earning to provide higher efficiency and lower gas fees, or give up low gas fee to provide long-term deposit and interest returns. Some projects even set up two separate trading pools, splitting the flow of funds within the project and lowering liquidity. For example, Curve provides two swap pools, the sUSD pool is only used for swap, and the Y pool provides the function of deposit and earn interest in addition to swap, but requires much higher gas fees. mStable only has one pool, which performs very similar to Y pool of Curve, offers interest earning but requires higher gas fee.

With reference to the bank’s reserve system, we designed a unique Dynamic Cash Reserve Algorithm, which dynamically allocates the funds in the pool, most of which is used for deposits to generate interest, and the rest is reserved to meet daily swap needs. In this way, the gas fee for swapping will be much lower ( ~80% lower gas fee on Smoothy compared with YPool in Curve and mStable according to our test product ) since no extra interaction with smart contracts from other DeFi protocols.

Currently, it is preset that 10% of the staked tokens in the pool will be reserved, and 90% will be deposited in the aggregation protocol to earn interest. As the swap proceeds, the reserve ratio will fluctuate between 0% to 20%. If the reserve ratio is not within the range of 0%-20%, it will automatically trigger the reserve ratio adjustment function to rebalance the reserve ratio to 10% again. By this way, we maximize the use of idle funds, and meantime ensure sufficient reserve funds to meet swap needs with low gas fees.

Compared with the high gas fees and long waiting time for Curve and mStable, Smoothy achieves the needs of depositing and generating interest at the same time, with high efficiency and low gas cost in one pool. It is more convenient to use, especially for small amount swap.

2. Zero-slippage swapping algorithm

Due to the market fluctuations and the infrastructure network performance limitations, all current DEXs including Uniswap have the high pricing slippage issue. Simply speaking, the final price is lower than the marked price when selling, and is higher when buying. For general blockchain projects, the slippage is acceptable, but for the same backed assets, excessive slippage will cause unnecessary loss.

Curve.fi and mStable have proposed solutions for less slippage relying on the design of the swap formula. But the problem is, for Curve.fi, even though the slippage rate is lower than Uniswap it still cannot guarantee 1:1 ratio swap. For mStable, it can guarantee 1:1 ratio swap within predefined range, however it cannot swap anytime since the swap will be prohibited if predefined weight is reached. In all, neither Curve.fi nor mStable has solved the slippage issue completely.

Zero-slippage and free swap, we have found a solution to achieve both.

SmoothSwap provides a new algorithm that can guarantee 1:1 ratio swap most of the time If the soft weights are satisfied; If not, a transaction is still allowed by imposing a penalty in some extreme cases.

To summarize our design:

Smoothy provides a single pool to support both swapping and interest earning with

- Zero- slippage

- Free swap at anytime

- Low gas fee

- Maximized interest earning

Comparison between Smoothy and other protocols

SMTY value capture

SMTY is the governance token of Smoothy.finance, which is used for decentralized governance of future projects and asset liquidity incentives.

The initial swap fee is set as 0.04%, where 0.03% will be distributed to LP and 0.01%* will be converted to SMTY and then burned.

95% of the interest earning through other DeFi aggregator will be distributed to LP, 5% of the interest will be converted to SMTY and then burned.

Token distribution plan

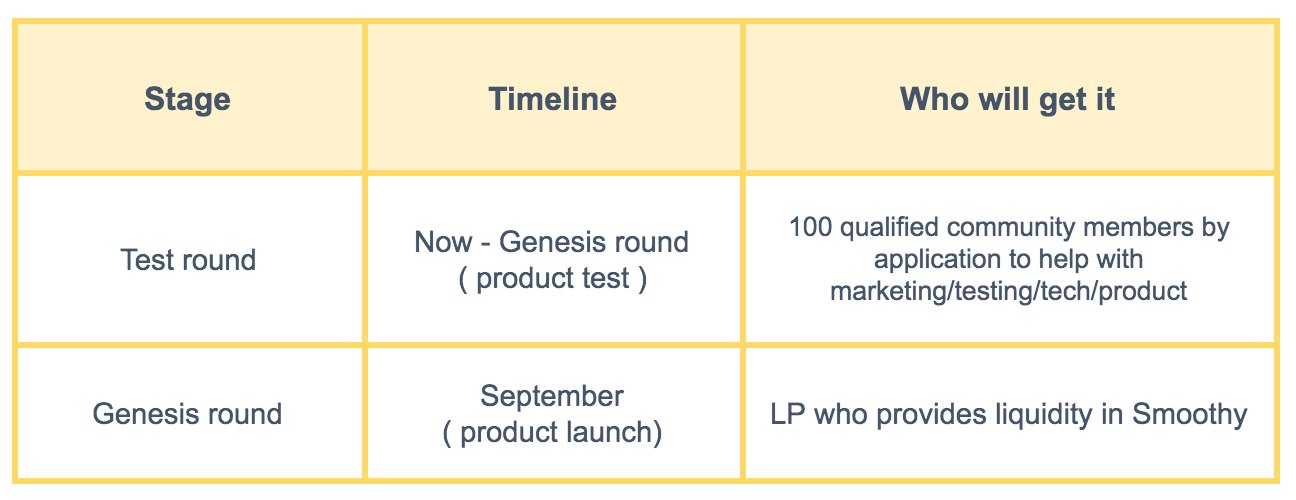

There is no private sale, no pre-set allocation portion for foundation and investor. Everyone is at the same starting line. You will get SMTY either by joining the test round through application or providing liquidity in Genesis round after Smoothy is launched.

For the emission rate of SMTY, we develop a pseudo-total-supply emission algorithm as the middle ground of constant emission (infinite supply) and fixed-time reduction emission (fixed supply). This means that SMTY will have much less inflation than that of constant emission, while the emission is long enough to attract LP to stay in Smoothy in the long term. We will share more details before product launch.

Token Economics

Total: 100,000,000 SMTY

- Team 15% (4 years vesting, 6 month cliff)

- Advisor 5% (2 years vesting, 3 month cliff)

- Testing round reward 1% (1 year vesting, 20% at TGE)

- Fundraising 10% (see below for vesting schedule)

- Operation, marketing, and partnership 19% (8% unlock at TGE to provide initial liquidity)

- Liquidity mining reward 50% (including pre mining and genesis mining)

For the 15% Team allocation, the SMTY tokens will be vested for 4 years with 6 months cliff.

For fundraising, the Smoothy team held 1 round of funding from private investors (8%) and public sale (2%):

Private Sale Round: $2,400,000 was raised at a $30,000,000 valuation. 8% of the total supply was allocated to private sale investors at $0.3 per SMTY token. 20% of the private sale allocation will be released TGE, and the remaining 80% will be released over the next one (1) year with 20% released on a 3 month schedule.

The 19% Operation/Marketing allocation will be distributed to our supporters in a series of programs that will help grow the community and bring in more partners. These programs will reward participants for using and contributing to Smoothy. More details of such programs will be announced in the future.

Public Sale Schedule

There are 2 types of public sale:

-

Fixed price: BSCPad, Ignition by Paid, and DAO Pad ($0.5, $50M valuation). There will be different whitelisting rules with cap for each platform, refer to their Twitters for details

-

Multi-priced crowd pooling: Paddle.finance ($0.5+, $50M+ valuation). No whitelisting, no platform token holding requirement, no cap, open to everyone, follow their Twitter for more info.

04/22 BSCPad (Binance Smart Chain)

IDO Price: $0.5 ($50M valuation)

Sale amount: 200,000 SMTY

Website: https://bscpad.com

Twitter: https://twitter.com/BSCPad

04/24–04/25 DAO Maker (Ethereum)

IDO Price: $0.5 ($50M valuation)

Sale amount: 400,000 SMTY

Website: https://daomaker.com

Twitter: https://twitter.com/TheDaoMaker

04/26–04/27 Paddle (Binance Smart Chain)

Sale starting price: $0.5+ ($50M+ valuation)

Sale amount: 1,100,000 SMTY

Website: https://paddle.finance

Twitter: https://twitter.com/PaddleFinance

04/27 Ignition by Paid (Ethereum)

IDO Price: $0.5 ($50M valuation)

Sale amount: 300,000 SMTY

Website: https://ignition.paidnetwork.com

Twitter: https://twitter.com/paid_network

Smoothy.finance Mining Tutorial

1. Visit Smoothy.finance, click the “DEPOSIT” button, and unlock your wallet by clicking the button on the upper right. We recommend using MetaMask on the desktop.

2. If you only want to deposit a single stablecoin, please approve first (left button means approve unlimited times, and right button means approve exactly this time), and then click the confirm button at the bottom of the page.

According to Smoothy’s design, the swap can be conducted in a 1:1 ratio most of the time. However, if % of the total pool for one stablecoin is too high(above the yellow line), there will be slippage. A warning message will popup in that case.

3. At the bottom of the DEPOSIT page, you can see the proportions of each token in the current pool. The yellow line is the soft weight that can perform a 1:1 swap, and the red line means the maximum proportion of the token in the pool. Slippage will occur if it extends the yellow line. With the expansion of the pool size, the accommodated tokens number will also increase.

4. To avoid slippage, we designed a safe deposit/withdraw mode.

First, click the “Multi-Deposit Without Price Impact” button, and then click “MAX Without Price Impact” button on the right side of the selected token. The system will calculate the safe amount without slippage automatically, and then follow the steps to finish depositing

5. Smoothy supports and recommends users to deposit multiple stablecoins at the same time which will save gas fee.

After you click the “Multi-Deposit Without Price Impact” button, please select the tokens you want to stake (click the square on the right), and then click the “MAX Without Price Impact” button. The safe amount of each stablecoin that can be deposited will be calculated automatically. Since the calculation of the number of tokens is interrelated, please click multiple times to get a more accurate result.

Note: The “Multi-Deposit Without Price Impact” function is based on the real-time calculation of the proportion of the pool. If the interval time between calculation and transaction confirmation is too long, the transaction might fail because of the proportion change of the pool. Therefore, if the system says that the transaction fails (such as abnormal contract execution, or extremely high gas fee), please refresh the page and recalculate the rate again.

6. After the transaction confirmation, you can see that syUSD in your account has been added, which indicates the staking succeeded.

How and Where to Buy Smoothy (SMTY)?

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since SMTY is an altcoin we need to transfer our coins to an exchange that SMTY can be traded. Below is a list of exchanges that offers to trade SMTY in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT/BNB deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase SMTY from the exchange: BSCPad, Ignition by Paid, and DAO Pad

The top exchange for trading in SMTY token is currently MXC.COM, Gate.io, AscendEX (Bitmax), LBank, and Bilaxy

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

Find more information SMTY

☞ Website ☞ Explorer ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

🔺DISCLAIMER: The Information in the post isn’t financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you

⭐ ⭐ ⭐ What You Should Know Before Investing in Cryptocurrency - For Beginner ⭐ ⭐ ⭐

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#blockchain #bitcoin #smty #smoothy