What is Kava.io (KAVA) | What is Kava.io token | What is KAVA token

What Is Kava (KAVA)?

Kava is a cross-chain DeFi lending platform that allows users to borrow USDX stablecoins and deposit a variety of cryptocurrencies to begin earning a yield.

The Kava DeFi hub operates like a decentralized bank for digital assets, allowing users to access a range of decentralized financial services, including its native USD-pegged stablecoin USDX, as well as synthetics and derivatives. Through Kava, users are able to borrow USDX tokens by depositing collateral, effectively leveraging their exposure to crypto assets.

Built on the Cosmos blockchain, Kava makes use of a collateralized debt position (CDP) system to ensure stablecoin loans are always sufficiently collateralized. If a borrower fails to maintain their collateral above a required threshold, the Kava liquidator module will seize collateral from failing CDPs and send it to the auction module for sale.

In addition to Kava’s USDX stablecoin, the Kava blockchain also includes the native KAVA token. This is a utility token used for voting on governance proposals and also functions as a reserve currency for when the system is undercollateralized.

Who Are the Founders of Kava?

Kava Labs, Inc., the parent company behind Kava, was co-founded by Brian Kerr, Ruaridh O’Donnell and Scott Stuart.

Brian Kerr is the current CEO of the platform and previously worked as an advisor for several blockchain and crypto platforms, including Snowball and DMarket. Kerr has had a varied and successful career and was educated in business administration.

Ruaridh O’Donnell, an MSc Physics graduate, is listed as Kava’s second co-founder and is a former engineer and data analyst at Levelworks. The final Kava co-founder is Scott Stuart, a former professional poker player who currently works as a product manager at Kava Labs.

Kava Labs also lists a dozen other employees and contractors, arguably the most prominent of which is Denali Marsh — an experienced smart contract developer and auditor who occupies the role of blockchain engineer at Kava.

What Makes Kava Unique?

Kava differentiates itself from other similar decentralized lending platforms thanks to its support for cross-chain assets.

Thanks to Cosmos’ zones technology, Kava users will be able to deposit a wide array of native assets, including Bitcoin (BTC), XRP, Binance Coin (BNB) and Binance USD (BUSD). But for now, cross-chain assets must be wrapped as Binance Chain (BEP2) assets.

Likewise, Kava also allows users to earn a yield by minting its USDX stablecoins. Once minted, these USDX tokens can be contributed to Kava’s money market, known as HARD Protocol, earning the user a variable APY while their collateral remains secured by Kava.

Kava users can run their own staking node to earn KAVA rewards directly from the protocol. However, only the top 100 Kava nodes (also known as validators) are eligible to receive these rewards. Beyond this, KAVA holders can stake their tokens on a variety of compatible exchange platforms, like Binance and Huobi Pool.

Beyond this, users can earn regular KAVA rewards by minting USDX on the platform. The system also employs several mechanisms to burn KAVA tokens, helping to reduce the circulating supply.

Why Borrow On Kava.io?

Users can deposit their digital assets and use them as collateral to borrow Kava’s crypto-backed stablecoin, USDX. Borrowers profit in several ways:

- Synthetic leverage: borrowers can swap USDX for more collateral and use it to take out another loan. By repeating this process, users can create synthetic leverage any supported crypto asset, effectively creating a leveraged long position.

- Hedging with interest: traders can hold USDX as a stable asset when seeking to limit exposure to volatile crypto assets. Holders of USDX make 4.5% APY by receiving revenue generated from interest payments made by borrowers, meaning traders automatically earn while hedging.

- Incentive rewards: early adopters are incentivized to borrow USDX by Kava’s liquidity bootstrapping Incentive Program, with $90 million in KAVA* in rewards available over 4 years.

- Stablecoin payments: the fast finality of the Kava blockchain enables USDX to be used for general payment purposes on many blockchain networks.

How to Use Kava.io

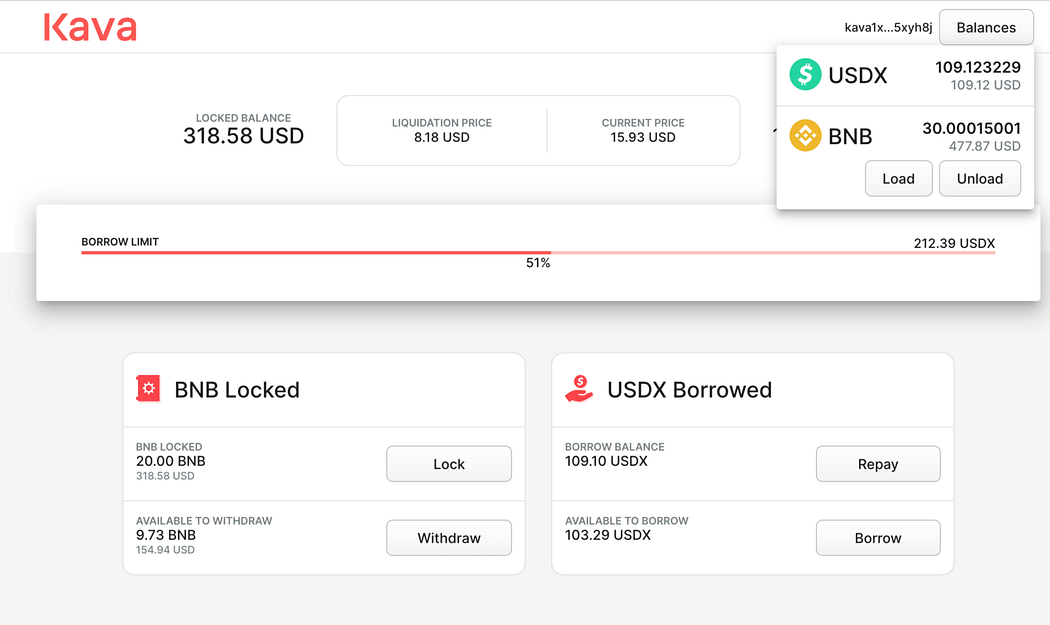

Kava’s Web App is the control center for cryptocurrency lending. It shows users their locked balance, borrowed balance, the current market price of their locked assets, and their borrow balance liquidation price.

Kava Web App Screenshot

The Kava Web App supports Trust Wallet and Ledger, and we’ve published guides for both:

Additionally, several wallets support Kava Protocol:

- Cosmostation (Guide)

- Frontier (Guide)

You can also send transactions using Kava’s Javascript SDK or CLI.

Protocol Mechanics

Kava.io users can borrow up to 67% of their locked balances’ value as USDX. Borrowers owe interest on their loans in the form of Borrow APYs which are repaid to the protocol. The repaid interest is distributed to USDX holders in the form of stability fees which net the holders 4.5% APY. Borrowers also earn rich rewards of up to 60% APY on their borrowed USDX through Kava’s Incentive Program which supports USDX liquidity by rewarding early USDX borrowers with KAVA. If the value of a user’s locked balance decreases and falls below the minimum borrow ratio, their locked balance is seized and incurs a 7.5% liquidation fee. The locked balances collected by liquidation are auctioned on the open market with the remaining balance returned to the original borrower.

KAVA holders govern the system by voting on protocol risk parameters and serve as the lender of last resort. If the total value of locked balances on the platform falls too quickly, KAVA is minted and sold at auction to raise funds and increase the systemwide locked balance.

Technology

Kava is built using the Cosmos SDK, a modular blockchain development framework. Kava Protocol operates with a Tendermint-based Proof-of-Stake (PoS) consensus mechanism which offers Byzantine Fault Tolerance, instant finality, and security. Kava Labs has implemented several Cosmos SDK modules that work together to provide lending services.

- The CDP module implements collateralized debt positions, the basic building block of loans.

- The Auction module contains several types of auctions triggered by different economic conditions to ensure system stability and maintain USDX’s 1:1 peg with the U.S. dollar.

- The Pricefeed module ingests market prices from Chainlink oracles.

- The BEP3 module implements the BEP3 Protocol, acting as a secure bridge for cross-chain asset transfers between Kava and Binance Chain.

- The Incentive module tracks CDP creation and issues weekly rewards to USDX borrowers.

There are several other modules that help the platform operate smoothly. You can read more about all of them in our docs.

Let’s dive into the core functionality supported by these modules.

Token Allocation

- Kava Shareholders:25%

- Token Treasury:28.48%

- Private Sale:40%

- IEO:6.52%

Token Information and Release Schedule

- Initial Total Token Supply: 100,000,000 KAVA

- Current Total Token Supply: 111,750,713 KAVA

- Circulating Supply: 46,876,230 KAVA

- Private Sale #1 - Token Price: $0.075 USD / KAVA

- Private Sale #2 - Token Price: $0.25 USD / KAVA

- Private Sale #3 - Token Price: $0.40 USD / KAVA

- Public Round Price: $0.46 USD / KAVA

- Token Lock-up plan and release plan: see the attachment

Learn about Cryptocurrency in this article ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

Would you like to earn KAVA right now! ☞ CLICK HERE

How and Where to Buy KAVA ?

KAVA has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy KAVA

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

After the deposit is confirmed you may then purchase KAVA from the exchange.

Exchange: Binance, Huobi Global, BiKi, FTX, and CoinTiger

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once KAVA gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information KAVA

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Explorer 3 ☞ Explorer 4 ☞ Explorer 5 ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

I hope this post will help you. If you liked this, please sharing it with others. Thank you!

#blockchain #bitcoin #crypto #kava.io #kava