What is Raydium (RAY) | What is Raydium token | What is RAY token

Raydium is an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX). Raydium has a first-mover advantage as an AMM within Serum and will be an integral part of bringing new and existing projects and protocols into the ecosystem. The protocol will act as a bridge for projects looking to expand to Solana and Serum, and in the process Raydium and the RAY token will become a foundation for enabling further development with partners, its own platform, and the ecosystem as a whole.

Unlike any other AMMs, Raydium provides on-chain liquidity to a central limit orderbook, meaning that Raydium LPs get access to the entire orderflow and liquidity of Serum.

Long term, Raydium aims to capture and maintain a leadership position among AMMs and liquidity providers on Serum, while leveraging the power of Solana to drive the evolution of decentralized finance (DeFi) and emerge as a leading protocol in the space alongside our partners and the community.

So, what is Raydium?

Raydium is an automated market maker (AMM) built on the Solana blockchain which leverages the central order book of the Serum decentralized exchange (DEX) to enable lightning-fast trades, shared liquidity and new features for earning yield.

Why is Raydium different?

Other AMM DEXs and DeFi protocols are only able to access liquidity within their own pools and have no access to a central order book. Additionally, with the majority of platforms running on Ethereum, transactions are slow and gas fees are high.

Raydium offers a few key advantages:

- Faster and cheaper: We leverage the efficiency of the Solana blockchain to achieve transactions magnitudes faster than Ethereum and gas fees which are a fraction of the cost.

- A central order book for ecosystem-wide liquidity: Raydium provides on-chain liquidity to the central limit order book of the Serum DEX, meaning that Raydium allows access to the order flow and liquidity of the entire Serum ecosystem.

- Trading interface: For traders who want to be able to view TradingView charts, set limit orders and have more control over their trading.

What can I do on Raydium?

Trade and swap

Raydium’s swap feature allows two tokens to be exchanged quickly through Serum, while the DEX UI also allows for more advanced trading features such as limit orders. These make for a better trading experience for users.

Earn RAY

There are a number of ways to earn RAY tokens while farming liquidity pools and staking. More features are on the way!

Power your project with Raydium

If you’re looking to launch your project on the Serum DEX or build out and supercharge features of your platform on Solana, Raydium can help and would love to talk partnership!

SPL Wallet

Before you get started on Raydium, you’ll need a Solana Program Library (SPL) wallet for storing your funds on the Solana blockchain and for interacting with the features on Raydium.

We highly recommend reading this straightforward ‘How To’ guide for the Sollet.io wallet, which describes how to create a wallet, add SOL to your wallet (which you will need for any transactions), and how to convert or transfer ERC-20 tokens to your SPL wallet.

Solong and Bonfida are two other well trusted wallet options.

Trade & Swap

Trade

Raydium is able to offer a powerful trading experience similar to that of a centralized exchange (CEX) thanks to integration with Serum. If you’ve ever been annoyed by the total absence of an order book, charting, or reliable limit orders on other DEXs, we think you’re going to love trading on Raydium.

Swap

If you prefer a quick and easy “Swap” option, we’ve still got you covered! Any SPL token can be quickly exchanged for another with RaydiumSwap.

Liquidity

Raydium’s liquidity comes both from its own liquidity pools, as well as from the wider Serum order book shared by all Serum users. This means more liquidity and less slippage for Raydium traders.

When you make a trade or swap on Raydium the transaction is charged a 0.25% fee:

0.22% is redeposited into the liquidity pool and acts as a reward for liquidity providers.

0.03% is sent to the staking pool and acts as a reward for those staking their RAY tokens.

Swapping

Swapping tokens on Raydium is similar to other platforms, just faster and cheaper. 😉

How to Swap

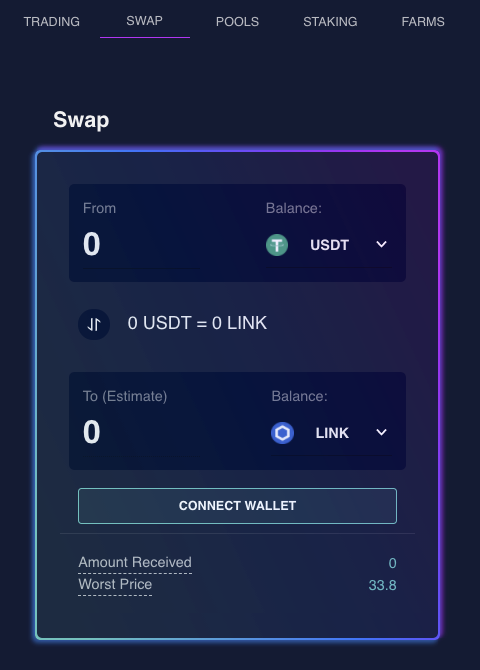

- Navigate to Swap using the tabs at the top of the app, then connect your wallet.

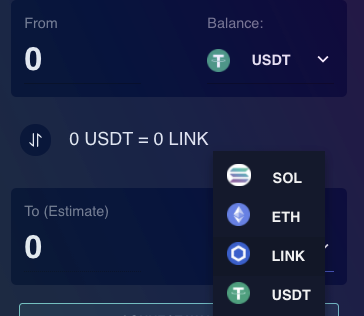

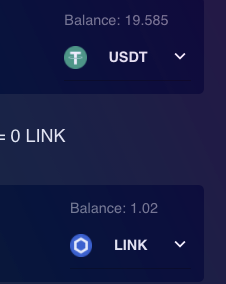

2.Next, select from drop down which tokens you want to swap. For this example, we’ll be swapping From USDT To LINK.

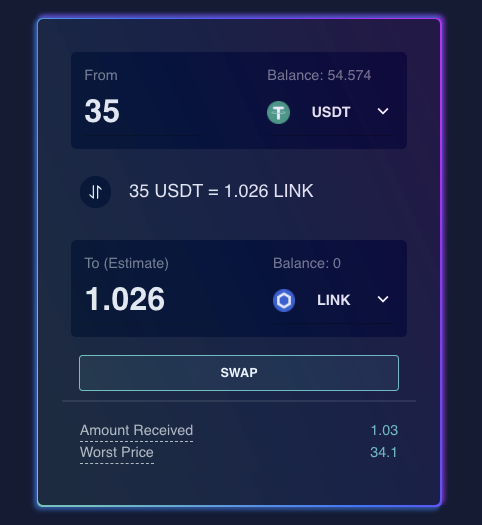

3. Enter the amount of tokens you wish to swap. Finally click Swap!

Note: Unlike Ethereum based Swaps that will cancel your entire order if price moves past your slippage tolerance during the swap, RaydiumSwap will fill your order up to the “Worst price” and cancel the rest.

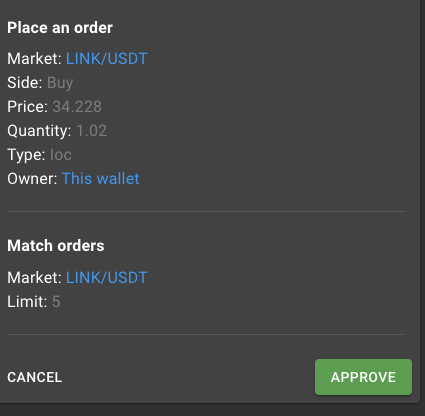

4. You will need to click ‘Approve’ in your wallet to confirm the transaction. Shortly after, you will be prompted a second time ‘Approve’, this time to settle the transaction. Make sure you quickly approve settling, otherwise the transaction may fail.

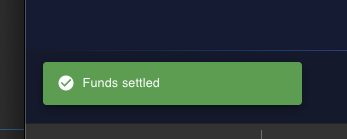

5. Shortly after settling the transaction you should be able to see your new balance, although this can sometimes take a few seconds to refresh.

You have now done your first swap on Raydium. Now let’s get swappin!

Liquidity Pools

Raydium’s liquidity pools allow anyone to provide liquidity by adding their assets to a pool.

How to add liquidity to a pool:

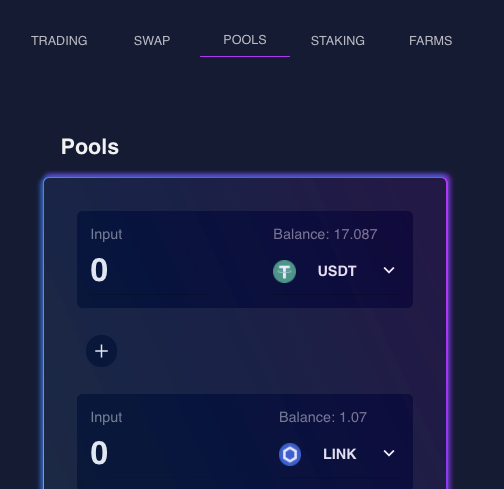

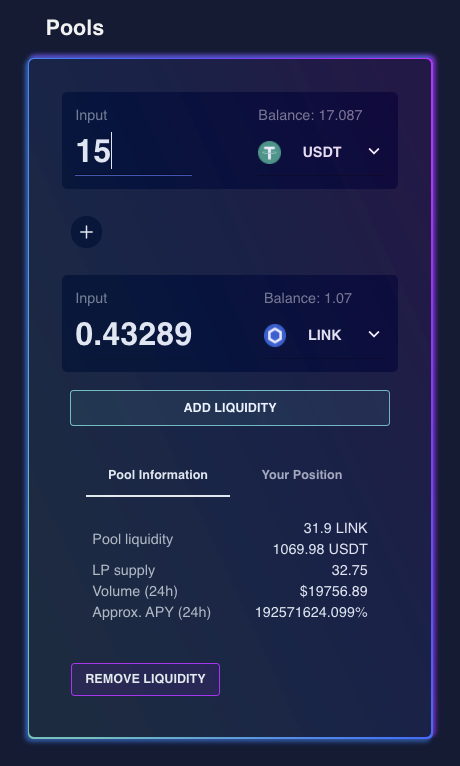

- Navigate to the ‘Pools’ tab on the app and connect your wallet.

2. Select the tokens you wish to add to the liquidity pool. You must add liquidity to the pool in the form of two token at a 1:1 ratio according to USD value. Enter the amount of the first coin you wish to add, the second coin will adjust according to match a 1:1 ratio. Then click ‘Add Liquidity’. You will need to click approve in your wallet once to approve the transaction and a second time to approve adding to the pool. Make sure to approve both times!

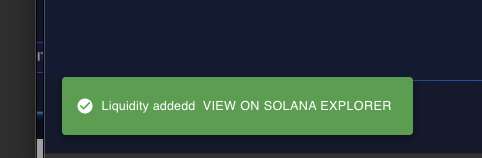

You should see a confirmation of ‘Liquidity added’. You should now be able to view your LP tokens in your wallet balance.

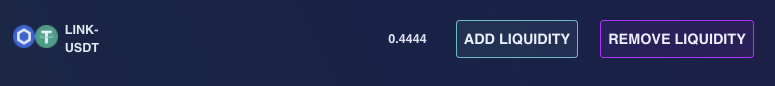

You have now successfully added to Raydium’s liquidity pool. If you wish to reclaim you tokens, simply click ‘Remove Liquidity’ and confirm the transactions.

That’s it, you’re now a liquidity provider on Raydium!

Liquidity pool explanation:

When you add to a pool you will receive Liquidity Provider tokens (LP tokens). For example, if a user deposited $RAY and $USDC into a pool, you would receive RAY-USDC RLP tokens.

These tokens represent a proportional share of the pooled assets, allowing a user to reclaim their funds at any point.

Every time a user trades between $RAY and $USDC, a 0.25% fee is taken on the trade. 0.22% of that trade goes back to the LP pool. 0.03% of that goes to RAY staking.

- Previously, if there were 100 RLP tokens representing 100 USDC and 100 RAY, each token would be worth 1 ETH & 1 RAY.

- If one user trades 10 USDC for 10 RAY, and another traded 10 RAY for 10 USDC, then there would now be 100.022 USDC and 100.022 RAY.

- This means each LP token would be worth 1.00022 USDC and 1.00022 RAY now when it is now withdrawn.

Raydium Farms

Raydium farms are liquidity pools that allow liquidity providers to generate RAY tokens as farming rewards in addition to the trading fees contributed to the pool.

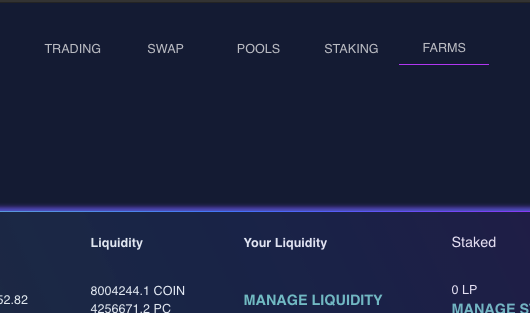

- Navigate to the ‘Farms’ tab and connect your wallet.

2. Next click add liquidity. Follow these instructions for adding liquidity.

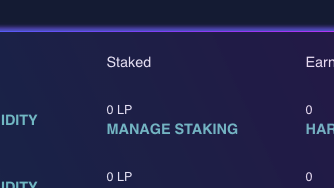

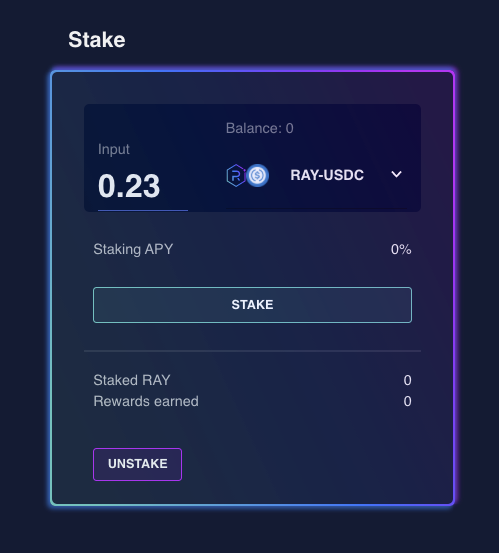

3. Once you have LP tokens in your wallet, click ‘Manage Staking’ next to the pool you would like to farm.

4. Enter the input amount, if you’ve like to stake all of your LP tokens, click on your balance and it should auto-fill. Then click ‘Stake’.

5. You will need to approve two transactions, make sure you approve both. After that you should see a ‘Tokens staked’ pop up in the bottom left of the page.

That’s it! You’re now farming with Raydium.

RAY Token

The basic tokenomics for RAY are explained below:

- 555 million RAY hard cap.

- The total RAY mining reserve consists of 34% of all tokens, or 188.7m RAY

- Emissions will last for approximately 36 months, with halvenings occurring every six months

- 0.03% of trading fees will be awarded to RAY stakers

How and Where to Buy Raydium (RAY) ?

RAY has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy RAY

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since RAY is an altcoin we need to transfer our coins to an exchange that RAY can be traded. Below is a list of exchanges that offers to trade RAY in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase RAY from the exchange.

Exchange: FTX, Uniswap (V2), Gate.io, Sushiswap, and 1inch Exchange

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once RAY gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi ☞ MXC ☞ ProBIT ☞ Gate.io ☞ Coinbase

Find more information RAY

☞ Website ☞ Explorer ☞ Whitepaper ☞ Social Channel ☞ Social Channel 2 ☞ Coinmarketcap

Would you like to earn RAY right now! ☞ CLICK HERE

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #raydium #ray