What is Visor Finance (VISR) | What is Visor Finance token | What is VISR token

Uniswap’s Version 3 — which launches on May 5th, less than six weeks from now, shocked most of the DeFi ecosystem when details were published just days ago. Of course the Uniswap team’s objective was to introduce improvements to capital efficiency and we all knew this. What took everyone by surprise though, was the way and which it was implemented.

DeFi has matured over the past year largely through the novel uses of fungible Uniswap Liquidity Pool tokens. LP tokens represent the ownership of a liquidity provider’s portion of a pool on Uniswap. However, using these tokens to denominate ownership of a pool is far from their only use case.

In May of 2020, Ampleforth was one of the first projects to utilize these LP tokens within a rewards program. Ampleforth allocated a portion of their tokens for participants who provided liquidity on Uniswap and then deposited the respective LP tokens in a reward contract they called the ‘geyser’. From then until now, that model has been adopted and re-engineered hundreds of times and created somewhat of a standard within DeFi- how liquidity seekers incentivize liquidity providers.

However, other uses have been discovered for LP tokens as well. For example, if a new project wants to signal that they will not or cannot ‘rug pull’ they provide a significant amount of liquidity on Uniswap and then time-lock their LP tokens so that participants know that this liquidity cannot be removed until a designated time.

More recently, MakerDAO passed a governance proposal which allows certain LP tokens to be accepted as collateral in order to mint their stablecoin Dai. This would allow borrowers to deposit LP tokens as collateral in protocols in order to get a loan.

Finally, in SushiSwap’s case, they leveraged the fungibility of these LP tokens to actually exit Uniswap pools for LP token holders and deposit the liquidity on their own exchange.

But the reason why the DeFi ecosystem is shocked is because in Uniswap v3, all these things will not function as they used to. Why? Because there will be no more fungible Uniswap LP tokens. Instead there will be LP NFT’s. NFT’s are here to stay in DeFi.

Uniswap v2 is centered around a single equation: x * y = k where x and y are the token quantities in the liquidity pool, and k is a constant product. In order to keep k constant, x and y can only move inverse to each other. Uniswap calls this the “ Constant Product Market Maker Model.” The “Constant Product Market Maker Model” is represented as an ERC20 pool contract where tokens represent the liquidity of the pool. However, due to this single pool, everyone is subject to a ‘passive market making strategy’. Furthermore, this passive strategy makes everyone providing liquidity subject to ‘impermanent loss’ while not providing the greatest capital efficiency because of the lack of directed capital.

Page 3 of the Uniswap v3 white paper explains the use of the NFT LP token

The Constant Product Market Maker Model will not be used anymore in Uniswap v3, which makes completely fungible liquidity tokens impossible. Instead, Uniswap v3 will move to ‘Non-Fungible Liquidity’ and will remove Native Liquidity Tokens and replace them with Liquidity Positions as individual NFT’s.

So what exactly is ‘Non-Fungible Liquidity’?

Since LP positions in v3 contain many more custom inputs such as Concentrated Liquidity, Range Orders, and Flexible Fees, all variables need to be contained within the individual non-fungible token (NFT).

Furthermore, Uniswap explains that they expect strategies will end up being tokenized,

Over time we expect increasingly sophisticated strategies to be tokenized, making it possible for LPs to participate while maintaining a passive user experience. This could include multi-positions, auto-rebalancing to concentrate around the market price, fee reinvestment, lending, and more.

And that in order to provide these features to v3 LP’s, specific NFT periphery contracts need to be wrapped around the LP NFT,

Anyone could create a periphery contract that wraps an individual liquidity position (including collected fees) in an ERC-721 non-fungible token.

Visor has set out to build such a composable periphery, allowing Visor NFT vaults to wrap individual LP NFT’s.

We envision a DeFi ecosystem where market conditions can unlock liquidity from networks of sovereign smart vaults, moving in and out of communion via gasless cryptographic signatures.

Visor’s UniversalVault asset locks are operated by signatures which can be relayed and aggregated off-chain, meaning networks of liquidity positions can be assembled by external DeFi protocols in a single transaction. The fact that Uniswap is launching such a powerful upgrade to their liquidity representation makes this all the more exciting.

What is Visor?

NFT Smart Vaults for liquidity provisioning. Visor envisions a DeFi ecosystem where market conditions can unlock liquidity from networks of sovereign smart vaults, moving in and out of communion via gasless cryptographic signatures.

Visor’s UniversalVault asset locks are operated by signatures which can be relayed and aggregated off-chain, meaning networks of liquidity positions can be assembled by external DeFi protocols in a single transaction.

As Visor rolls out NFT Vault upgrades, we anticipate some of the following immediate use cases to compliment the Uniswap v3 launch:

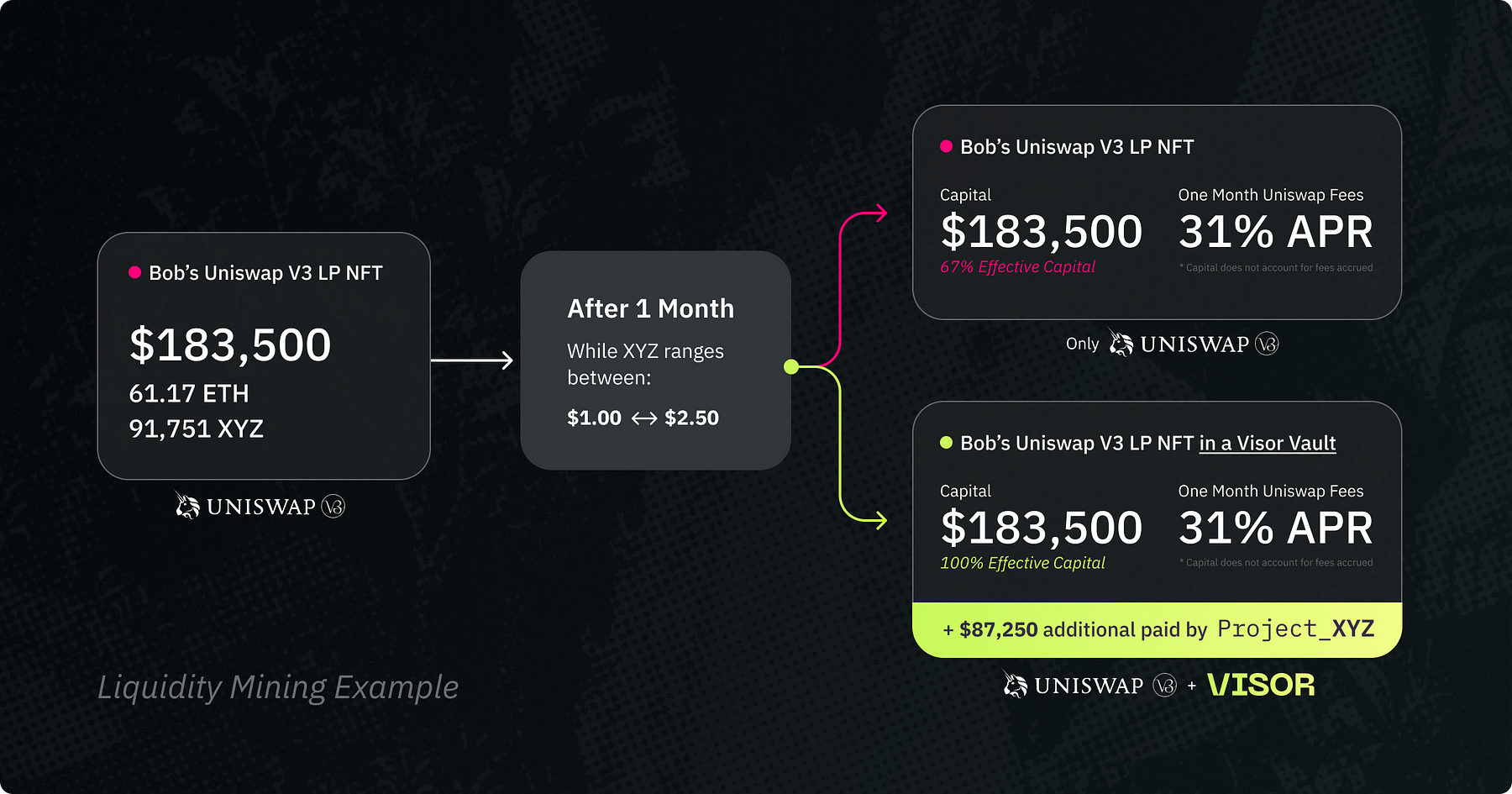

- Uniswap LP NFT deposited in a Visor Vault is able to trustlessly receive rewards from liquidity mining programs

Project_XYZ pays an ‘active liquidity miner’ directly to their Visor Vault

Given the right infrastructure exists upon v3 launch, projects will immediately seek to take advantage of Uniswap v3 for incentivizing ‘active liquidity mining’; allocating rewards only to liquidity providers within a designated range or a certain defined strategy. In order to reward liquidity providers, Visor will allow users to stake their LP NFT’s, coupled with an additional layer (Hypervisor) that allows projects to reward those liquidity providers.

In contrast, the two most common rewards program models, based on Chef and SNX, will not be compatible with Uniswap LP NFT’s.

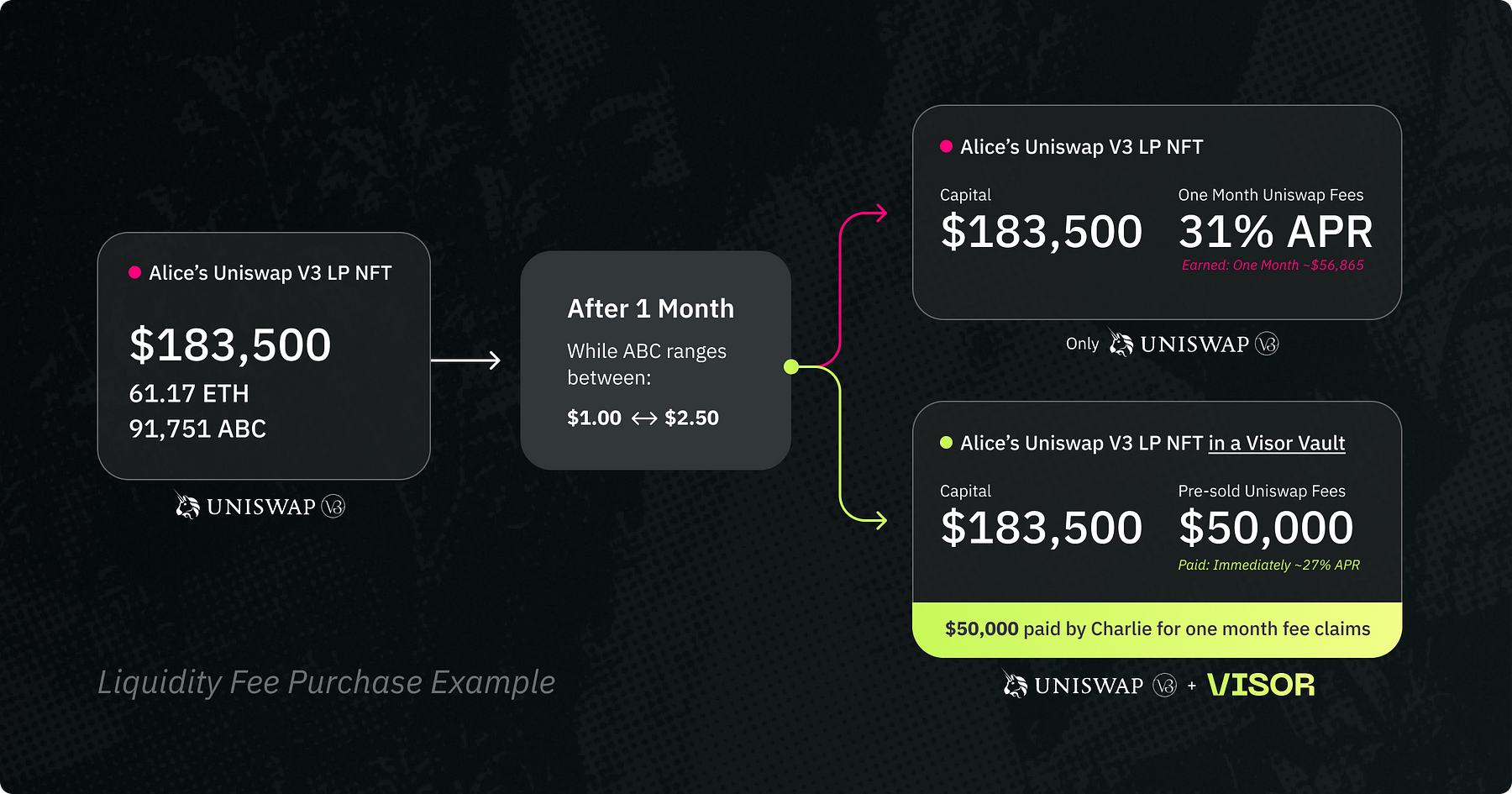

2. Directing Uniswap v3 LP fees to another party, creating an income generating asset

Charlie pays Alice upfront for one month of fee access from Uniswap v3 LP NFT

Fees earned in earlier versions of Uniswap were re-deposited in the pool as liquidity. Liquidity in the pool would grow over time, even without explicit deposits. However, in Uniswap v3, due to the non-fungible nature of positions, fees do not get re-deposited and instead fee earnings are stored separately and held as the tokens in which the fees are paid.

A Visor smart vault could contain a whole collection of income generating assets.

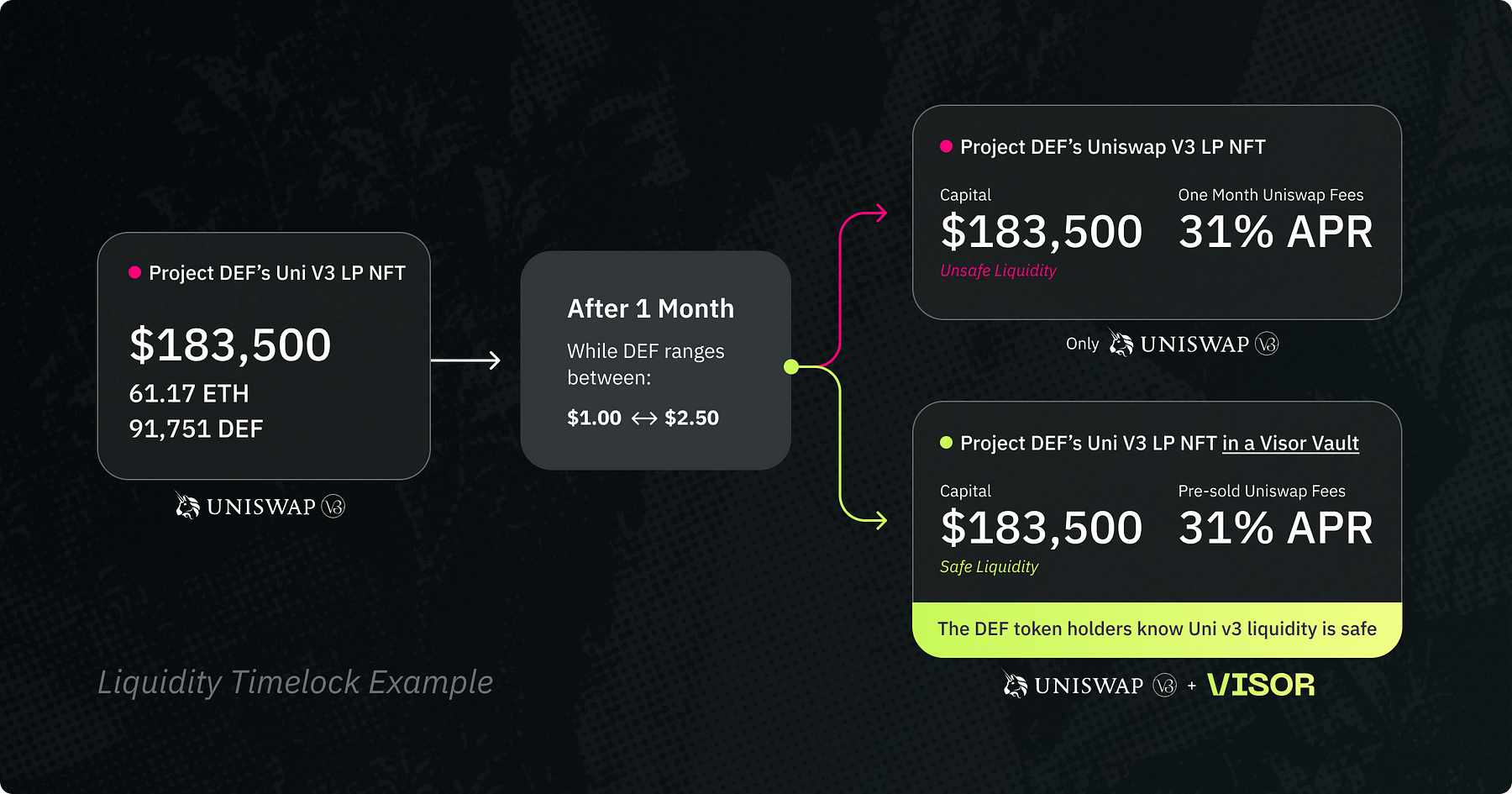

3. Timelocking a Uniswap LP NFT which is deposited in a Visor Vault

A project can lock up their Uniswap LP NFT with Visor

Traditionally, a liquidity locker such as Unicrypt allowed projects to store LP tokens in a smart contract, revoking permission to move these LP tokens from a starting block to an ending block. However with Uniswap v3, projects will not be able to use the same methods, contracts and providers of existing liquidity lockers. To address this issue, we are developing a timelock feature with an accompanied UI to allow projects to timelock their LP NFT within a Visor Vault.

Those three specific use-cases will be what Visor is focused on for the foreseeable weeks along side the Uniswap v3 launch, but we also want to highlight an additional use-case for networked Vaults that has us very excited; truly decentralized borrowing and lending via collateralization of assets inside vaults.

In a world where DeFi protocols interface with permissioned locks, an owner of a vault could simply submit a signature for its assets to become collateralized, allowing a lender to provide a loan based on this collateral.

Upon a default or liquidation event down the road, the ownership of the collateral could transfer seamlessly without extraneous transactions that relinquish custody ahead of time.

Announcing the Token Distribution and Launch of Visor Finance

Visor’s Balancer Liquidity Bootstrapping Pool will open up at 5pm EST on Friday, March 12, 2021

The LBP event took place on a decentralized exchange named Balancer, using a mechanism called Liquidity Bootstrapping Pool. Any proceeds generated from the event will go to the Visor Treasury, a smart contract fully and transparently controlled by the Visor, five person Gnosis Safe Multisig with spending limits.

The official Visor Twitter account will tweet the Balancer contract address, in addition so will the Visor Discord Announcement Channel. Everything else should be considered a scam. Please make sure the Balancer address is the same as the contract address when proceeding

This is the VISR token address: 0xF938424F7210f31dF2Aee3011291b658f872e91e

The Balancer LBP is not like a regular Balancer pool. The price will start high to disincentivize bots, front-running and speculation. Over time, the price will automatically decrease by design, so please only participate if you know what you are doing.

The purpose of the proposed Liquidity Bootstrapping event is to:

- Distribute the Visor token among the wider Visor community, to decentralize decision-making power.

- Build liquidity for the Visor protocol, setting it up for long-term success.

- Begin price discovery for the VISR token.

As of now there are 0 tokens in circulation, the only tokens that will be circulating from now until the liquidity minting phase 1 and 2 will be the ones circulating from the LBP.

30% of the total supply of VISR tokens will become available through the Liquidity Bootstrapping Event. The price is calculated based on the amounts of tokens in the Balancer pool and their weights:

30 000 000 VISR and $100,000 USD in ETH with weights 96 : 4 = (30000000 * .96)/(56.33 * .04)

The average price for participation in the Balancer Liquidity Bootstrapping Pool was nearly 40 cents.

The price weights start at 96:4 and change linearly over time towards a 50%-50% split after 48 hours.

Visor was created to solve the main issues within the existing landscape of liquidity mining in DeFi. To reiterate from our last article, those main issues are: discoverability, reputation, programmability, and security of liquidity. These solutions come in the form of a protocol built to mint and interact with NFT Smart Vaults. Visor is building the liquidity mining protocol of the future.

Visor provides solutions for the next generation of liquidity mining

We see a newly architected DeFi world where everyone owns a Smart Vault represented as an NFT. With this NFT, the user has an enhanced ability to interact with the existing DeFi protocols as usual, but through their NFT. This means that a liquidity rewarding program can require a locking of LP tokens, but instead of depositing the tokens in the project’s smart contract, the user stakes or locks them to their NFT — and still gets the rewards.

Our Live Visor Finance Web App for minting and interacting with the Visor NFT

Iterating off Alchemist’s original UniversalVault model, we have made significant developments by providing an upgradeable, extensible platform for a living, self-sovereign Smart Vault. This allows anyone to introduce new features and upgrades to the Visor NFT and offer unique modules for different use cases not to mention, updates and extensions all overseen via decentralized governance. Users may now mint their own Visor NFT from our web UI and be ready to participate in our upcoming rewards program.

**You can now mint your Visor NFT at **https://vault.visor.finance

Additionally, many projects offering liquidity mining programs have signaled their intent to offer compatibility with NFT Smart Vaults. This alone is a game changer. But we think this is just the beginning!

NFT’s are traditionally for art or games, but our’s are used for the interaction between DeFi Protocols

When anyone hears the term NFT, mostly they think of digital art or in-game assets. However, one of the earliest use cases for an NFT was implemented by Urbit to operate an Urbit Star. With an Urbit asset and accompanied UI, the user has the ability to manage their identity as an atomic component of a greater p2p network infrastructure for the purpose of helping to power a clean slate OS using Urbit NFT

In that similar vein, we have implemented an NFT for a use case that is not art or game related, but in order to interact directly with DeFi protocols. Let’s go over some key aspects of what you will be able to do with a Visor NFT.

Some key aspects of your Visor NFT:

A Self Sovereign investment vault (Visor NFT), the interface between your custodied funds and the decentralized finance protocols you interact with

Each Visor is identified by its unique string of digits which is an ERC721 compliant id and can be used for identity purposes across DeFi protocols

Your funds immediately become unlocked without counter-party risk at anytime during the liquidity mining program if you desire

Assets while never leaving your custody and within your Visor can be assigned to multiple liquidity mining programs by bonding to desired endpoints.

Allows your funds to be quickly discovered by liquidity mining programs and authorize staking and unstaking to your Visor NFT for reward distribution.

Further developments coming soon:

Some of these additional features on our road map that we’d like to develop is a Liquidity Discovery Matching Engine where your NFT can automatically sync to new liquidity reward programs that can discover to your NFT and begin paying.

In addition to the matching engine we are beginning to develop an interface for **Liquidity Seekers (LS) **to make Requests For Liquidity (RFL) that allow for the addition of fine tune filters where the request is not just based on asset type and amount, but based on time, reputation, and dynamic rates.

We hope to see a new standard of NFT Smart Vaults be implemented across all of DeFi

Balancer Liquidity Bootstrapping Pool

A Balancer Liquidity Bootstrapping Pool is a pool designed to allow a project to generate liquidity through variable weighting of assets. This is a fair launch that makes distribution more equal between participants because the price curve is designed to dynamically react to the free market forces and is completely public. The price curve also does not favor early participants so alpha and insiders have no advantage. To participate in the fair launch you can visit our Balancer Bootstrapping Liquidity Pool. The fair launch on Balancer will last 48 hours starting at 5pm on Friday, March 12th 2021.

VISR Token Launch on Balancer

Join the Balancer Liquidity Bootstrapping Launch Here

Overall VISR Distribution Schedule

- Balancer Liquidity Bootstrapping Pool: 30% (LBP fair launch)

- Liquidity Provision: 20% (Depositing ETH-VISR pair to Uniswap)

- Post-launch Liquidity Minting Incentives: 25%

- Retroactive Gas subsidies: 5%

- **Bounties / Grants: **10%

- **Development / Operations: **(Locked and released each month for 24 months) 10%

Uniswap Liquidity Provision

Liquidity will be provided immediately into Uniswap within the ETH-VISR pair. This will be 20% of the ETH raised and 20% of the tokens as needed. The Liquidity will be locked in Uniswap for the entire duration leading up to the Liquidity Minting phase and after.

Liquidity Minting Reward Pool (Phase 1)

The liquidity minting phases will consist of multiple rounds of liquidity incentivization periods. However, during our first phase of the reward program we will be optimizing for the minting and initial usage of the Visor NFT by key DeFi participants.

- The goal of the first phase is to distribute tokens to a wide range of smaller, very active participants in DeFi.

- To achieve this, we are introducing a whitelist where only addresses that have been active governance participants in other protocols are eligible.

- The whitelist is composed of addresses that participated in the offchain governance of any protocol on Snapshot.page or onchain governance on Compound, MakerDao or MolochDao as well as delegators on Compound, voters on Yearn, voters on UMA, delegators on YAM, voters and escrowers on Curve and delegators and voters on Uniswap.

Before Phase 1 begins, there will be another announcement with all the deployment details and contracts.

Liquidity Mining Reward Pool (Phase 2)

Phase 2 of the rewards program will focus on the incentivization of liquidity for VISR. This will additionally be accompanied with the use of a Visor NFT.

Other phases of Liquidity Minting Incentives will follow soon after phase 2 and focus on the unique usage of the NFT for liquidity mining with our partners.

Gas Subsidies

Minting an NFT takes a significant amount of gas to execute the transaction. For this reason we are designating a portion of tokens and ETH to subsidizing the gas costs for first time NFT minters who are on the whitelist.

Bounties / Grants

In order to promote the standardization of NFT Smart Vault usage in DeFi, there are certain bounties and grants that we need to create to stimulate both developers and community involvement. For generic bounties, these will be posted in our Discord channel and pay out based on successful completion. For development bounties, these will be offered and paid out using the Gitcoin platform.

Development / Operations

In order to pay for costs associated with Visor, for future development and any initiatives that may arise, 10% of the tokens will issued to the team for ongoing implementation of the Visor smart contracts, Web App, marketing, and continuing to build out what is on our development road map.

As discussed above, some of these additional things on our road map that we’d like to develop is a Liquidity Discovery Matching Engine where your NFT can automatically sync to new liquidity reward programs that can discover to your NFT and begin paying.

Additionally, we are seeking to develop an interface for Liquidity Seekers to make Requests For Liquidity (RFL) that allow for the addition of fine tune filters where the request is not just based on asset type and amount, but based on time, reputation, and rates.

Team

Visor is being built by an anonymous group of DeFi veterans who have worked at leading DeFi companies and are working on creating the vision of the next wave of Self-Sovereign Decentralized Finance.

How and Where to Buy Visor Finance (VISR)?

VISR is now live on the Ethereum mainnet. The token address for VISR is 0xf938424f7210f31df2aee3011291b658f872e91e. Be cautious not to purchase any other token with a smart contract different from this one (as this can be easily faked). We strongly advise to be vigilant and stay safe throughout the launch. Don’t let the excitement get the best of you.

Just be sure you have enough ETH in your wallet to cover the transaction fees.

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step

You need a wallet address to Connect to Uniswap Decentralized Exchange, we use Metamask wallet

If you don’t have a Metamask wallet, read this article and follow the steps

☞What is Metamask wallet | How to Create a wallet and Use

Next step

Connect Metamask wallet to Uniswap Decentralized Exchange and Buy VISR token

Contract: 0xf938424f7210f31df2aee3011291b658f872e91e

Read more: What is Uniswap | Beginner’s Guide on How to Use Uniswap

The top exchange for trading in VISR token is currently Uniswap (V2), 1inch Exchange, Bilaxy and 0x Protocol

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once VISR gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

Find more information VISR

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Message Board ☞ Coinmarketcap

🔺DISCLAIMER: The Information in the post is my OPINION and not financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you

⭐ ⭐ ⭐ What You Should Know Before Investing in Cryptocurrency - For Beginner ⭐ ⭐ ⭐

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#blockchain #bitcoin #visr #visor finance