What is Pancakeswap | Beginner's Guide on How to Use Pancakeswap

What is Pancakeswap

PancakeSwap is a decentralized exchange on Binance Smart Chain, one of Ethereum’s top competitors.

Interestingly enough, the Binance Smart Chain blockchain is the creation of Binance, a centralized crypto exchange known for being the largest in the world. With PancakeSwap, Binance is essentially competing against two distinct cryptocurrency establishments — Ethereum and Uniswap.

The intrigue gets even deeper because PancakeSwap can outshine Binance itself if exchange volume gets deep enough. However, cryptocurrency narratives aside, PancakeSwap is one of today’s largest DeFi protocols, and one that needs explaining if you’re new.

This guide to PancakeSwap will teach you the basics of how the decentralized exchange and liquidity protocol work, along with how to use each to your advantage.

After all, there are enough differences when you compare Uniswap to PancakeSwap that it’s well worth understanding PancakeSwap’s features.

What is PancakeSwap? It’s more than just another food-themed DeFi protocol

PancakeSwap is a decentralized exchange built on Binance Smart Chain, a fast and inexpensive alternative to Ethereum.

Much like the celebrated Uniswap DeFi AMM protocol running on Ethereum, PancakeSwap enables users to swap between cryptocurrency assets by tapping into user-generated liquidity pools.

To create said liquidity pools, PancakeSwap offers a plethora of DeFi farming opportunities for liquidity providers. The liquidity grab has so far worked like a charm — well over $1 billion in total value locked (TVL) has migrated to PancakeSwap since it opened its doors.

However, unlike Uniswap, PancakeSwap rewards those who stake its native BEP-20 token called CAKE. When you stake CAKE, you get SYRUP at a 1:1 ratio. Holding SYRUP entitles you to 25% of the CAKE emissions distributed proportionally to holders.

PancakeSwap vs. Uniswap vs. SushiSwap

In today’s cryptocurrency landscape, there are three major decentralized exchanges ruling the roost.

- Uniswap — The original DeFi liquidity protocol built on Ethereum. Today’s standard for easy cryptocurrency trading using ERC-20 tokens and mostly ETH pairs.

- SushiSwap — A community-governed Uniswap fork that has evolved into a DeFi hub offering token swaps, farming, and crypto lending/borrowing.

- PancakeSwap — Uniswap clone built on BSC to deliver fast and inexpensive trades using BEP-20 tokens and the BSC←→ETH bridge.

While all three enable decentralized exchange, community governance, yield farming, and LP (liquidity provider) opportunities, only Sushi and PancakeSwap pay rewards back to token holders who stake their tokens.

There are only two important decentralized exchanges in Ethereum’s DeFi ecosystem: Uniswap and SushiSwap. Both compete with each other at an extreme level, so which one is better and why?

Revenue sharing token

SUSHI holders who stake their tokens receive xSUSHI, a revenue-sharing token that earns transaction fees from the protocol. Similarly, CAKE holders who stake their tokens receive SYRUP, entitling holders to rewards paid in CAKE.

The fundamental difference between the three DeFi protocols is that the UNI token is solely used for governance. This difference explains why large liquidity migrations from Uniswap to both Sushi and PancakeSwap happened as LPs sought more wealth creation.

Farming liquidity provider tokens

Similar to yield farming on SushiSwap, farming LP tokens on PancakeSwap is pretty simple. Find a pair of assets you already hold or are willing to supply, fire up your Metamask wallet, deposit, and farm.

The beauty of farming using Pancakeswap vs. SushiSwap, however, is in how much cheaper it is to deposit said assets on the former. Binance Smart Chain is way cheaper to use than Ethereum — but that’s because it’s also far more centralized.

Cheaper + faster transactions

Additionally, PancakeSwap is less expensive and faster to use than both Uniswap and Sushi. The reason is PancakeSwap is built on Binance Smart Chain, a high-throughput blockchain built by Binance to compete with Ethereum.

BSC achieves its scaling prowess in part by being less decentralized than Ethereum, but that doesn’t seem to deter users from taking advantage of its barely-there transaction fees. Trading on PancakeSwap is undeniably better for smaller wallets who can’t quite call themselves crypto whales and don’t have unlimited funds to drop on gas fees.

Accessing PancakeSwap is still familiar for Ethereum users since you can connect to the exchange using Metamask, just like you do when using Uniswap and SushiSwap.

Gamified exchange experience

Uniswap is a somewhat serious decentralized exchange apart from its fun unicorn logo. Ditto SushiSwap and its homage to Japanese food and spa culture.

PancakeSwap, on the other hand, takes the fun to a new level with PancakeSwap Lottery. Every day, users deposit a number of CAKE tokens into the lottery then wait for the winning numbers to be announced.

The more deposits, the larger the pot, and the greater the stakes. To increase your odds of winning, you deposit more CAKE. The mechanics of the Lottery are simple yet brilliant, which explains why it’s such a hit with users.

How to use PancakeSwap DeFi Platform

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step

Don’t let the fancy names for the PancakeSwap platform confuse you. It calls itself an AMM, short for Automated Market Maker, but that’s just another way of saying exchange.

In short, an AMM like PancakeSwap or Uniswap is a decentralized liquidity protocol used to create the basis of liquidity for the platform’s exchange function. Users like yourself provide liquidity so that other users can seamlessly swap tokens using the decentralized exchange.

So, PancakeSwap AMM replaces the centralized order book found on exchanges like Coinbase and Binance. This functionality is fortunate for users who want to use PancakeSwap to exchange cryptocurrencies or provide them in return for rewards.

Before delving into PancakeSwap, you’ll need to understand how to connect Metamask to Binance Smart Chain. Here is an easy guide to follow before getting started on PancakeSwap.

PancakeSwap DEX

To use the PancakeSwap decentralized exchange, jump over to Pancakeswap.finance, then click Trade from the menu.

After doing so, you get two options: Exchange and Liquidity. Click Exchange to toggle the tool at the center of your screen to the Swap option.

Now, you can select the inputs for the exchange. Choose the cryptocurrencies you want to swap from the drop-downs in each line. When you trade crypto on PancakeSwap, you’re exchanging against the AMM liquidity pools generated by users instead of an order book.

This makes swaps easy, fast, and flexible compared to a centralized exchange since anyone can create a pair, provide liquidity for it, and thus open up a new market for the DEX.

Once you’ve selected the assets you want to exchange, hit the Swap button, confirm the transaction in your wallet, and you’re done!

One thing to note is that you can only trade BEP-20 tokens on the PancakeSwap DEX. That’s because PancakeSwap is built on Binance Smart Chain, not Ethereum. However, even if you only hold ERC-20 tokens, you’re in luck — just use the Binance Bridge to wrap your assets for use on PancakeSwap.

Binance Bridge

If you want to trade ERC-20 tokens on PancakeSwap, you’ll need to wrap them on the Binance Bridge to turn them into BEP-20 assets (Binance Smart Chain token standard).

To do so, head over to the Binance Bridge, then connect your wallet. Assuming you’re connecting from a Metamask wallet on the Ethereum main network, you’ll be asked to confirm the transaction (after you input the token you’re bridging to BSC) on the Ethereum side, which will cost an amount paid in ETH.

While this may be expensive due to high Ethereum gas fees, once you get your crypto assets wrapped and bridged over to BSC, you’ll save tons in trading fees by virtue of PancakeSwap’s low costs.

Binance Bridge isn’t just for cross-chain assets used in trading. You can also use it to bridge Ethereum assets you want to use to provide liquidity and yield farming on PancakeSwap.

Once you’ve finished your activities on PancakeSwap and want to convert your BEP-20 assets back to ERC-20, just follow the same steps in reverse using Binance Bridge.

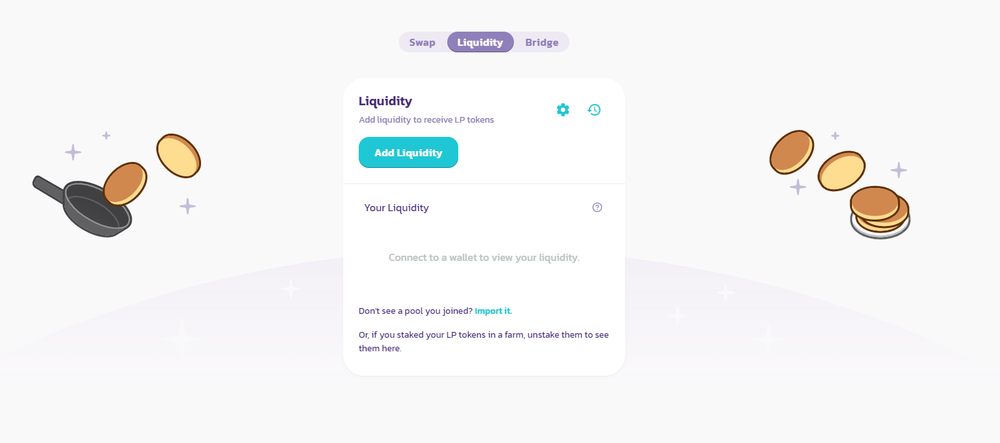

How to provide liquidity to PancakeSwap

Like Uniswap and SushiSwap, you can become a liquidity provider on PancakeSwap to receive rewards. Doing so is easy and keeps the AMM liquid for exchange users.

Click Liquidity, then Add liquidity, and make sure your wallet is unlocked. Now you’ll be asked to specify which tokens you’re providing liquidity for. Remember, providing liquidity on PancakeSwap is done in pairs, meaning you must provide two tokens.

You can provide liquidity to either:

- Existing pools

- A pool created by you

Creating your own pool is usually done by new projects looking to debut their cryptocurrency token. If that doesn’t sound like you, providing liquidity to an existing pool is the better option.

Once you select the pair you’re providing liquidity for, go ahead and deposit by confirming the transaction. After depositing, you’ll receive FLIP, an LP token that represents your stake in the pool.

The benefit of holding the FLIP LP token is every time an exchange happens that taps into your pool’s liquidity, you receive a portion of the rewards. To claim those rewards, you simply redeem your FLIP tokens to unlock the underlying assets which, by now, have grown in value.

Yield farming on PancakeSwap

Yield farming and providing liquidity are two different things you can do on PancakeSwap — don’t mix them up!

Providing liquidity means your original asset amounts increase as the pool they’re in is used for exchange transactions. Yield farming means you deposit one set of tokens to mint another token altogether.

To yield farm using PancakeSwap, select the Farms tab. Make sure the toggle is switched over to Live farms so you see what’s going on right now. A long list of options should populate the page including many farms with BUSD and BNB base pairs.

Choose the farms that interest you most, then click details to see how much CAKE each farm earns. PancakeSwap farming APY is currently high across several pairs, with farms like DUSK-BNB earning well over 200% APY.

After clicking Details, PancakeSwap will prompt you to unlock your wallet before detecting the currencies inside and allowing you to deposit them in the farm. Once you’ve deposited, the page will update with your CAKE earned.

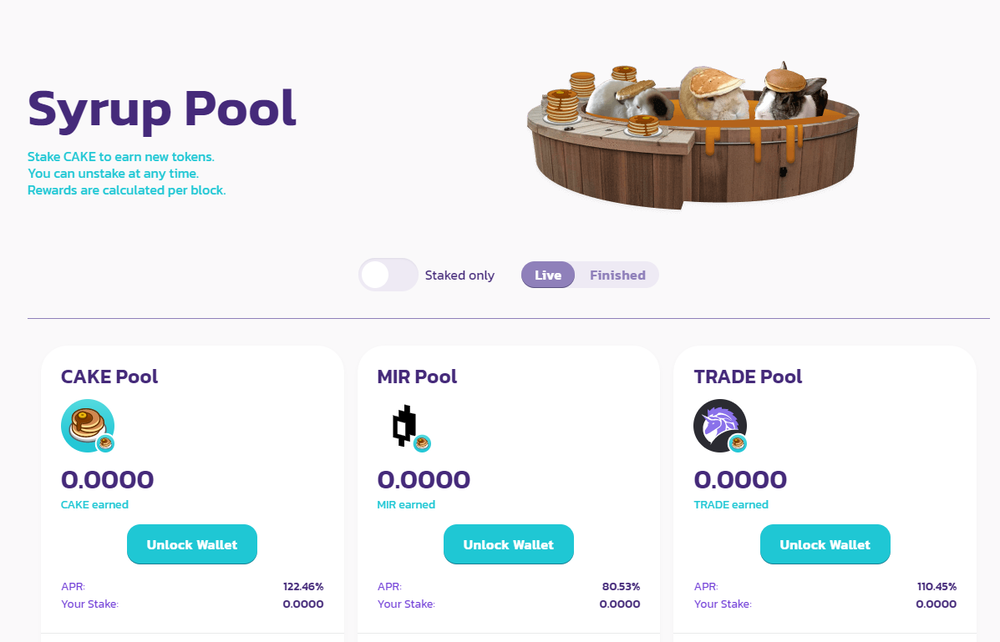

Using PancakeSwap Syrup Pools

Alright, so you understand how to provide liquidity on PancakeSwap, and how yield farming works, but along comes yet another pool that is different to all the rest.

PancakeSwap Syrup Pools are a way to stake your CAKE tokens in exchange for a Binance Smart Chain project’s new token. The way it works is you deposit your CAKE token in a syrup pool to receive the project’s BEP-20 token in return.

You get a shiny new token that might rise in value, and the project gets liquidity bootstrapping for their project and an immediate listing on PancakeSwap exchange.

To get into a Syrup Pool, click Pools, find the one that appeals to you (do your own research!), then deposit your CAKE and receive new tokens.

Playing the PancakeSwap Lottery

Sometimes, getting lucky on a crypto trade can feel a lot like winning the lottery. Why not just play the lottery instead? PancakeSwap Lottery allows you to do exactly that using your CAKE tokens.

Click Lottery, then buy lottery tickets using CAKE tokens. The more CAKE you spend, the better your odds of winning (because you have more tickets, of course). If you match 2 or more of the winning numbers on your tickets, you win a portion of the overall CAKE pot.

Lottery sessions happen several times per day — every six hours to be exact. This keeps the turn over high and your chances for eventually striking gold intact.

Initial farm offering (IFO)

PancakeSwap is spearheading a new ICO model called the IFO, short for Initial Farm Offering.

An IFO enables CAKE-BNB liquidity providers to buy a new project’s tokens. Joining an IFO is straightforward if you’re already a CAKE-BNB liquidity provider — just deposit your LP tokens on the IFO page.

If you want to participate in an IFO but don’t have CAKE-BNB LP tokens yet, you’ll need to get some first. Buy BNB and CAKE tokens equal to the total amount you want to contribute (decide total contribution amount, then buy 50% BNB and 50% CAKE). Then, deposit those tokens in the CAKE-BNB liquidity pool to receive your LP tokens.

Now, head back to the IFO page, deposit your LP tokens, then when the IFO is finished, you’ll receive the project’s tokens in exchange.

Is PancakeSwap better than Uniswap?

You’re probably wondering if PancakeSwap is better than Uniswap or rival exchanges like SushiSwap.

The short answer is no, but it isn’t a long way off. There is plenty of liquidity on PancakeSwap, making it a great decentralized exchange.

But, since PancakeSwap is on Binance Smart Chain, and BSC isn’t fully decentralized, we hesitate to call it a true decentralized exchange. Not being fully decentralized does have its advantages though.

For one, PancakeSwap is much faster and cheaper to use than Uniswap and has similar levels of liquidity. The only issue there is if you want to trade ERC-20 tokens, you’ll need to use the Binance Bridge coming in and out of Ethereum, which, depending on gas costs, can be prohibitively expensive for some.

As such, the best user experience for PancakeSwap is for those who already have BEP-20 tokens and are eager to keep their activities on Binance Smart Chain. With BSC’s rate of expansion these days, it shouldn’t be hard to do so, either.

As one of the earliest blockchains supporting smart contracts, the bulk of DeFi activity has been focused on the Ethereum blockchain. Its huge community of users and developers has proven to be an excellent starting point to create powerful decentralized applications (dapps).

However, surges in interest towards the back end of 2020 and the start of 2021 mean that the spotlight has been shifting away from Ethereum applications. Essentially Ethereum has become a victim of its own success in the DeFi space, as gas prices have risen to all-time highs, and as a result, forcing users to look elsewhere for better value transactions. Binance Smart Chain and DeFi dapps in their ecosystem are reaping the rewards.

Using PancakeSwap

At this point, it is essential to understand that a blockchain wallet is required to interact with Binance Smart Chain and PancakeSwap. Furthermore, any users familiar with the layout and design of Sushiswap will instantly feel at home on PancakeSwap.

- Get either the Binance Smart Chain wallet or use Metamask.

- Add Binance Smart Chain as one of the networks in Metamask, following the steps in the video below.

- Once the wallet has been set up, users can trade on PancakeSwap.

- Users need to provide liquidity to earn rewards, while PancakeSwap also allows users to easily swap one BEP-20 token for another. More about these options below.

PancakeSwap Exchange

PancakeSwap is a decentralized exchange for swapping BEP-20 tokens similar to Uniswap or SushiSwap and uses an automated market maker (AMM) model. Simply put, that means that users can trade digital assets on the platform. Importantly, there isn’t an order book and Instead, users trade against a liquidity pool.

Those pools are filled with other users’ funds. They deposit them into the pool, receiving liquidity provider tokens in return. They can use those tokens to reclaim their share, plus a portion of the trading fees. In short, you can trade BEP-20 tokens, or add liquidity and earn rewards.

Farming & Staking on PancakeSwap

A significant trend in 2020 and continuing is yield farming and PancakeSwap also allows you to farm its governance token – CAKE. Users can deposit liquidity provision (LP) tokens, locking them up in a process that rewards users with CAKE. The list of LP tokens accepted is long but a few major ones are:

- CAKE – BNB LP

- BUSD – BNB LP

- BETH – ETH LP

- USDT – BUSD LP

- USDC – BUSD LP

- DAI – BUSD LP

- LINK – BUSD LP

- TWT – BNB LP

Users can also earn by staking their CAKE in SYRUP pools after they have deposited funds to receive LP tokens and used them to farm CAKE. From there, users can stake CAKE and earn other tokens through special staking pools.

Further specific details about both farming and staking activities can be found here. The biggest SYRUP pool is for CAKE, where you can stake your CAKE to earn even more CAKE, but there are several other tokens you can earn by staking CAKE as well.

_Learn more about Binance Smart Chain and its DeFi applications: _

Is PancakeSwap Exchange Safe to use?

PancakeSwap is a DeFi based DEX exchange, whose smart contract is audited by Certik. Smart Contracts always hold their own risks and bugs. Even though audited properly, there may be any smart contract vulnerabilities at any time, which may result in bugs or errors in the platform which may cause asset loss.

🔺DISCLAIMER: Trading Cryptocurrency is VERY risky. Make sure that you understand these risks if you are a beginner. The Information in the post is my OPINION and not financial advice. You are responsible for what you do with your funds

Learn about Cryptocurrency in this article ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

Read more:

☞ What is Binance | How to Create an account on Binance (Updated 2021)

☞ What is Metamask wallet | How to Create a wallet and Use

☞ What is Trust Wallet | How to Create a wallet and Use

☞ What is Uniswap | Beginner’s Guide on How to Use Uniswap

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#blockchain #bitcoin #pancakeswap