What is Lever Network (LEV) | What is Lever Network token | What is Lever token | What is LEV token

In this article, we’ll discuss information about the Lever Network project and LEV token

Since exploding in 2020, Decentralized Finance (or DeFi) has been gaining great attention and popularity, which can often be seen in mainstream media’s headlines. With the exponential growth, DeFi has recorded a total value locked (TVL) of $41.29 Billion with lending and DEX products taking up almost 90%. (via DeFi Pulse)

Lending and trading are two of the pillar businesses in the current DeFi space with the most TVL. However, they are practically isolated from each other, leading to extremely low capital efficiency. Rare lending protocols support sport or even margin trading and most DEXes don’t provide loans. Also, even though users get transferable and tradable deposit certificates after depositing in lending protocols, there are few platforms to actually facilitate the financial use of them.

Therefore, Lever is developed to bridge the gap between lending protocols and DEXes, increasing capital efficiency in DeFi.

Welcome to LEVER

Lever is essentially an open-source margin trading platform where you can lend, borrow and perform leveraged trading to either buy long/sell short an asset in just one place.

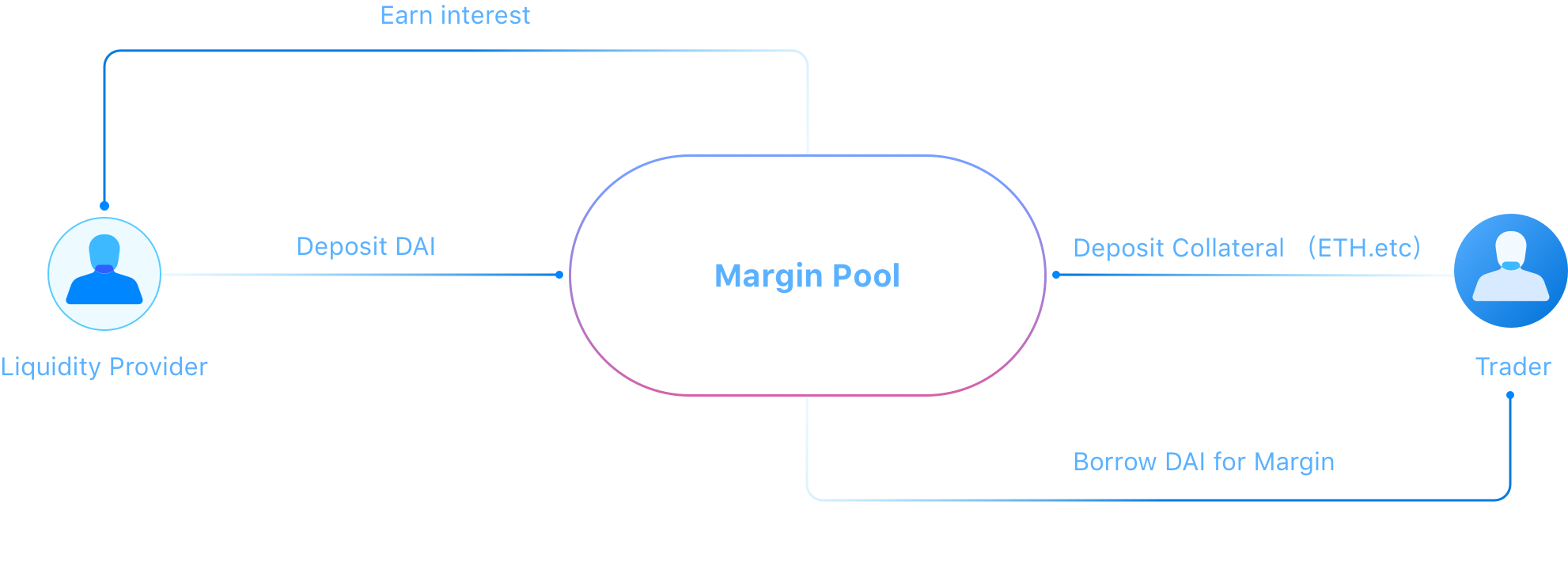

For lenders/borrowers, you can lend your idle crypto assets (including your deposit certificates from other lending protocols) to earn interest or use them as collateral to take out loans.

And for traders, after making a margin deposit in the margin pool, you will be able to open either long or short positions in a supported asset in Lever with up to 3X leverage. The platform makes use of external AMMs like Uniswap to provide surplus liquidity for margin traders to open positions of any size.

Using Lever, you can comfortably leverage your available capital for larger gains.

Why Lever?

Key features of Lever are explained as follow:

Efficient Asset Utilization: On Lever users can lend their idle crypto assets to others and enjoy higher interest rates.

Quick and convenient trading experience: Borrowing and trading are seamlessly integrated within Lever. Traders can easily open a long or short position in just one step. In the future version of Lever, Market Order, Limit Order and Stop Order will also be supported.

Enormous liquidity: Relying on AMMs like Uniswap, Sushiswap, Pancakeswap, and 1inch, Lever is able to provide deep liquidity for your trade. Also, it is able to effectively reduce the slippage when opening or closing large positions.

Much more tokens can be shorted: In addition to WBTC and ETH, more DEFI and ERC20 assets like SNX, UNI and AAVE can be shorted. Lever also offers a visualized operation interface for position management.

More collateral options for loans: Outside of common native tokens like ETH, DAI and USDC, Lever allows users to take out loans by using deposit certificates from other lending protocols, such as aTokens from Aave and cTokens from Compound.

Market Problems

As mentioned above, according to our observation, the problems in DeFi mainly lays in the following aspects:

- Gaps between lending products and DEXes. The activities of borrowing and trading of assets often happen in two separate places. Users will have to go through a strenuous process of taking out loans from lending platforms first then to trade on their preferred exchanges.

- Inefficient utilization of users deposited assets. Usually, users will get tokenized deposit certificates after making deposits in lending protocols, such as aTokens from AAVE and cTokens from Compound. These tokens represent the value of their underlying assets, but can rarely be reutilized for investment or trading.

- Rare DeFi products provide margin trading. Margin trading can effectively amplify traders’ gains. It’s popular in the traditional finance market and also has a huge demand in the DeFi space. Though there are a few protocols that offer this service, their liquidity is not enough.

Solution and Features

- _Quick & Convenient Trading _— Borrowing and trading are seamlessly integrated within Lever. Traders can easily borrow and trade assets in just one place. Lever also offers a visualized operation interface for position management.

- _High Capital Efficiency _— Other than native tokens, lenders can deposit AAVE’s aTokens and Compound’s cTokens to earn extra interest in Lever. This makes double interest possible, as lenders can first deposit their assets in AAVE/Compound, then use the aTokens/cTokens they receive to redeposit in Lever. Moreover, these tokens can also be used as collateral to take out loans.

- Margin Trading and Enormous Liquidity. Thanks to Lever’s powerful margin pool, traders can easily open leveraged positions to either long or short an asset. In addition to WBTC and ETH, many DEFI and ERC20 assets like SNX, UNI and AAVE now can be shorted at Lever. Furthermore, by relying on AMMs like Uniswap, Lever can provide enough liquidity and reduce slippage for positions of any size.

Benefits of Margin Trading

1. Buy long or sell short certain assets with leverage.

Users are mainly borrowing for unexpected expenses, leveraging their holdings or for new investment opportunities.

For instance, if you are long holding asset A and are bullish on asset B, in this case, you can deposit your asset A in Lever as collateral and borrow a stablecoin like USDT or DAI with or without leverage depending on your preference, then swap it to asset B. Once both prices go up, your gains will be amplified.

2. Earn more passive incomes.

Other than receiving interest on your deposit, you can earn LEV token rewards through Lever’s liquidity mining program.

How to Perform Margin Trading?

Here is a guide to margin trading on Lever:

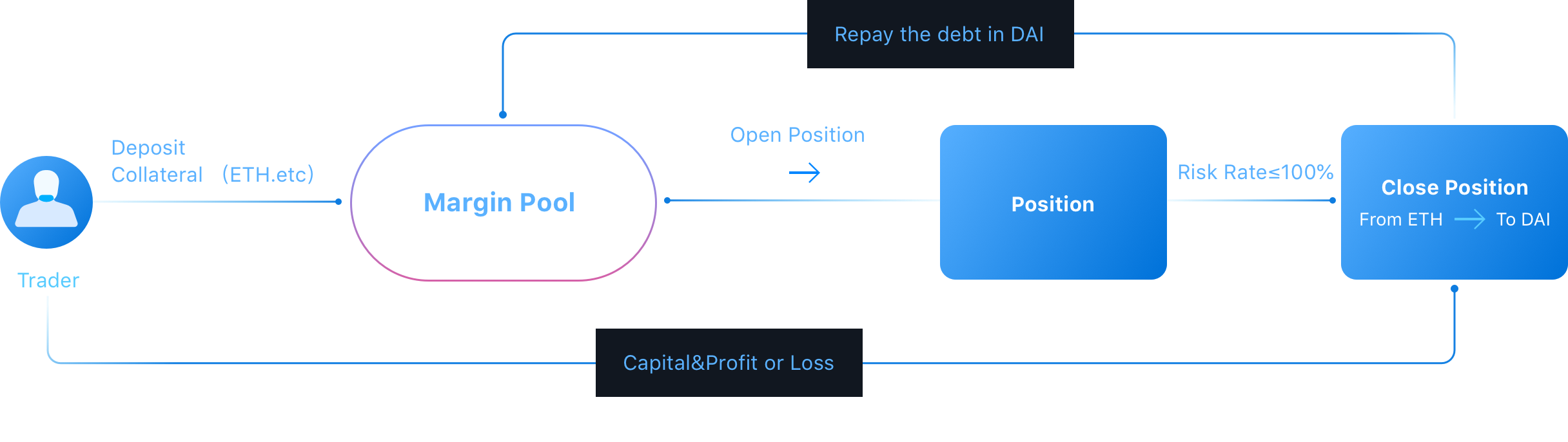

1. Deposit: First you need to deposit any supported asset in Lever. The platform supports various assets to be used as collateral, which can start earning interest after depositing.

2. Margin: After depositing, simply head to the “Margin” section and click on “Sell(Short)”/“Buy(Long)” for the asset pair you want to trade.

3. Opening a Position: Set the amount you need based on your available deposit that would be used as collateral for the loan. Then select the leverage ratio, the system will automatically convert the maximum amount that can be used for this trade.

Lever VS CEXs

The advantages of Lever over CEXes are as follow:

Lever VS dYdX

Similar to Lever, dYdX is also a decentralized exchange offering margin trading. Here is a competitive analysis of the two.

Would you like to earn TOKEN right now! ☞ CLICK HERE

How and Where to Buy LEV token ?

LEV token is now live on the Ethereum mainnet and Binance mainnet. The token address for LEV is 0xbc194e6f748a222754c3e8b9946922c09e7d4e91. Be cautious not to purchase any other token with a smart contract different from this one (as this can be easily faked). We strongly advise to be vigilant and stay safe throughout the launch. Don’t let the excitement get the best of you.

Just be sure you have enough ETH or BNB in your wallet to cover the transaction fees.

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step

You need a wallet address to Connect to Uniswap or Pancakeswap Decentralized Exchange, we use Metamask wallet

If you don’t have a Metamask wallet, read this article and follow the steps

☞What is Metamask wallet | How to Create a wallet and Use

Transfer $ETH to your new Metamask wallet from your existing wallet

Next step

Connect Metamask wallet to Uniswap or Pancakeswap Decentralized Exchange and Buy, Swap LEV token

Contract: 0xbc194e6f748a222754c3e8b9946922c09e7d4e91

Read more:

What is Uniswap | Beginner’s Guide on How to Use Uniswap

What is Pancakeswap | Beginner’s Guide on How to Use Pancakeswap

The top exchange for trading in LEV token is currently Uniswap, Pancakeswap

There are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once LEV gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

Find more information LEV

☞ Website ☞ Explorer ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Documentation ☞ Coinmarketcap

🔺DISCLAIMER: The Information in the post isn’t financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you

⭐ ⭐ ⭐ What You Should Know Before Investing in Cryptocurrency - For Beginner ⭐ ⭐ ⭐

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#blockchain #bitcoin #lev #lever network