What is Delta Financial (DELTA) | What is Rebasing Liquidity (DELTA) | What is DELTA token

In this article, we’ll discuss information about the project Delta Financial and DELTA token

Introduction

Information between option markets and underlying assets take longer to be reflected due to the relatively illiquid side of options trading compared to spot markets. An additional challenge is the lack of liquidity causing an increase of premiums in option prices. Options with relative low liquidity are expected to be relatively higher priced, also implying a higher volatility for these options.

Delta plans to close this gap by using a combination of liquidity standards to deploy an on-chain options layer with scalability in mind, to meet the increase in market demand for permissionless systems.

Illiquid nature of options:

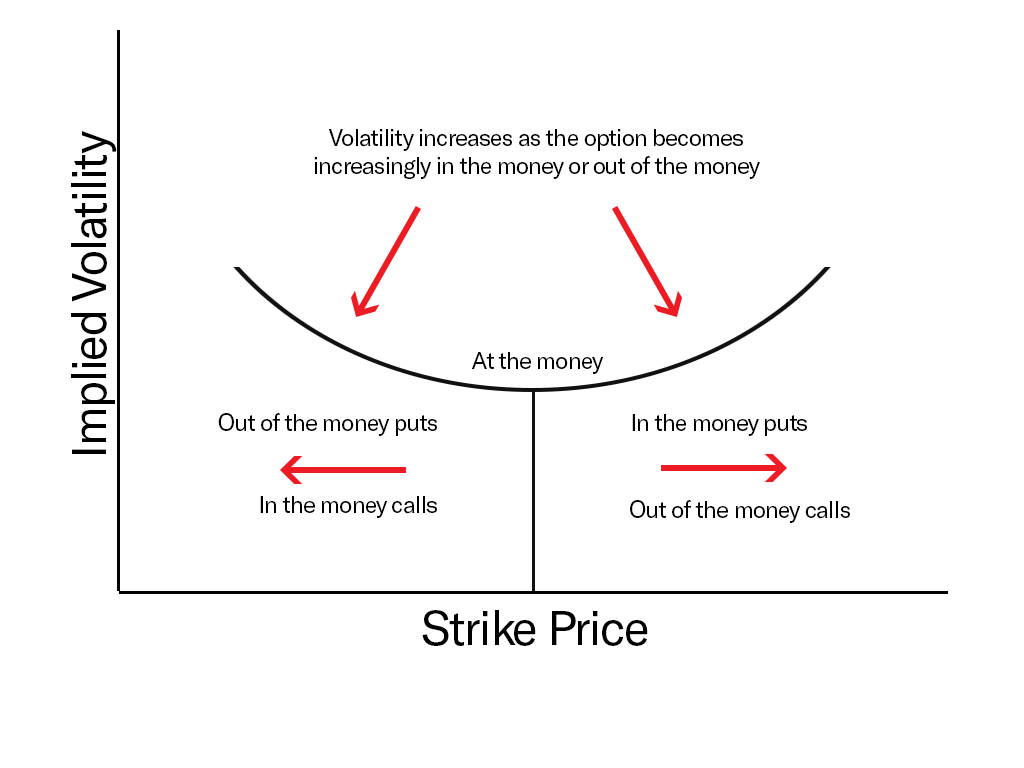

Traditional finance has been documenting volatility smile or smirk of options for nearly three decades. While a growing body of analysis corroborates the role of liquidity in determining asset prices in equity markets, fewer studies analyse the impact of liquidity in option prices.

A healthy and liquid options market creates a more balanced graph of a particular set of options.

A Volatility Smile can be observed in a well-balanced market. A situation in which at-the-money options have lower implied volatility than out-of-the-money or in-the-money options.

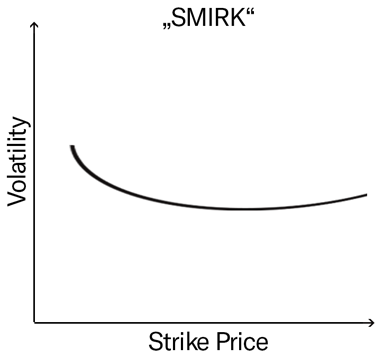

Volatility smirks on the other hand, can be observed during an increase of market uncertainty when the curve is weighted to one side.

Since DeFi is still in its infancy, factors such as uncertain market conditions of not just the underlying asset of the option but also its liquidity will amplify the steepness of the volatility smirk.

Guaranteeing liquidity in a decentralized options market will flatten the volatility by adding market certainty to the platform, effectively reducing the premiums charged on option prices.

Delta is using a new open vesting liquidity standard which takes the violent nature of price action within the cryptocurrency space into account. Furthermore, using liquidity which is based on a vesting schedule increases market certainty and opens up the possibility to secure a unique environment which promotes healthy options prices for a variety of different tokenized assets.

Delta Infrastructure and mechanisms:

Delta Vesting Schedule

Delta has a vesting mechanism built into its token that is triggered on transfer. This vesting period is based on a block number schedule.

When Delta is transferred, a token vesting schedule is activated. 10% of the total token balance is sent to the user while 90% is initially locked and released linearly, over a 2 week period.

A token transfer cancels the vesting schedule and the immature tokens get distributed to the Vault as staking rewards.

Delta Liquidity Model

Delta’s liquidity is divided into two different types

- Open Vesting Liquidity through the Delta Vesting Schedule

- Permanently Locked Liquidity

The immature Delta tokens which are locked through the token vesting schedule can be used by the system to stabilize its liquidity demands. The flexibility of the Open Vesting Liquidity model is secured by allowing its initial user to leave the vesting contract prematurely. In such event the Deep Farming Vault takes over the Open Vesting Liquidity demands, by providing the missing capital for the remainder of time.

The tokens that represent the permanently Locked Liquidity, used in Delta’s infrastructure, are called rLP tokens. By using a mechanism called Liquidity Rebasing, these rLP tokens become increasingly difficult to mint, creating a limited supply. Once Delta launches, liquidity rebasing will consistently raise the minting price of rLP tokens while the liquidity pool size remains unaffected. Before the first Liquidity Rebasing, users have the opportunity to stake their capital during a Limited Staking Window to redeem rLP tokens at face value.

Deep Farming Vault

Delta’s Deep Farming Vault collects immature Delta through Vesting Schedule interruptions. It can use its capital to assist the system incase of an increase in liquidity demands. To secure enough capital, the vault incentivizes its contributors by distributing the received immature Delta to staked rLP & Delta token holders.

Tokenomics

Token Symbol: DELTA

Total supply: 45,000,000 DELTA (Fixed Supply, minting not possible)

Delta Token Distribution:

~46% (20,700,000 DELTA): Liquidity Reserve Vault

~4% (1,800,000 DELTA): Bonding Curve Liquidity

~23% (10,350,000 DELTA): Delta Team Fund

~17% (7,650,000 DELTA): Strategic Partnerships & Growth

~10% (4,500,000 DELTA): R&D Fund

The token vesting structure varies depending on the bucket. These vesting contracts unlock tokens on a continuous basis until the vesting schedule is completed. The distribution of this supply is projected as follows:

~40–45% Liquidity Reserve Vault

The Liquidity Reserve Vault guarantees a Floor price for Delta and is used for the initial liquidity for options. This Vault may diversify its reserves to increase performance. The Liquidity Reserve Vault also monitors Deep Farming Vault performance and guarantees a minimum APY. The Liquidity Reserves may be utilized to support other Vaults.

~5–10%: Bonding Curve Liquidity Allocation

The primary liquidity to purchase Delta tokens will come from a Bonding Curve pool such as Uniswap. This allocation will guarantee liquidity for Users to trade Delta. Ethereum will be the main trading pair for the Bonding Curve Pool. The target liquidity for the Bonding Curve is set to ~1000–1500 ETH and the corresponding amount of Delta. The rest of the staked assets will be locked together with the remaining Delta in the Liquidity Reserve Vault.

The ratio between the Bonding Curve Liquidity Allocation and Liquidity Reserve Vault may vary depending on the capital staked during the Limited Staking Window. The goal is to offer efficient liquidity to the bonding curve and promote healthy price movements.

Delta Team Fund

These funds will be used to support the long-term development of the project. Covering operational costs and securing key hires. A part of these tokens will be granted to current Delta team members which will be unlocked continuously for 12 Months. The team has delivered consistently and proven their value, work ethics and skills during a time of uncertainty. They are long term oriented and have the best interest for the protocol in mind.

Strategic Partnerships & Growth

This allocation is used for external initiatives to give Delta the right kickstart in terms of Exchange listings, Marketing and Partnerships. This allocation is unlocked at launch to obtain traction, provide liquidity for listings and quickly grow the project.

Research & Development

This fund will be used for ongoing research, Security Audits, incentives for Bug Bounty Programs and incentivize consultants to further strengthen the project’s security and development. 80% of the tokens will be unlocked continuously for 12 Months.

Limited Staking Window

To launch Delta, a new staking mechanism called Limited Staking Window (LSW) is deployed. For a limited time, users can stake Ethereum towards a new type of token. The staked contributions in the LSW remain locked. Once the Limited Staking Window closes, participants will receive rLP Tokens. These tokens are limited in supply through the aforementioned Liquidity Rebasing mechanism. The LSW will distribute rLP tokens to all Stakers at face value after the window closes.

coreDEX DELTA

Introducing the native tokens of coreDEX

Delta will serve as an important building block for coreDEX. The token will be working conjointly inside CORE’s ecosystem to enhance its overall utility and address the need for options and futures. coreDEX DELTA is the first part of the coreDEX infrastructure.

CORE token holders are fully integrated in Delta’s options layer. Parts of the profits generated from Vault strategies, Options, Open Vesting Liquidity and future features will be distributed to the CORE ecosystem and used to auto market buy the CORE token. CORE LP & CORE token holders may stake their assets in the upcoming coreDEX Migration Contract to participate in early fee sharing during coreDEX alpha and beta.

Would you like to earn TOKEN right now! ☞ CLICK HERE

How and Where to Buy DELTA ?

DELTA is now live on the Ethereum mainnet. The token address for DELTA is 0xfcfc434ee5bff924222e084a8876eee74ea7cfba. Be cautious not to purchase any other token with a smart contract different from this one (as this can be easily faked). We strongly advise to be vigilant and stay safe throughout the launch. Don’t let the excitement get the best of you.

Just be sure you have enough ETH in your wallet to cover the transaction fees.

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step

You need a wallet address to Connect to Uniswap Decentralized Exchange, we use Metamask wallet

If you don’t have a Metamask wallet, read this article and follow the steps

☞What is Metamask wallet | How to Create a wallet and Use

Next step

Connect Metamask wallet to Uniswap Decentralized Exchange and Buy DELTA token

Contract: 0xfcfc434ee5bff924222e084a8876eee74ea7cfba

Read more: What is Uniswap | Beginner’s Guide on How to Use Uniswap

The top exchange for trading in DELTA token is currently Uniswap, 1inch Exchange, and 0x Protocol

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once DELTA gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information DELTA

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

🔺DISCLAIMER: Trading Cryptocurrency is VERY risky. Make sure that you understand these risks if you are a beginner. The Information in the post is my OPINION and not financial advice. You are responsible for what you do with your funds

If you are a beginner, learn about Cryptocurrency in this article ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

Don’t hesitate to let me know if you intend to give a little extra bonus to this article. I highly appreciate your actions!

Wallet address:

BTC : 1FnYrvnEmov2w9fovbDQ4vX8U2dhrEc29c

USDT : 0xfee027e0acfa386809eca0276dab286900d75ad7

DOGE : DSsLMmGTwCnJ48toEyYmEF4gr2VXTa5LiZ

Thank for visiting and reading this article! Please share if you liked it!

#bitcoin #cryptocurrency #delta #delta financial