What is APYSwap (APYS) | What is APYSwap token | What is APYS token

In this article, we’ll discuss information about the APYSwap project and APYS token

DeFi market overview:

Decentralized finance (DeFi) has shifted the way that cryptocurrency users interact with the protocol, introduced variety of new features and, most importantly, gave back the asset ownership to users rather than intermediaries. However, as the DeFi ecosystem develops, it faces a number of issues, one of which is complexity. An average user is now required to have a specific and up-to-date knowledge of how to interact with pools, deposit liquidity and mitigate impermanent loss.

In addition, many may find it hard to differentiate between various DeFi projects and evaluate their potential risks and rewards. Portfolios are in constant need of attention if you are looking to maximize profits, which may be difficult to keep track of. Finally, Ethereum transaction fees have grown significantly, making it more expensive for regular users to interact with yield farming opportunities and other dApps.

APYSwap offers a unique solution to these problems. APYSwap is a protocol for decentralized cross-chain exchange of shares of Tokenized Vaults. It implements a delegation function for user assets and provides a marketplace for financial assets trading. APYSwap allows users on multiple blockchains (initially Ethereum, Polkadot and Binance Smart Chain) to create and control their native blockchain vaults and transfer the ownership to third parties. Users may also benefit from passive income without actively managing their portfolio. Alpha version is already available with beta and Polkadot’s parachain version still in development.

Product and features:

APYSwap consists of three layers: the protocol and smart contracts, the layer 2 aggregation marketplace as well as the user wallet on the top layer. APYSwap Vault is the underlying layer. It is a smart contract managing access to its funds and functionality to other blockchain agents depending on their share ownership of the vault. It can interact with any trustless service on the Ethereum, Polkadot and Binance Smart Chain networks.

Ownership of the vault is split between multiple agents by tokenization. This allows portfolio managers to create specific combinations of Liquidity Providers, Yield Farming and other tokens and enables the transfer of divisible shares of these portfolios to third parties. Therefore, instead of unlocking the assets for trading, users can instead trade APYSwap Vault shares. This provides liquidity to the previously illiquid assets without losing the rewards tied to assets remaining locked.

Polkadot, Binance Smart Chain or Chromia blockchain can be used as Layer 2 networks to transfer or trade shares in APYSwap vaults, while the assets remain anchored to the Ethereum network. This also allows for the Uniswap-style exchange, where the users can exchange tokens on Chromia layer 2 without the high gas fees and Ethereum transaction times.

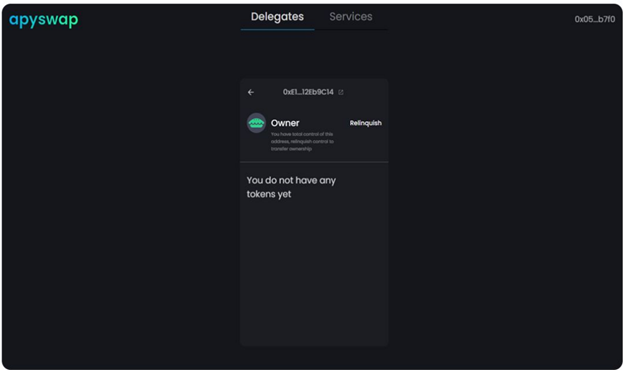

Portfolios and APYSwap Vault shares are available at APYSwap Marketplace. Marketplace transaction will be signed via APY Mask, a Metamask-style web wallet. This wallet may also be used to manage the APYSwap Vaults, transfer their ownership, etc. Users can login via APY Mask and vote with their APY token balance for the addition of new services or whitelist/blacklist certain DeFi projects.

Current share prices of the APYSwap Vault as well as the asset’s pool is determined by oracles. Fees in APY tokens are used to reward oracles’ honest reporting and tokens can be staked to vote for honest oracle selection. Share prices will be settled naturally by the market, since it is up to a buyer to decline or accept the price, offered by the seller. An oracle price assessment will also be implemented, where buyer/seller would be able to pay delegated oracles with APYSwap tokens in exchange for their services.

Users may choose to delegate control of their shares to the rebalancing contract via the on-chain or hybrid solution, select the rebalancing strategy and their portfolio will be automatically managed on their behalf.

How does APYSwap fit into the DeFi Lego ecosystem?

Current issues within DeFi

DeFi ecosystem faces a variety of different problems. One of the most significant issues within the DeFi field, is the fact the existing instruments are far too complex for an average user. Users are required to study an extensive amount of information about pools and liquidity deposits, as well as to understand the concept of impermanent loss to avoid the actual losses.

As the things within the DeFi change at a rapid pace, portfolios are in need of constant supervision to maximize profits, which may prove difficult to keep track of. For example, Sushiswap and Uniswap reward pools change regularly and to make profit, one has to pay close attention to these changes.

In addition, users may find it difficult to distinguish between different DeFi projects and evaluate their potential risks and rewards. Provision of infrastructure for DeFi applications by multiple blockchains makes it difficult to navigate across different blockchains. Finally, the price of Ethereum has recently surged, making the GAS fees incredibly costly, which, unfortunately, prevents the regular users from interacting with yield farming opportunities and other dApps.

Liquditiy protocols, money market protocols and their limitations

Liquidity protocols and money market protocols offer a wide range of services. One could not talk about the liquidity protocols without mentioning Uniswap. Uniswap is an Ethereum-based decentralized exchange, which allows its users to swap ERC20 tokens. It provides a solution to the problems centralized exchanges face by eliminating the need for intermediaries, while also allowing you to retain the self-custody of your wallets.

However, the protocol itself is not without its issues. GAS fees and block congestion negatively affect the user experience. The fees reduction plans are in place in the 3rd version of the protocol but it will take some time until these changes are implemented. In addition, the existence of impermanent loss makes it costly and potentially risky to deposit the funds into automatic market makers, which may turn an ordinary user away from DeFi services.

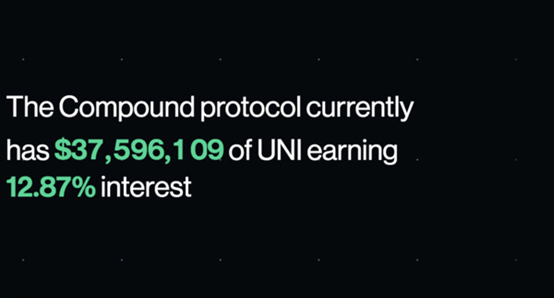

Money market protocols such as Compound offer their users an option to borrow and issue loans by locking their assets in the protocol. Compound’s native token, cToken, allows users to earn interest on asset provision, while also enabling them to transfer those assets within other applications. The issue though, is that Compound runs the risk of illiquidity. If a certain withdrawal transaction is large enough, others will be unable to withdraw the funds, thus preventing users from interacting with the protocol.

While the protocols themselves offer significant advantages compared to the existing banking system and centralized exchanges, there is a room for improvement from the perspective of a non-professional trader. This is exactly where the APYSwap comes into play.

APYSwap’s solution to the existing DeFi problems

APYSwap takes the best that the current liquidity and money market protocols have to offer, while providing a better user experience at the same time. It builds upon the foundation of projects such as Uniswap and Compound by using them as a base layer and reaches out to the audience who is not as experienced in financial products.

Typical crypto investor may find it time consuming to study every single service available within the market, as well as the intricacies of every available protocol. APYSwap allows users on multiple blockchain to create and control vaults on their native blockchain as well as to transfer the ownership of these vaults to a third party. By supporting multiple DeFi protocols APYSwap offers a simple, yet effective user experience for selecting asset management options. Therefore, APYSwap recreates the experience of traditional FinTech, without sacrificing the decentralization in assets’ ownership.

APY Swap implements a delegation function for user assets and creates a marketplace for trading these financial assets. Portfolio managers are able to use these tools to design financial products on the protocols they are familiar with, since APYSwap provides support to the variety of popular DeFi protocols. With APYSwap’s versatility, there is no need to for portfolio managers to worry about technical development or end-user experience.

Therefore, APYSwap distinguishes itself from the existing DeFi protocols by being a much more user-friendly, while also retaining their advantages. It attracts a larger audience by making the financial products more accessible and more intuitive to an average consumer, thus solidifying its position as a leading protocol in the current market.

About APYS token:

There is a total token supply of 100,000,000 APYSwap tokens .

APYSwap tokens are used to safeguard and govern the APYSwap’s ecosystem. They ensure that only the reputable DeFi projects are available on the marketplace. Their role is to provide an insurance utility. Projects, interested in listing at the APYSwap’s marketplace, will have to purchase APYS tokens and lock them. If the project has proven to be untrustworthy, tokens will be unlocked and distributed as a compensation.

Token owners will be able to vote for new portfolio projects. In the long term, the platform will shift towards the complete decentralization with community acting as decision makers. Portfolio managers will be incentivized to purchase the APY tokens, since they can attract more users by offering unique projects in their portfolio. However, they will need tokens to vote for the addition of said projects into the APY’s whitelist. Therefore, portfolio managers will contribute to APY token’s market value.

Token utility:

APYSwap tokens are used to safeguard and govern the APYSwap’s ecosystem. They ensure that only the reputable DeFi projects are available on the marketplace. Their role is to provide an insurance utility. Projects, interested in listing at the APYSwap’s marketplace, will have to purchase APY tokens and lock them.

If the project has proven to be untrustworthy, tokens will be unlocked and distributed as a compensation. A time limited yield farming opportunity will be launched in exchange for locking funds in the vault.

Token owners will be able to vote for new portfolio projects. At first, APY team and early adopters will provide portfolios and tokenized vaults. In the long term, the platform will shift towards the complete decentralization with community acting as decision makers.

Portfolio managers will be incentivized to purchase the APY tokens, since they can attract more users by offering unique projects in their portfolio. However, they will need tokens to vote for the addition of said projects into the APY’s whitelist. Therefore, portfolio managers will contribute to APY token’s market value.

Source : https://www.youtube.com/watch?v=3a43WNrVGhY

Would you like to earn TOKEN right now! ☞ CLICK HERE

How and Where to Buy APYSwap ?

APYSwap is now live on the Ethereum mainnet. The token address for APYS is 0xf7413489c474ca4399eee604716c72879eea3615. Be cautious not to purchase any other token with a smart contract different from this one (as this can be easily faked). We strongly advise to be vigilant and stay safe throughout the launch. Don’t let the excitement get the best of you.

Just be sure you have enough ETH in your wallet to cover the transaction fees.

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step

You need a wallet address to Connect to Uniswap Decentralized Exchange, we use Metamask wallet

If you don’t have a Metamask wallet, read this article and follow the steps

☞What is Metamask wallet | How to Create a wallet and Use

Next step

Connect Metamask wallet to Uniswap Decentralized Exchange and Buy APYS token

Contract: 0xf7413489c474ca4399eee604716c72879eea3615

Read more: What is Uniswap | Beginner’s Guide on How to Use Uniswap

The top exchange for trading in APYS token is currently Uniswap Decentralized, BKEX, Gate.io, Hoo, MXC.COM, and 1inch Exchange

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once APYS gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information APYS

☞ Website ☞ Explorer ☞ Whitepaper ☞ Social Channe ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

🔺DISCLAIMER: Trading Cryptocurrency is VERY risky. Make sure that you understand these risks if you are a beginner. The Information in the post is my OPINION and not financial advice. You are responsible for what you do with your funds

If you are a beginner, learn about Cryptocurrency in this article ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

Don’t hesitate to let me know if you intend to give a little extra bonus to this article. I highly appreciate your actions!

Wallet address:

BTC : 1FnYrvnEmov2w9fovbDQ4vX8U2dhrEc29c

USDT : 0xfee027e0acfa386809eca0276dab286900d75ad7

DOGE : DSsLMmGTwCnJ48toEyYmEF4gr2VXTa5LiZ

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#cryptocurrency #bitcoin #blockchain #apys #apyswap