What is Vesper finance (VSP) | What is Vesper finance token | What is VSP token

Vesper Finance is a platform of DeFi primitives designed to make your money work harder for you. Vesper works as a “metalayer” for DeFi, routing deposits to highest yield opportunities within risk tolerance for the particular pool. Products are non-custodial and auto-compounding.

Under-the-hood, Vesper enables a truly set-and-forget experience at scale through a unique approach that enables yield aggregating “strategies” to be upgraded, replaced, connected, and concurrent – all with no added burden on the end user.

What is Vesper?

Vesper is a platform of DeFi products designed for ease-of-use, longevity, and scale. It is a comprehensive ecosystem governed by the VSP token.

Vesper Grow

What are Vesper Grow Pools? Vesper Grow Pools are algorithmic DeFi lending strategies. They pool capital from a group of users and deploy it to generate interest across various DeFi protocols. Accrued interest is used to buy back the pool’s deposit asset (which may be ETH, BTC, USDC, or something else), and award it as interest to participants.

How do I interact with Grow Pools? All you have to do is choose the pool you are interested in and deposit your asset. One transaction, and the pool does the rest. Similarly, you can withdraw your funds and claim your interest with one transaction.

What Grow Pools are available today? As of the launch there are three pools: ETH, BTC, and USDC. We will frequently offer trial pools to the community before they go prime-time on the Vesper website.

Has the code been audited?

Yes. The code has undergone two independent audits by Coinspect and Certik. See the Audits and Due Diligence section for more details.

What is the benefit to depositing my funds in an Grow Pool? Grow Pools deploy your assets into DeFi lending strategies. You can choose a pool based on your risk tolerance and desired token. This reduces a process that typically comprises more than a dozen fee-extracting transactions, hours of research, and constant monitoring down to a one-time deposit and withdrawal. Additionally, Grow pool participants farm VSP tokens, further rewarding users with even greater passive returns, catalyzing participation, and forming the basis for progressively decentralized governance.

What happens to my funds after I deposit them in a Grow pool?

Deposits are pooled and deployed through the strategy outlined by the particular Grow pool. See the Strategies page for more information on what that strategy may look like.

Is there any risk associated with Vesper Grow pools?

Grow pools that interface with loans are at risk in the event of a so-called black swan event, such as when a pool asset sees a flash crash in a short amount of time. In this event, the pool’s outstanding debt position may become under-collateralized, leaving the lender insolvent, and the pooled funds may be hit with a liquidation fee, which could translate into a loss to the participant.

Each token supported offers a pool that pursues conservative and aggressive strategies. Conservative pools use higher collateralization ratios and are therefore less vulnerable to such a risk – but not completely immune.

Additionally, Grow pool strategies are only as safe as the platforms they interact with. Medium-risk pools only interact with blue-chip DeFi protocols like Maker, Aave, and Compound, but high-risk pools may interface with newer and less established alternatives.

What are the fees?

There is a 0.6% fee on withdrawal from Vesper Grow pools, and a 15% platform fee on yield generated by the deposited assets.

Where do the fees go?

The platform fee and withdrawal fee are both taken in the form of pool shares, and delivered to the Treasury Box. They continue to earn yield as any pool share would, until they are converted to VSP tokens by selling them on the open market via an AMM like Uniswap or SushiSwap. These VSP go to the vVSP pool to be distributed to vVSP holders.

VSP Token

What is the VSP token?

VSP is the governance token that serves as the basis for the Vesper ecosystem. VSP holders can vote on proposals, and additionally deposit their tokens to passively accumulate more VSP.

How do I earn VSP tokens?

There are three ways to earn VSP tokens:

- Participating in Vesper pools. Each pool is assigned an amount of VSP tokens that are distributed to participants proportionate to size of stake. Initial Grow pools are incentivized for three months after launch.

- Providing liquidity. Liquidity Providers to the VSP-ETH Uniswap pair are incentivized with VSP similarly to the Grow pools. The trading pair is incentivized for one year after launch.

- Staking your VSP. Users can deposit their tokens to the VSP treasury pool. A small percentage of withdrawals are allocated to the treasury box, and those funds are used to buy back VSP and award to pool depositors.

How will I receive my VSP tokens?

VSP tokens are ‘dripped’ to pool participants, and held by the smart contract until they broadcast a transaction to exit the pool, whereupon the VSP is delivered to their address.

What is the vVSP Pool?

The vVSP pool is a revenue-sharing mechanism. It rewards VSP holders with additional VSP when they deposit their tokens in it.

Just like the other pools, where you deposit ETH to get vETH, or USDC to get vUSDC, you can stake VSP and you will get vVSP, a tokenized share of the vVSP pool.

After withdrawal and yield fees are collected in the pool (ETH, BTC, USDC, etc.), they go to the Treasury Box and are used to buy back VSP on Uniswap. Of this VSP, 5% goes to the project’s founders, and the rest is delivered to vVSP pool participants as yield on their deposit.

Vesper’s Tokenomics — An Overview

[REVISED 2/16/2021 1:15pm Eastern — To reflect shift in LP rewards towards Sushiswap]

The VSP token is the very center of Vesper, connecting the entire system and forming the basis of its longevity. One’s VSP holdings represent their voting weight in the Vesper ecosystem. Almost all revenue generated by all Vesper products are additionally used to buy back VSP from the open market.

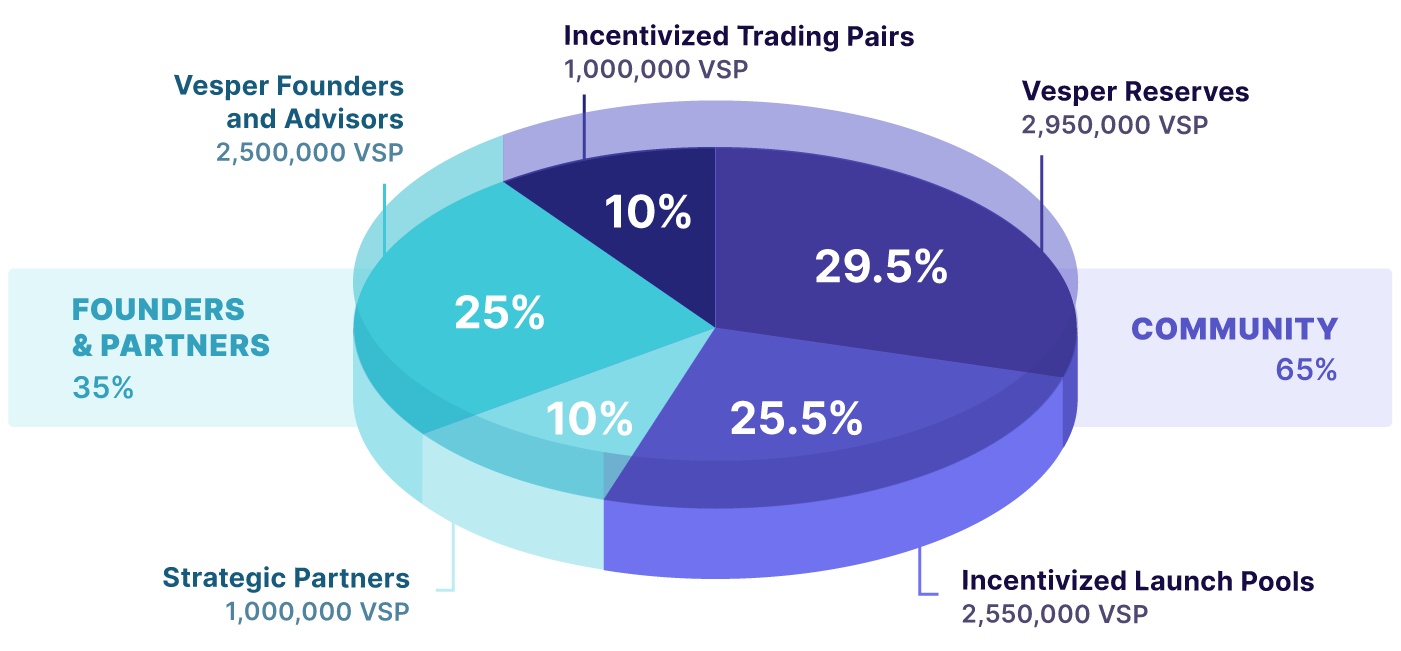

VSP Token Distribution

The total supply is 10,000,000 VSP, which breaks down like this:

- 6.5M VSP (65%) goes to the community, which includes 2.55M for the Incentivized Launch Pools, 1M to incentivize liquidity providers, and 2.95M to the Vesper Reserves.

- 3.5M VSP (35%) is for Vesper team, advisors, and strategic partners, which is subject to vesting over twelve months.

VSP Token and vVSP Staking

VSP tokens can be staked in the vVSP pool. Revenue generated throughout the entire ecosystem buys back VSP, which is then delivered as yield to the vVSP pool. VSP also forms the core of the Vesper revenue model.

Stakers also use their tokenized vVSP shares to vote in Vesper’s governance, which can take the form of the following:

- Approval of strategies proposed by developer community

- Deployment of Vesper Reserves to incentivize new products

- Alterations to the Vesper governance and revenue specifications

Participation is extended to vVSP only, so that longterm holders staking to earn more VSP are also the ones that make decisions for the ecosystem through voting.

Token Emissions

Please note that these emissions are not finalized, and may be subject to change at the discretion of the community. (For more on Vesper’s governance, refer to the documentation’s chapter on Vesper’s decentralization plan.)

Launch Pools (2,550,000 VSP)

- 450,000 allocation to pre-launch Beta participants, airdropped at launch

- 2,100,000 over twelve months, heavily weighted towards the first three months

Reserves (2,950,000 VSP)

- Reserves for ecosystem growth and developer/community incentives, as determined by VSP voters

Liquidity Providers (1,000,000 VSP)

- Incentivization for LPs on Uniswap, SushiSwap and Loopring (with SushiSwap retaining majority)

- 1,000,000 distribution over 12 months, heavily weighted towards the first month (and more acutely — the first weeks)

Team and Advisors (2,500,000 VSP)

- 208,333 (1/12) unlocked at launch

- 2,291,667 (11/12) vested with streaming unlock (constant drip each block) for eleven months following launch

Strategic Partners (1,000,000 VSP)

- 83,333 (1/12) unlocked at launch

- 916,667 (11/12) vested with streaming unlock (constant drip each block) for eleven months following launch

Emissions: First Month

The above qualitatively explains the shape and pace of emissions. Though Vesper is not committing to a concrete schedule for the next twelve months, here is what VSP emissions look like at launch and in the first weeks to follow:

At launch, 450,000 VSP are airdropped to beta participants. 291,667 VSP is airdropped to the team, advisors, and partners at the same time. 300,000 VSP is posted as initial liquidity to SushiSwap and 200,000 VSP is posted as liquidity to Uniswap.

In total, 1,241,667 VSP are circulating at launch — 12.42% of total supply.

Through the first month, each of the three primary holding pools have a linear drip of 125,000 VSP each — 375,000 total.

Liquidity Providers receive a drip of 185,000 VSP for the first month. 60% of these rewards go to SushiSwap, and 40% to Uniswap (plus a small amount to Loopring). This is weighted towards the first weeks:

- Week One: 74,000

- Week Two: 55,500

- Week Three: 37,000

- Week Four: 18,500

Team, advisors, and partners have streaming unlock at 1/12 of allocation (291,667 VSP) each month.

Circulating supply will look approximately as follows:

- Day 0: 1,241,667 VSP (12.42% of total supply)

- Day 7: 1,482,334 VSP (14.82%)

- Day 14: 1,704,501 VSP (17.05%)

- Day 21: 1,908,168 VSP (19.08%)

- Day 28: 2,093,335 VSP (20.93%)

Anticipate roughly 70–80% of VSP total supply to be circulating after the first year. At this time, the VSP community can also vote to change the VSP supply. The minting function is time locked and unavailable within the first 12 months of launch, locking the supply at 10 million VSP for at least the first year.

Would you like to earn TOKEN right now! ☞ CLICK HERE

How and Where to Buy Vesper finance (VSP) ?

VSP is now live on the Ethereum mainnet. The token address for VSP is 0x1b40183efb4dd766f11bda7a7c3ad8982e998421. Be cautious not to purchase any other token with a smart contract different from this one (as this can be easily faked). We strongly advise to be vigilant and stay safe throughout the launch. Don’t let the excitement get the best of you.

Just be sure you have enough ETH in your wallet to cover the transaction fees.

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step

You need a wallet address to Connect to Uniswap Decentralized Exchange, we use Metamask wallet

If you don’t have a Metamask wallet, read this article and follow the steps

☞What is Metamask wallet | How to Create a wallet and Use

Next step

Connect Metamask wallet to Uniswap Decentralized Exchange and Buy VSP token

Contract: 0x1b40183efb4dd766f11bda7a7c3ad8982e998421

Read more: What is Uniswap | Beginner’s Guide on How to Use Uniswap

The top exchange for trading in VSP token is currently Uniswap (V2), Bilaxy, Poloniex, Sushiswap, and 1inch Exchange

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once VSP gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information VSP

☞ Website ☞ Website 2 ☞ Explorer ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Message Board ☞ Coinmarketcap

🔺DISCLAIMER: The Information in the post is my OPINION and not financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you

⭐ ⭐ ⭐ What You Should Know Before Investing in Cryptocurrency - For Beginner ⭐ ⭐ ⭐

#blockchain #bitcoin #crypto #vesper finance #vsp